U.S. Utility Bills Remain High Despite Cooling Inflation: 56 Million Affected by Rate Increases

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis examines the persistent disconnect between cooling overall inflation and elevated utility costs affecting American households. The phenomenon represents a significant pocket of sticky inflation that directly impacts household budgets across the nation.

The current utility rate situation results from multiple converging factors [2].

The $31 billion in rate requests during 2025 represents a record volume, indicating that utilities anticipate continued cost pressures [2][3]. As expert Charles Hua noted, “The rate data are a leading indicator on where bills will go next” [2].

While the overall Consumer Price Index slowed to 2.4% in January 2026—the lowest level in five years [1][2]—utility costs have decoupled from this broader trend. Electricity prices increased 6.3% year-over-year, and natural gas rose 10%, both marking the highest annual increases in five years [2]. This divergence highlights the sector-specific challenges that monetary policy cannot easily address.

The burden is not evenly distributed. Approximately 56 million customers have seen approved rate increases, while an estimated 1 in 5 households report being unable to afford heating costs [2]. Average winter heating costs are projected at approximately $1,000 per household, with some extreme cases reporting monthly bills exceeding $10,000 [2]. The crisis has also led to mounting household debt, with approximately 16% of households now owing $23 billion in unpaid utility bills, projected to reach $28 billion in 2026 [3].

The AI boom and associated data center expansion represent the most significant new factor in utility demand growth. This finding correlates with analysis from Goldman Sachs noting that middle-class Americans are effectively paying for the data center and AI boom through higher utility rates [4]. This represents a structural shift in electricity demand patterns that will likely persist regardless of broader economic conditions.

Bipartisan legislation has been introduced in the Senate. Senators Hawley (R-MO) and Blumenthal (D-CT) introduced the GRID Act to prevent data centers from driving up consumer utility rates [5][6]. This represents the first coordinated federal effort to address the cost allocation issue, though passage remains uncertain and would not provide immediate relief.

The approved $11.6 billion in rate increases represents only a portion of requested increases. The remaining $19.4 billion in pending or denied requests suggests continued upward pressure on rates as utilities pursue additional approvals throughout 2026 [2].

- Continued Rate Pressure: The $31 billion in total requests signals potential for additional bill increases beyond current approved amounts [2].

- Household Debt Accumulation: Unpaid utility bills reaching $23 billion with projections of $28 billion in 2026 indicate growing financial stress among consumers [3].

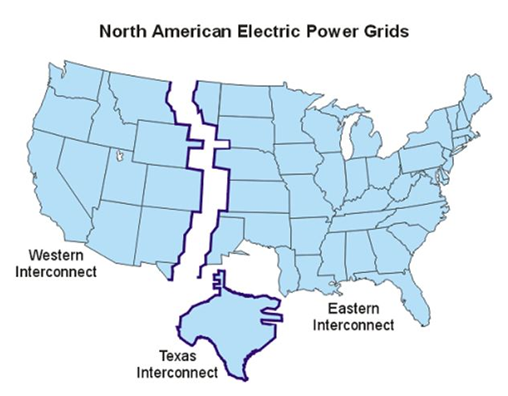

- Regional Disparities: Impact varies significantly by region depending on utility infrastructure quality and regulatory environments [2].

- Data Center Demand Growth: AI infrastructure expansion shows no signs of slowing, suggesting continued demand pressure [4].

- Energy Assistance Programs: Households can explore LIHEAP and utility-provided assistance programs for heating cost relief [2].

- Energy Efficiency Investments: Immediate conservation measures and efficiency upgrades can reduce long-term costs.

- Legislative Outcomes: If passed, the GRID Act could restructure how data center electricity costs are allocated, potentially providing consumer relief [5][6].

The analysis reveals that while headline inflation has cooled to a 5-year low, utility costs remain a significant pocket of persistent inflation affecting American households. Approximately 56 million customers have experienced approved rate increases totaling $11.6 billion, with utilities having requested an additional $19.4 billion. The primary drivers include aging infrastructure requiring capital investment, extreme weather impacts, volatile fuel costs, and unprecedented data center electricity demand. Households are struggling with 1 in 5 unable to afford heating costs and total unpaid utility bills approaching $28 billion. Legislative efforts like the GRID Act represent potential policy solutions, though implementation timelines remain uncertain.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.