Silver Price Rally Analysis: Key Drivers and Sector Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I have sufficient data to provide a comprehensive analysis. Let me compile the findings.

Silver prices have experienced a remarkable rally, with spot silver surging over 2% to reach $76.64 per ounce and COMEX silver futures climbing more than 1% to $76.47 per ounce [0]. This substantial price appreciation reflects a confluence of macroeconomic, industrial, and geopolitical factors that have positioned silver as a critical commodity in 2026. The rally comes after silver reached an all-time high above $120 per ounce earlier in 2026 before experiencing a significant correction, with the metal now consolidating near $75-76 per ounce levels [1].

The silver market is facing its

- Total global silver supplyis expected to grow by approximately 1.5% in 2026 to 1.05 billion ounces—the highest level in a decade

- However, demand continues to outpace supply due to robust industrial consumption and investment demand

- Many silver mines are by-products of other metals like copper and zinc, limiting quick supply expansion [3]

Silver has benefited significantly from safe-haven buying patterns:

- Physical investment recovery: After three consecutive years of decline, Western physical investment is expected to recover in 2026 as silver’s exceptional price performance and ongoing macroeconomic uncertainty reignite investor interest [2]

- Retail interest surge: The precious metal experienced a dramatic rally driven by safe-haven buying and retail investor interest, with prices peaking above $121/oz previously [4]

- Gold-silver correlation: As a sister metal to gold, silver has tracked gold’s safe-haven rally while offering higher volatility and potential returns [5]

Industrial applications remain the largest component of silver demand:

- Photovoltaic (Solar) Sector: Despite high prices prompting some silver “thrift” (reduction in usage), solar installations continue to expand globally

- AI and Technology Boom: The mining and metals supercycle is being driven by AI infrastructure and the deterioration of fiat currency values [6]

- EV and Electronics: Continued growth in electric vehicles and electronic manufacturing sustains industrial demand

Physical delivery concerns have added another dimension to the rally:

- COMEX inventory plunges: Silver inventory has declined significantly as physical demand challenges Western pricing mechanisms [7]

- Registered silver category: Data for February 11, 2026 showed a single-day negative adjustment of 3,256,882 ounces in the Registered silver category at CME Group’s Commodity Exchange [7]

- Delivery concerns: With March Silver open interest currently at 380 million ounces but only 103 million ounces currently available, potential delivery bottlenecks have created speculative pressure [8]

The renewable energy sector, particularly solar PV manufacturing, faces significant challenges from elevated silver prices:

- Silver intensity in solar: Silver paste is a critical material in solar cell production, making photovoltaic manufacturers highly sensitive to silver price movements

- Global PV silver demand contraction: According to analysis from Xueqiu, global PV silver demand is projected to contract by approximately 17% in 2026 due to high prices [9]

- Silver Institute forecast: The Washington-based Silver Institute projects that silver industrial fabrication will decline by 2% year-on-year in 2026, to a four-year low of around 650 million ounces, led by thrifting efforts [10]

The solar industry is responding to cost pressures through innovation:

- Silver reduction initiatives: Manufacturers are actively developing methods to use less silver per panel without sacrificing efficiency

- Substitution trends: According to J.P. Morgan Global Research, the price rally has already set in motion an acceleration in substitution trends, which will severely restrict the growth of solar applications in the broader silver demand environment [5]

- Long-term perspective: Despite raw material fluctuations, solar energy remains a long-term cost-saving solution, with industry participants focusing on high-efficiency modules and technology upgrades [3]

The impact varies by region:

- Indian manufacturers: Companies focusing on local manufacturing and technology upgrades will be better positioned to manage rising raw material costs [3]

- Chinese demand: China remains an exception where demand is expected to grow slightly, supported by product innovation and the increasing popularity of gold-plated silver jewelry [2]

Silver’s industrial applications extend well beyond solar:

- Electronics: Electrical and electronics manufacturing remains a major consumer

- Automotive: EVs and traditional automotive applications require silver-containing components

