Gold Price Surge Analysis: Macroeconomic Drivers and Central Bank Policy Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

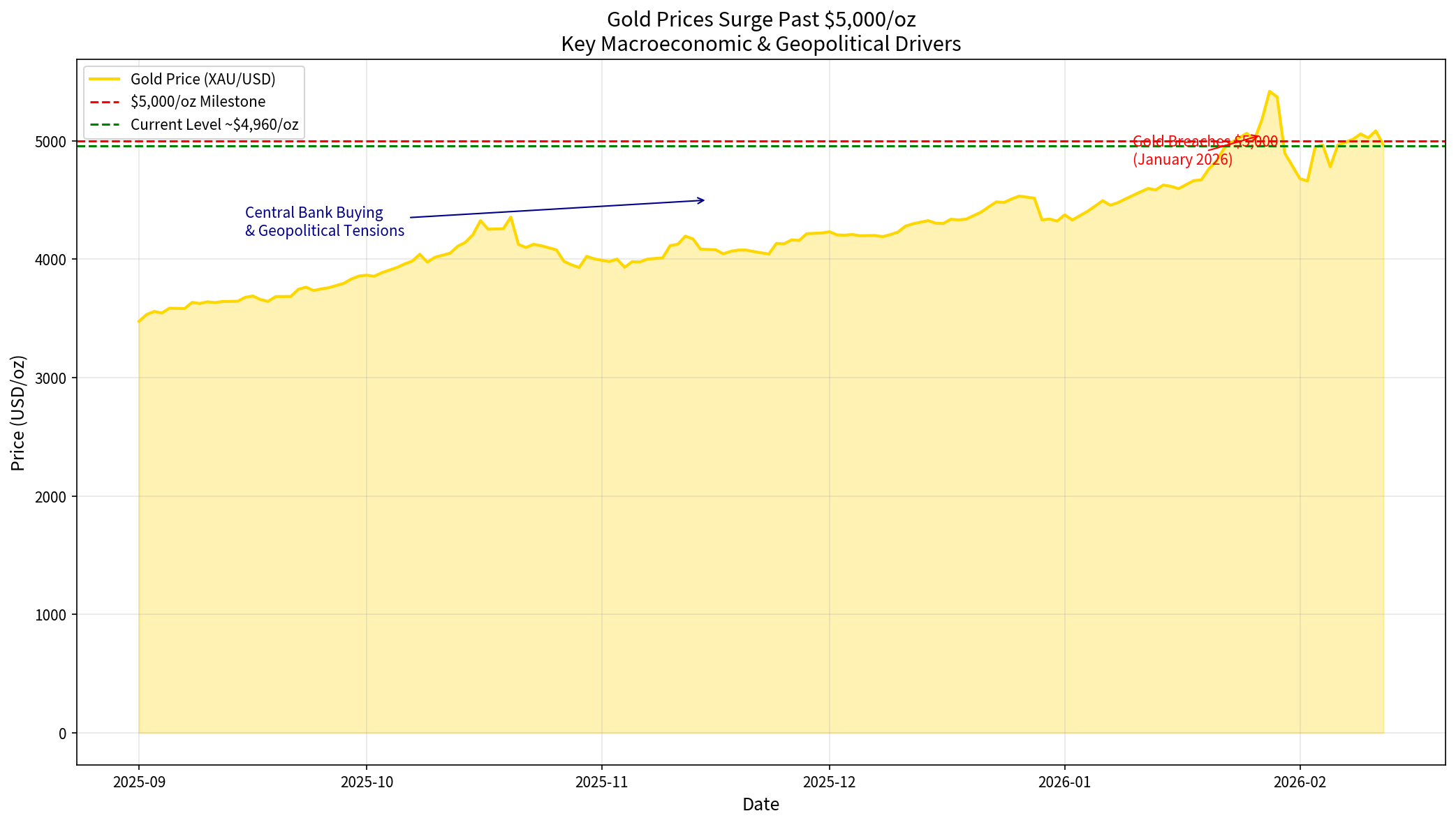

Gold prices have reached unprecedented levels, with spot gold trading near $4,960/oz and futures at approximately $4,980/oz as of February 12, 2026 [0]. This represents a remarkable rally that has seen gold breach the historic $5,000/oz milestone in January 2026—the first time in history the precious metal has achieved this level [1]. The current price reflects a year-to-date gain of approximately 17%, following an extraordinary 64% surge in 2025 [1].

This analysis examines the key macroeconomic and geopolitical factors propelling gold prices to these record levels and explores how sustained high gold prices may influence global central bank monetary policies and inflation control strategies.

