Bull Market Strengthening: AI-Driven Sector Rotation Creates Stock Picker's Environment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The current market environment presents a compelling narrative of transformation rather than collapse. The Seeking Alpha article [1] characterizes the ongoing correction as a healthy reset that broadens market leadership, and this perspective is substantiated by several key market dynamics observed in recent trading data [0].

The market correction, triggered by AI-driven fears, has produced significant sector rotations affecting leveraged growth, precious metals, and cryptocurrency sectors. Between February 3-5, 2026, the selloff erased approximately $1 trillion from software stocks alone, crashed Bitcoin nearly 50% from its October peak, and sent silver plunging 31% in a single session [5]. However, the Russell 2000’s year-to-date gain of 5.4% provides evidence of small-cap leadership that historically signals broader market participation [1].

The sector performance data reveals a nuanced picture: defensive sectors (Consumer Defensive +2.03%, Utilities +0.40%) are currently outperforming, which might appear contradictory to a bullish outlook [0]. This suggests the market is in a transitional phase where profit-taking in overextended growth positions coexists with rotation toward new value opportunities. The technology sector’s decline of 2.54% and financial services’ 2.82% drop reflect the pressure on previously dominant growth positions [0].

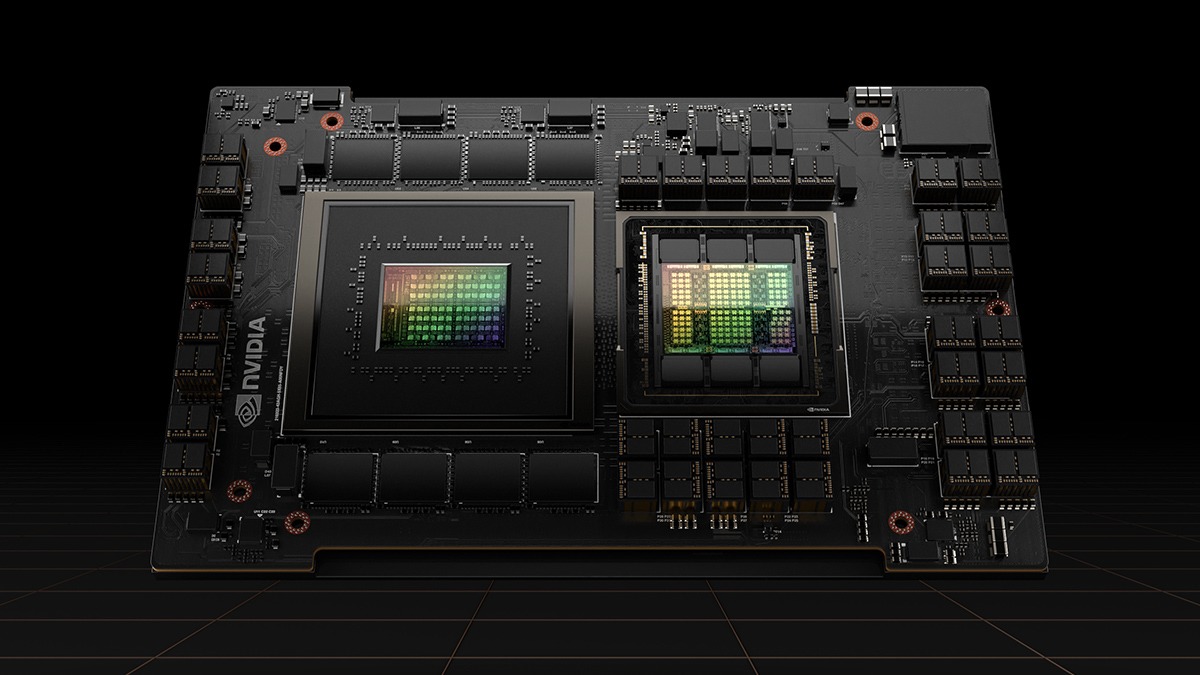

The AI sector rotation represents a fundamental shift in market sentiment. AI has transitioned from being a hype driver to a source of fear, with investors questioning the sustainability of massive AI infrastructure spending [2]. Software stocks have retreated approximately 29% from their September highs amid these AI disruption fears [3]. This rotation, while painful in the short term, creates the “stock picker’s environment” the article describes, where active security selection may outperform passive index exposure.

-

AI Investment Sustainability: Questions mounting about whether AI capital expenditure will continue at current levels, with companies adding substantial debt for data center buildouts facing funding risks [3]. OpenAI’s ability to deliver on commitments is being questioned [3].

-

Sector Concentration Reversal: Prior market was heavily concentrated in mega-cap tech; current rotation may not sustain if earnings don’t follow the sector shift. The technology sector’s 2.54% decline [0] represents significant value destruction.

-

Small-Cap Fundamental Validation: Russell 2000’s outperformance needs fundamental validation through earnings growth. Historical patterns show small-caps can lead during economic acceleration but face headwinds during uncertainty.

-

Upcoming Catalysts: Nvidia earnings on February 25 represent a key AI benchmark that could stabilize or exacerbate volatility [3]. CPI data and Fed communications could trigger further market swings.

-

Stock Picker’s Environment: The correction creates new value opportunities in sectors that have been overlooked during the mega-cap tech dominance. Active security selection may outperform passive index exposure.

-

International Exposure: Companies with international revenue exposure may benefit from dollar dynamics and global economic growth as the rotation matures.

-

Cyclical Rotation Potential: If economic data supports growth, cyclicals could assume leadership from defensive sectors, rewarding early positioning.

The analysis reveals a market in transformation rather than collapse. The Seeking Alpha characterization of this as a “healthy reset” finds partial support in the data: Russell 2000’s 5.4% YTD gain suggests domestic economic resilience, and the sector rotation is creating new value opportunities [1][0]. However, defensive sectors currently leading [0] is typically a risk-off signal that warrants caution. The $1 trillion software stock wipeout between February 3-5 [5] and $4 billion Bitcoin ETF outflows [4] indicate significant stress in risk assets. The current environment favors balanced positioning with attention to the pace of rotation. Monitoring upcoming earnings (particularly Nvidia on February 25), CPI data, and Q1 2026 earnings will be crucial for validating whether this represents a healthy correction or the beginning of a more significant downturn.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.