- Chemicals: Silver is used in various industrial processes and catalysts

Recent market data reveals mixed sector performance [0]:

| Sector | Daily Change | Status |

|---|---|---|

| Consumer Defensive | +2.03% | Outperforming |

| Basic Materials | +0.05% | Slight Gain |

| Industrials | -2.26% | Underperforming |

| Technology | -2.54% | Underperforming |

The

Silver-related equities have shown elevated volatility:

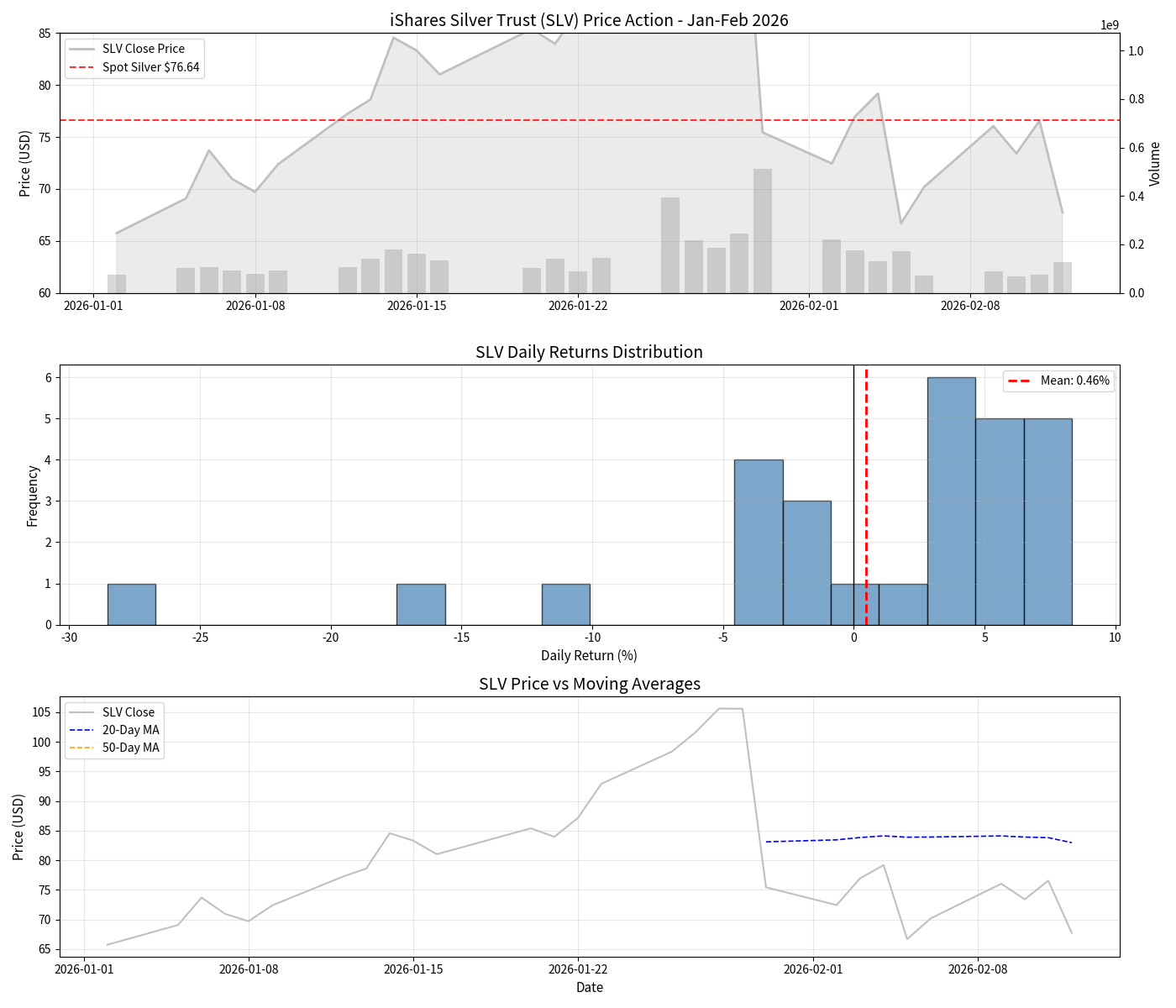

- iShares Silver Trust (SLV): Trading range of $65.75 - $105.60 in 2026, with current levels around $67.73 [0]

