Tech Sector Rotation: AI Skepticism Triggers $500 Billion Value Shift as Growth Dominance Wanes

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Barron’s report [1] published on February 12, 2026, which documents a meaningful shift in investor sentiment toward technology stocks amid rising concerns about artificial intelligence investments. The timing of this report coincides with a significant market correction in the tech sector, providing real-time validation of the rotation thesis. Market data [0] shows the NASDAQ Composite falling 2.13% on the day, its worst performance among major indices, while the Russell 2000 declined 2.36% and the S&P 500 pulled back 1.40%. These movements reflect growing investor preference for diversification away from mega-cap technology concentrations that have driven market returns for multiple consecutive years.

The rotation pattern evident in today’s trading represents a potential inflection point in market leadership. While technology has been the primary driver of equity market gains since 2023, supported by the artificial intelligence revolution, investors are now questioning whether the massive capital commitments required for AI infrastructure will translate into proportionate returns. This skepticism emerges not from a rejection of AI’s transformative potential, but rather from uncertainty about timing and magnitude of monetization. The data suggests investors are repositioning portfolios to capture value in sectors that may benefit from economic resilience while limiting exposure to the concentration risk inherent in technology-heavy indexes.

The sector rotation pattern described in the Barron’s analysis [1] is clearly visible in February 12 market data [0]. Consumer Defensive stocks emerged as the strongest performers, gaining 2.82% in a sign investors are prioritizing stability over growth. Real Estate followed with a 1.53% gain, Basic Materials advanced 1.01%, and Utilities added 0.68%, collectively demonstrating the defensive posture investors are adopting. Conversely, Consumer Cyclical stocks declined 2.52%, Technology fell 1.87%, and Financial Services dropped 2.01%, reflecting the rotation away from growth-oriented and economically sensitive sectors.

This sector divergence reveals important insights about investor risk management. The outperformance of defensive sectors typically signals concern about economic growth prospects or elevated uncertainty regarding future corporate earnings. The concentration of losses within Consumer Cyclical and Technology sectors suggests specific weakness in growth-oriented holdings rather than broad market weakness. The equal-weighted S&P 500’s relative outperformance against the cap-weighted index on rotation days indicates that investors are systematically selling mega-cap technology names while maintaining exposure to smaller, less AI-concentrated companies [4].

Individual technology stock declines on February 12, 2026 validated the rotation narrative with striking magnitude [2][3]. Apple (AAPL) experienced the most significant decline, falling 5.12% to $261.40, resulting in an approximately $200 billion reduction in market capitalization. Tesla (TSLA) declined substantially, erasing around $52 billion in market value, while Amazon (AMZN) lost approximately $51 billion. Broadcom (AVGO) saw declines resulting in a $42 billion market cap reduction, Cisco (CSCO) lost approximately $39 billion, and Meta (META) declined by roughly $35 billion. NVIDIA (NVDA), often considered the flagship AI beneficiary, fell 1.20% to $187.77, eliminating about $21 billion in market value, while Microsoft (MSFT) declined a more modest 0.19% to $403.62.

The aggregate technology sector market capitalization loss exceeding $500 billion in a single trading session [2][3] represents a substantial revaluation event. This magnitude of decline suggests the rotation is not merely tactical but reflects fundamental reassessment of technology sector valuations. The severity of Apple’s decline, in particular, may reflect company-specific concerns including regulatory scrutiny from the Federal Trade Commission over Apple News content curation practices [3], combined with broader sector rotation pressures. NVIDIA’s relative resilience compared to other mega-cap technology names may reflect continued confidence in artificial intelligence demand, though the stock’s 46.59x price-to-earnings multiple remains elevated by historical standards [0].