Gold’s ascent to nearly $5,000/oz represents one of the most significant commodity rallies in modern financial history. The metal has demonstrated remarkable resilience across multiple market conditions, defying traditional correlations and analyst expectations.

| Metric | Value |

|---|---|

Current Spot Price |

~$4,960/oz |

Current Futures Price |

~$4,980/oz |

Intraday Gains |

+0.77% (spot), +0.65% (futures) |

52-Week Range |

$2,633 - $5,419/oz |

52-Week Performance |

+88%+ |

2025 Annual Gain |

+64% (largest since 1979) |

YTD 2026 Gain |

+17% |

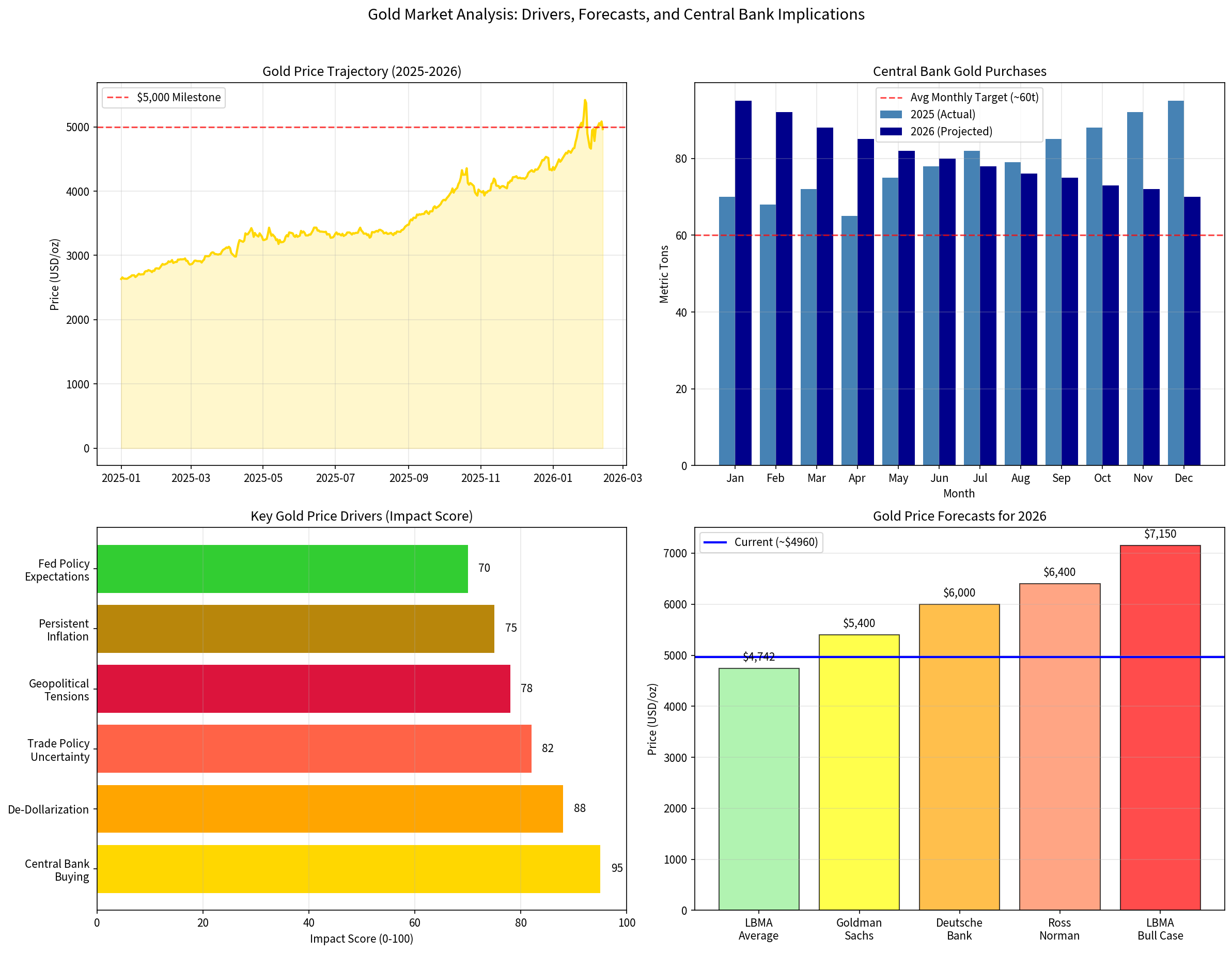

Central bank gold purchases have emerged as the

- Central banks purchased approximately 863 metric tonsof gold in 2025

- Goldman Sachs projects continued purchases of approximately 60 metric tons per monththroughout 2026

- Poland alone plans to increase its gold reserves from 550 metric tons (end-2025) to 700 metric tons [1]

This buying spree represents a structural shift in reserve management philosophy, particularly among emerging market central banks seeking to reduce exposure to Western financial systems and currency volatility.

