Five Trends Driving Energy Markets in 2026: Comprehensive Industry Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis examines the five fundamental trends identified by industry experts from CME Group, Wood Mackenzie, IEA, and other leading research institutions that will define global energy market dynamics throughout 2026. The energy landscape in 2026 represents a pivotal transition from the volatility and geopolitical uncertainty that characterized 2025, moving toward deeper structural forces shaped by policy decisions, supply growth, and transformative demand shifts driven by artificial intelligence and data center expansion [1][2].

The global liquids market faces a significant supply surplus in 2026, with production growth substantially outpacing demand. Global liquids supply is projected to grow by

A dramatic surge in LNG supply is fundamentally reshaping global gas markets, creating a buyer’s market environment. In 2026,

The rapid expansion of AI data center infrastructure is creating unprecedented electricity demand growth, transforming power markets globally. AI-related power demand is projected to grow approximately

Copper has emerged as the critical commodity underpinning the energy transition, with supply-demand dynamics creating significant price pressures. The copper market is experiencing a

Global energy investment is experiencing a temporary pullback after the 2021-2025 surge. Global energy and natural resources investment is forecast at

The most significant insight from the 2026 energy market analysis is the shift from cyclical volatility driven by geopolitical tensions and trade disputes to structural transformation driven by fundamental supply-demand rebalancing. While 2025 was characterized by trade tensions, geopolitical uncertainty, and persistent market volatility, 2026 is defined by deeper forces that will reshape energy markets for years to come [1][2].

The 29 million metric tons of new LNG capacity coming online in 2026 represents the most significant supply event in the global gas market this decade. This supply wave transforms global gas markets from a seller’s market to a buyer’s market, with lasting implications for pricing, contract structures, and regional market integration [4][5]. The price decline from 2022 peaks (approximately two-thirds reduction) creates new economics for gas-fired power generation and reduces reliance on oil-fired plants globally.

Unlike previous demand growth cycles, AI-driven power demand represents a structural shift rather than a cyclical one. The projected

The convergence of AI data center expansion, electric vehicle scaling, and grid modernization creates a “triple threat” of demand growth for copper and other critical minerals. With a decade of mining underinvestment and limited new supply capacity coming online, prices face structural upward pressure. This represents a significant constraint on the pace of energy transition and may drive increased government intervention to secure supply chains [7].

The 4% decline in global energy investment in 2026 represents a healthy correction after a 41% surge since 2020, rather than a fundamental restructuring. This temporary pause may delay new projects, but a rebound is expected once commodity prices stabilize. The investment pullback creates opportunities for strategic M&A as companies reposition portfolios during a period of compressed valuations [2][8].

-

Oversupply in Oil Markets: The 1.8 mb/d gap between supply growth (2.5 mb/d) and demand growth (0.7 mb/d) keeps crude prices under persistent pressure, threatening profitability for high-cost producers [2][3].

-

Geopolitical Volatility: Continuing geopolitical turbulence could alter supply-chain routes and investment flows, with the US-China rivalry reshaping the global energy map [6].

-

Grid Infrastructure Constraints: The rapid pace of AI-driven power demand growth may outpace grid infrastructure investment, creating bottlenecks and reliability concerns [2][6].

-

Stranded Asset Risk: Utilities investing heavily in generation capacity face the risk of overbuilding, particularly if AI-driven chip efficiency improvements moderate demand growth faster than anticipated [2].

-

Critical Mineral Supply Constraints: Copper supply deficits could price out certain energy transition projects and create bottlenecks in grid modernization and EV scaling [7].

-

LNG Infrastructure Investment: The buyer’'s market created by abundant LNG supply creates opportunities for gas utilities to expand infrastructure and secure long-term contracts at favorable terms [2][3][5].

-

Strategic Acquisitions: Compressed valuations during the investment correction create opportunities for companies to acquire high-quality assets and resources [2][8].

-

Power and Utilities M&A: Structurally higher demand for energy and resilience drives investment across “all of the above” generation mixes, creating M&A opportunities [8].

-

Critical Minerals Investment: Copper miners benefit from structural demand growth, and governments are stepping up to secure critical mineral access, potentially spurring local benefaction projects [2][7].

-

Grid Modernization: The need for grid resilience against wildfires and extreme weather events creates investment opportunities in grid infrastructure and smart grid technologies [2][3].

The energy markets in 2026 are defined by five interconnected trends that represent a fundamental restructuring of global energy dynamics. The massive LNG supply wave (29 million metric tons of new capacity) is creating a buyer’s market with prices potentially halving again by the early 2030s [2][4]. Oil markets face persistent oversupply with Brent crude forecast at $57/bbl, while OPEC+ struggles to manage volumes against non-OPEC growth [2][3].

AI-driven power demand growth of approximately 20% annually is transforming electricity markets and creating unprecedented demand that has already become a political flashpoint regarding affordability [2][6]. Critical minerals, particularly copper, face structural supply deficits as the “triple threat” of AI data centers, EVs, and grid modernization collides with a decade of underinvestment [7].

Global energy investment is pulling back 4% to $1.58 trillion after a 41% surge since 2020, creating a healthy correction that may delay projects but sets the stage for rebound [2]. M&A activity will accelerate as companies reposition portfolios, with power and utilities M&A particularly active as structurally higher demand drives investment across generation mixes [8].

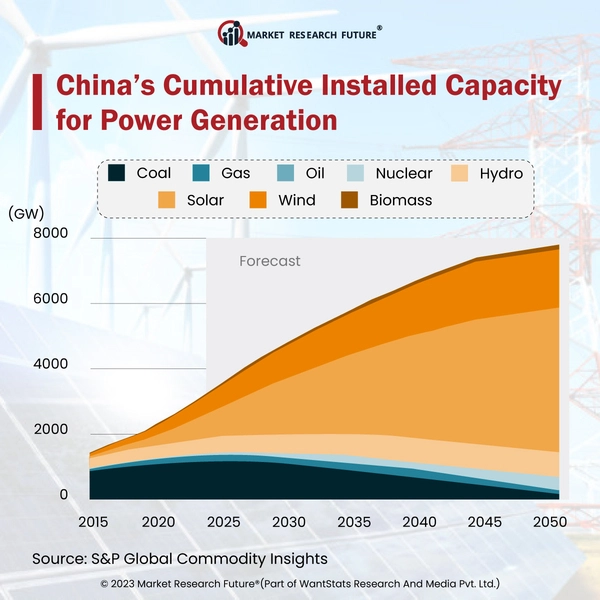

EU carbon prices are trending higher toward approximately €84/tCO₂ in 2026, with potential rise to €87/ton, driven by supply tightening from MSR placements, maritime allowance cancellations, and fewer REPowerEU auctions [3][4]. Record-breaking solar and wind capacity additions from 2025 are expected to continue, with energy storage reaching a “maturity point” for regional deployments [6].

The overall market environment in 2026 is characterized by abundant traditional energy supply, slower-than-expected clean energy transition deployment, and transformative demand shifts from digital infrastructure growth. Participants across the energy value chain must adapt to this new environment while monitoring geopolitical developments that could rapidly alter market trajectories.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.