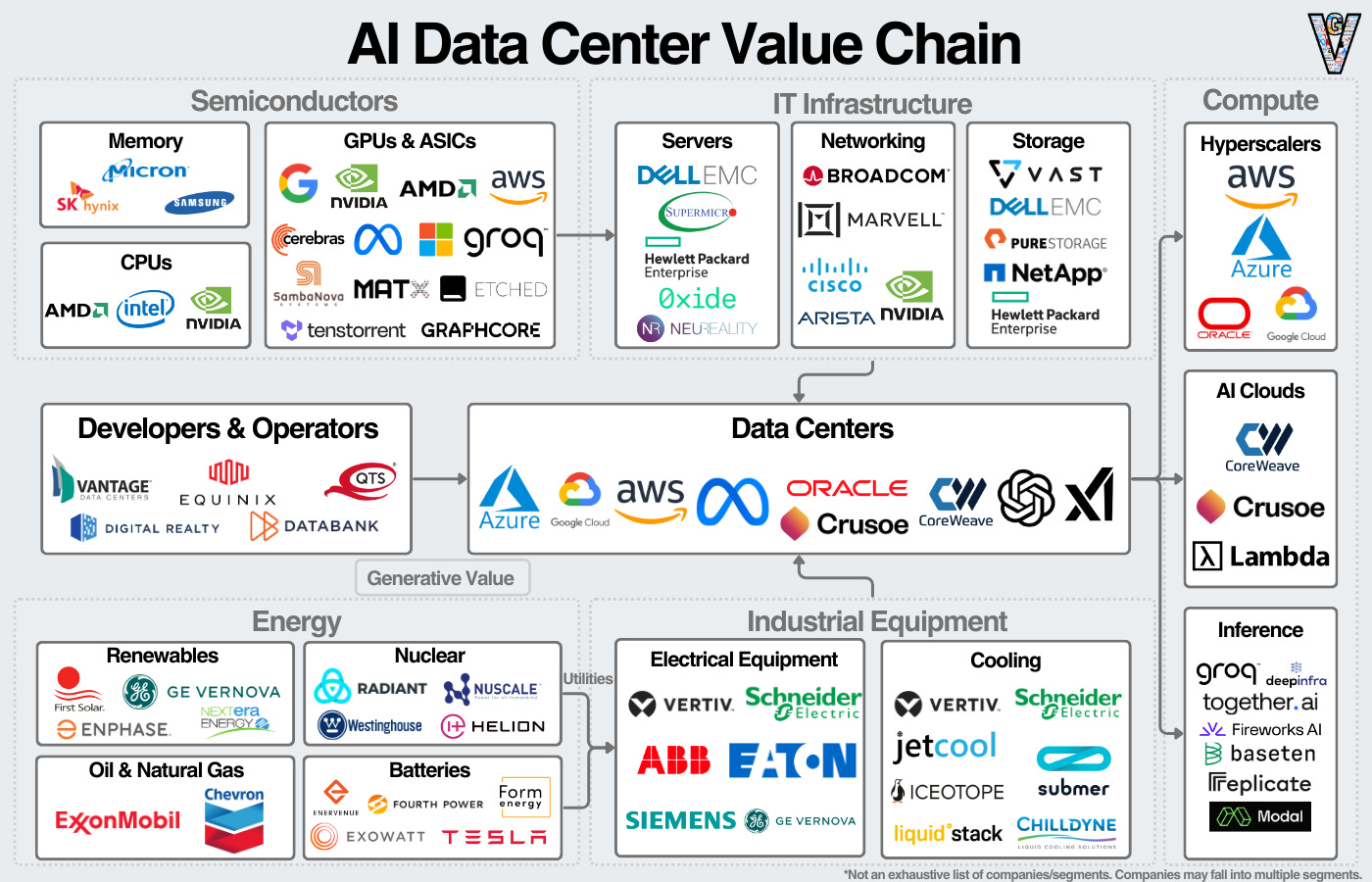

The growing skepticism about artificial intelligence investments documented in multiple analyses [4] centers on several interconnected concerns. Goldman Sachs research highlighted by Morningstar emphasizes uncertainty regarding future profit margins as companies absorb massive infrastructure spending costs. The scale of capital commitments is staggering, with major technology companies collectively committing over $100 billion to AI infrastructure development without guaranteed return timelines. This uncertainty creates a valuation challenge for investors attempting to price future earnings streams from AI investments against current capital expenditure requirements.

Morningstar’s analysis [4] identifies additional factors amplifying AI skepticism. New artificial intelligence tools may disrupt traditional software demand patterns, creating uncertainty about competitive positioning even for established technology leaders. The disruption risk extends beyond individual companies to entire industry structures, with historical parallels drawn to the newspaper and tobacco industries’ inability to adapt to technological change. These comparisons, while perhaps hyperbolic, underscore investor concern about technological displacement risk. Oracle’s planned $45-50 billion cloud infrastructure raise exemplifies the capital intensity required to compete in AI infrastructure, while Anthropic’s $30 billion raise at a $380 billion valuation and SpaceX/xAI’s $1.25 trillion valuation demonstrate the substantial capital flows into AI-related ventures [2][4].

Despite the rotation in investor sentiment, big technology companies continue to deliver robust earnings growth that complicates the bearish thesis [3][4]. NVIDIA’s fourth quarter fiscal year 2026 outlook exemplifies continued strength, with earnings per share projected at $1.52, representing 70% year-over-year growth, and revenue forecasts of $65.56 billion, indicating 60% annual growth. UBS analysts responded by raising NVIDIA’s price target to $245, suggesting 28% upside from current levels based on strong supply chain indicators supporting continued demand growth. This earnings strength creates a fundamental tension between the rotation narrative and underlying business performance.