The BRICS alliance (Brazil, Russia, India, China, South Africa, and expanding members) has accelerated efforts to reduce reliance on the US dollar in international trade and reserve holdings [2][3]. Gold has emerged as the primary beneficiary of this trend due to its universal acceptance and “sanctions-proof” characteristics.

The Russia-Ukraine conflict has intensified this trend dramatically. Western financial sanctions on Russia’s central bank reserves have served as a wake-up call for nations concerned about the security of USD-denominated assets. Central banks worldwide are reevaluating reserve allocation strategies, with gold gaining significant traction as an alternative store of value [3].

The Trump administration’s aggressive trade policies have created substantial market uncertainty, directly supporting gold prices through safe-haven demand [4]. Key developments include:

- Tariff Threats:100% tariffs on Canadian goods and 145% tariffs on Chinese imports have intensified trade war concerns

- “TACO” Trade:The phenomenon of “Trump Always Changing Outcomes” has created unprecedented market volatility

- NAFTA Renegotiations:Uncertainty surrounding North American trade relationships has boosted safe-haven assets

Emma Wall, Chief Investment Strategist at Hargreaves Lansdown, noted that Trump’s trade policies continue to worry investors, providing ongoing support for gold prices [4].

US inflation remains at approximately 2.7%, still above the Federal Reserve’s 2% target [5]. This persistent inflationary environment has transformed gold’s role from a peripheral safe-haven asset to a core portfolio hedge against eroding purchasing power.

Apollo Global Management’s Chief Economist Torsten Slok emphasized that “new risks emerge when inflation is persistently above the Fed’s 2% target,” explaining why gold has maintained its strength even during periods of elevated interest rates [5].

Market expectations for Federal Reserve rate cuts have strengthened, with investors anticipating more aggressive monetary easing than previously forecast [6]. Notable perspectives include:

- David Einhorn (Greenlight Capital):Predicts the Fed will cut rates “substantially more than two times” this year, citing Kevin Warsh (Trump’s pick to succeed Powell) as a potential catalyst for more accommodative policy

- Market Pricing:Bond markets are increasingly pricing in multiple rate cuts, reducing gold’s opportunity cost

However, the traditional inverse correlation between gold prices and interest rates has fundamentally

Multiple geopolitical flashpoints continue to support gold’s safe-haven appeal:

| Flashpoint | Impact on Gold |

|---|---|

Russia-Ukraine War |

Ongoing conflict maintaining risk premium; sanctions-driven reserve diversification |

US-NATO Relations |

Friction over Greenland and European defense spending creating uncertainty |

Middle East Instability |

Regional tensions supporting energy-price-linked gold demand |

South China Sea |

Maritime disputes between China and neighbors adding to geopolitical risk |

Gold-backed ETFs recorded exceptional inflows in 2025, with

The most significant market development has been the breakdown of the long-standing inverse correlation between gold prices and real interest rates [5]:

- Rising interest rates → Higher opportunity cost for holding non-yielding gold → Lower prices

- Falling interest rates → Lower opportunity cost → Higher gold prices

- Fed’s aggressive rate hikes (2022-2023) failed to produce expected gold declines

- Gold prices remained resilient even as rates plateaued above 5%

- The correlation has “decayed significantly” according to Torsten Slok [5]

This decoupling suggests a fundamental shift in how investors view gold’s role in portfolios:

- Alternative Allocation:Gold is no longer merely a defensive asset but a potential alternative allocation

- Inflation Hedge:Rising gold prices signal persistent inflation expectations

- Portfolio Protection:Investors are allocating to gold as protection against multiple systemic risks

Ray Dalio, founder of Bridgewater Associates, has recommended approximately

Major financial institutions have substantially raised their gold price targets:

| Analyst/Institution | Price Target | Timeframe | Notes |

|---|---|---|---|

Goldman Sachs |

$5,400/oz | End of 2026 | Raised from $4,900; cites central bank demand |

Deutsche Bank |

$6,000/oz | 2026 | Recently reiterated forecast |

Ross Norman |

$6,400/oz | 2026 peak | Average 2026 price: $5,375/oz |

LBMA Survey (Average) |

$4,742/oz | 2026 average | Based on 45+ analyst responses |

LBMA Survey (Bull Case) |

$7,150/oz | 2026 maximum | Upside scenario |

The LBMA (London Bullion Market Association) survey of 45+ analysts provides a consensus view projecting average prices of $4,742/oz for 2026, with bull case scenarios reaching as high as $7,150/oz [1].