- Daily volatility: 8.05% standard deviation in daily returns, with maximum daily gain of 8.33% and maximum daily loss of -28.54% [0]

- Hecla Mining (HL): Major silver miner showing significant correlation with silver price movements [0]

Analyst expectations remain constructive:

- J.P. Morgan: Sees silver prices averaging $81/oz in 2026—more than double its average in 2025—though this depends on multiple factors including global demand [5]

- Bullish thesis: Investors are increasingly focused on whether current supply-demand imbalances and safe-haven sentiment are sufficient to drive silver higher [2]

- Price correction risk: Silver experienced a historic 25% single-day decline from its highs, demonstrating extreme volatility

- Industrial demand destruction: If prices remain elevated, industrial users may accelerate substitution or reduce consumption

- COMEX delivery mechanics: Potential delivery bottlenecks could create short-term price dislocations

- Currency dynamics: Dollar weakness typically supports precious metals, while strength creates headwinds

- Silver mining companies with low production costs

- Physical silver and silver-backed ETFs

- Hedged precious metals investors

- Solar panel manufacturers with thin margins

- Industrial users unable to pass through costs

- Price-sensitive electronics manufacturers

The silver price rally represents a convergence of structural supply deficits, robust industrial demand, safe-haven flows, and physical delivery concerns. While the $76+ per ounce level reflects genuine fundamental support, the extreme volatility—both above $120 and the subsequent correction—underscores the metal’s speculative character.

For the renewable energy sector, elevated silver prices present both challenges and catalysts. The 17% projected contraction in PV silver demand demonstrates the industry’s sensitivity, but also accelerates innovation in silver-efficient technologies. Over the longer term, the renewable energy transition may prove more consequential for silver demand than short-term price fluctuations.

Industrial manufacturing faces similar pressures, with the sector’s performance likely to diverge between those able to absorb or pass through higher input costs versus those facing margin compression. The Basic Materials sector’s relative resilience reflects some protection via direct silver exposure, while the Industrials sector’s weakness may partly reflect cost concerns.

Investors considering silver exposure should balance the fundamental support from structural deficits against elevated valuations and extreme short-term volatility. Sector-specific analysis suggests silver miners may offer leveraged exposure to continued price strength, while solar and industrial users may face transitional challenges before adaptation takes hold.

[0] Ginlix API Data - Market indices, sector performance, and SLV price data

[1] Trading Economics - Silver Price Chart and Historical Data (https://tradingeconomics.com/commodity/silver)

[2] Reuters - “Rising investment to keep global silver demand steady in 2026” (https://www.reuters.com/world/china/rising-investment-keep-global-silver-demand-steady-2026-silver-institute-says-2026-02-10/)

[3] Bluebird Solar - “Rising Silver Prices and Their Impact on Solar Energy” (https://bluebirdsolar.com/blogs/all/rising-silver-prices-and-their-impact-on-solar-energy)

[4] Mexico Business News - “Gold Holds Steady; Silver Swings in 2026” (https://mexicobusiness.news/mining/news/gold-holds-steady-silver-swings-2026)

[5] J.P. Morgan Global Research - “How Will Silver Prices Fare in 2026?” (https://www.jpmorgan.com/insights/global-research/commodities/silver-prices)

[6] Seeking Alpha - “The Mining And Metals Supercycle-Driven By AI And The Deterioration Of Fiat Currency Values” (https://seekingalpha.com/article/4863081)

[7] Kitco News - “Silver inventory plunges as physical demand challenges western pricing” (https://www.kitco.com/news/article/2026-02-12/silver-inventory-plunges-physical-demand-challenges-western-pricing)

[8] YouTube/Clive Thompson - Financial Markets update February 9, 2026 (https://www.youtube.com/watch?v=_Q13EUVKXMU)

[9] VMAX Power PV - “The Global Solar Market Faces a New Paradigm Under the Silver Shock” (https://www.vmaxpowerpv.com/news/the-global-solar-market-faces-a-new-paradigm-under-the-silver-shock/)

[10] PV Magazine USA - “Silver prices forecast to strengthen further this year” (https://pv-magazine-usa.com/2026/02/11/silver-prices-forecast-to-strengthen-further-this-year/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.