The persistence of earnings growth among major technology companies raises questions about the sustainability of the rotation thesis. If artificial intelligence investments are beginning to generate revenue, the monetization timeline may be shorter than skeptics anticipate. Technology companies maintain strong balance sheets, continued digital transformation momentum, and established competitive positions that provide resilience against competitive disruption. The market’s willingness to penalize technology stocks despite continued earnings strength may represent an overreaction that creates opportunity for contrarian investors, though such timing remains challenging to execute profitably.

The rotation toward value and cyclical stocks reflects a mature market phase where investors reduce concentration in previously dominant sectors. Technology’s market capitalization dominance created vulnerability as index funds and active managers accumulated substantial positions, meaning any sentiment shift triggers outsized selling pressure. The current rotation may represent normalization rather than reversal, with technology stocks likely to remain market leaders but without the dominant outperformance of recent years.

The distinction between tactical and structural rotation remains critical for interpretation. Tactical rotation typically reverses within weeks to months as short-term sentiment normalizes, while structural rotation reflects fundamental changes in growth expectations that may persist for years. Current evidence supports elements of both interpretations—the magnitude of single-day declines suggests emotional response that may partially reverse, while the genuine concerns about AI return timelines and capital intensity suggest more durable sector preference changes.

Energy sector strength, with oil prices up approximately 12% year-to-date [4], provides a catalyst for value rotation by improving profitability outlooks for energy companies and inflation-sensitive sectors. This commodity strength intersects with AI skepticism to create a confluence supporting the value rotation thesis. Small-cap relative strength, as measured by Russell 2000 performance, adds credibility to the rotation narrative by indicating investor willingness to diversify beyond mega-cap technology names.

The technology sector faces elevated risk from multiple directions requiring careful monitoring. Concentration risk remains significant as mega-cap technology companies continue to dominate index performance, meaning rotation pressure could trigger continued selling pressure. Valuation concerns persist, with high price-to-earnings multiples creating vulnerability to earnings disappointments that would trigger substantial multiple compression. Regulatory risk continues to escalate, with Apple facing FTC scrutiny [3] and broader Big Tech antitrust pressures showing no signs of abatement.

AI infrastructure spending risk represents perhaps the most significant medium-term concern. Companies have committed over $100 billion to AI development without clear return visibility, and if these investments fail to generate proportionate revenue growth, margin compression could significantly impact profitability. Competitive disruption risk from alternatives to NVIDIA chips, including Cerebras systems deployed by OpenAI [3], adds uncertainty about market share and pricing power in the AI hardware market.

The rotation creates potential opportunities for investors with longer time horizons. The $500 billion technology sector market cap decline [2][3] may represent overreaction if AI monetization timelines prove shorter than current skepticism suggests. Defensive sectors offering positive performance on rotation days may provide portfolio stabilization during continued volatility. Small-cap exposure through Russell 2000 or equal-weighted index products offers diversification from mega-cap concentration while maintaining equity market participation.

Key catalysts warranting monitoring include NVIDIA’s GPU Technology Conference in March 2026, which will provide AI chip roadmap updates and demand signal indications. Fourth quarter earnings season will test AI ROI evidence through company guidance and capital spending updates. Energy and commodity price trajectories will influence value rotation sustainability, while Federal Reserve policy decisions will affect the relative attractiveness of growth versus value investment styles.

Market data from February 12, 2026 confirms a significant rotation away from technology stocks toward value and defensive sectors, driven by investor concerns about AI investment returns. The technology sector lost over $500 billion in market capitalization in a single day, with Apple declining 5.12% and losing approximately $200 billion. Simultaneously, Consumer Defensive stocks gained 2.82%, Real Estate rose 1.53%, and other defensive sectors outperformed growth-oriented sectors.

Despite this rotation, major technology companies continue to demonstrate strong earnings growth, with NVIDIA projecting 70% EPS growth and 60% revenue growth in Q4 FY26. The Barron’s analysis [1] accurately captures this market inflection point, though the sustainability of the rotation remains uncertain. Investors should distinguish between tactical positioning opportunities and potential structural shifts in market leadership.

The rotation’s duration will depend on evidence regarding AI investment returns, Federal Reserve policy direction, energy sector strength, and fourth quarter earnings season outcomes. Technology stocks are likely to remain market leaders but may no longer dominate market returns to the same degree as in recent years.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.