Sustained high gold prices present multifaceted challenges for central banks attempting to control inflation:

- Rising gold prices serve as a market signal of persistent inflation expectations

- This suggests investors believe inflation will remain above central bank targets

- Market confidence in inflation returning to 2% appears limited

Gold’s role as an inflation hedge removes a traditional pressure valve from the monetary policy transmission mechanism. When investors can hedge inflation through gold, they may be less responsive to central bank rate hikes.

Central banks may need to consider several strategic adjustments:

| Challenge | Potential Policy Response |

|---|---|

Persistent inflation expectations |

Maintain hawkish stance longer; fewer rate cuts |

Gold as inflation hedge |

Enhance forward guidance; qualitative tightening |

Currency volatility |

Potential FX intervention to support currencies |

Reserve diversification |

Reconsider own reserve composition |

De-dollarization pressures |

Develop alternative reserve instruments |

Torsten Slok warns that a “permanently higher-inflation regime” could keep central banks on a “high-rate track” [5]. This scenario would have several implications:

- Interest Rate Environment:Policy rates may remain elevated relative to pre-2020 norms

- Yield Curve Dynamics:Long-term yields may stay higher for longer

- Asset Allocation:Traditional 60/40 portfolios may require restructuring

- Credit Conditions:Sustained higher rates could pressure corporate and consumer borrowing

Gold strength historically correlates with US dollar weakness. A sustained gold rally may indicate:

- Declining confidence in USD as primary reserve currency

- Rising concerns about US fiscal sustainability

- Increasing diversification into alternative assets

Rising gold prices boost the value of existing central bank gold holdings, encouraging continued diversification. This creates a positive feedback loop supporting gold prices.

Higher gold prices can transmit to broader inflation through several channels:

- Higher Import Prices:Countries importing gold face higher costs

- Consumer Wealth Effects:Gold holders experience apparent wealth increases

- Commodity Price Linkages:Gold often leads other commodity prices

- Investment Flow:Capital flows into gold may divert from productive investment

The surge in gold prices to nearly $5,000/oz reflects a confluence of factors:

- Central Bank Buying:~863 metric tons purchased in 2025; ~60t/month projected for 2026

- De-Dollarization:BRICS nations accelerating reserve diversification

- Geopolitical Risk:Russia-Ukraine war, US-China tensions, trade uncertainty

- Persistent Inflation:~2.7% US CPI still above 2% target

- Correlation Decay:Traditional gold-rate relationship has broken down

- ETF Inflows:Record $89 billion into gold-backed ETFs in 2025

Central banks face several challenges from sustained high gold prices:

- Inflation Expectations:Gold prices signal market skepticism about inflation returning to target

- Policy Credibility:Persistent gold rally may challenge central bank inflation-fighting credibility

- Toolkit Reconsideration:Traditional monetary policy tools may prove less effective

- Reserve Management:Central banks must reconsider their own reserve allocations

- Portfolio Allocation:Analysts increasingly recommend gold as a core holding (5-15% of portfolios)

- Risk Management:Gold provides portfolio diversification during geopolitical stress

- Inflation Protection:Long-term hedge against currency debasement

- Currency Hedge:Protection against potential USD weakness

| Risk Factor | Potential Impact |

|---|---|

Fedhawkish Pivot |

If Fed raises rates unexpectedly, gold could correct |

Geopolitical De-escalation |

Resolution of major conflicts could reduce safe-haven demand |

USD Reversal |

Stronger-than-expected dollar could pressure gold |

Inflation Decline |

Significant drop in inflation could reduce gold’s appeal |

Central Bank Selling |

If major holders begin selling, prices could fall |

[1] Investing.com - “Gold has more room to run as geopolitics, cenbank buying fuel gains” (January 26, 2026)

[2] FinancialContent.com - “The Golden Pivot: Central Banks Breach 5000-Tonne Milestone as BRICS De-Dollarization Accelerates” (February 12, 2026)

[3] Yahoo Finance - “Investing legend David Einhorn says gold is replacing US Treasurys” (February 2026)

[4] BBC News - “What’s going on with the price of gold?” (February 2026)

[5] Fortune - “Wall Street top analyst sees decaying relationship between gold and interest rates” (February 11, 2026)

[6] CNBC - “David Einhorn says the Fed will cut ‘substantially more’ than two times” (February 11, 2026)

[7] Reuters - “Goldman Sachs raises 2026-end gold price forecast to $5,400/oz” (January 22, 2026)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.