U.S. Inflation Falls to Nearly Five-Year Low of 2.4% in January 2026

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

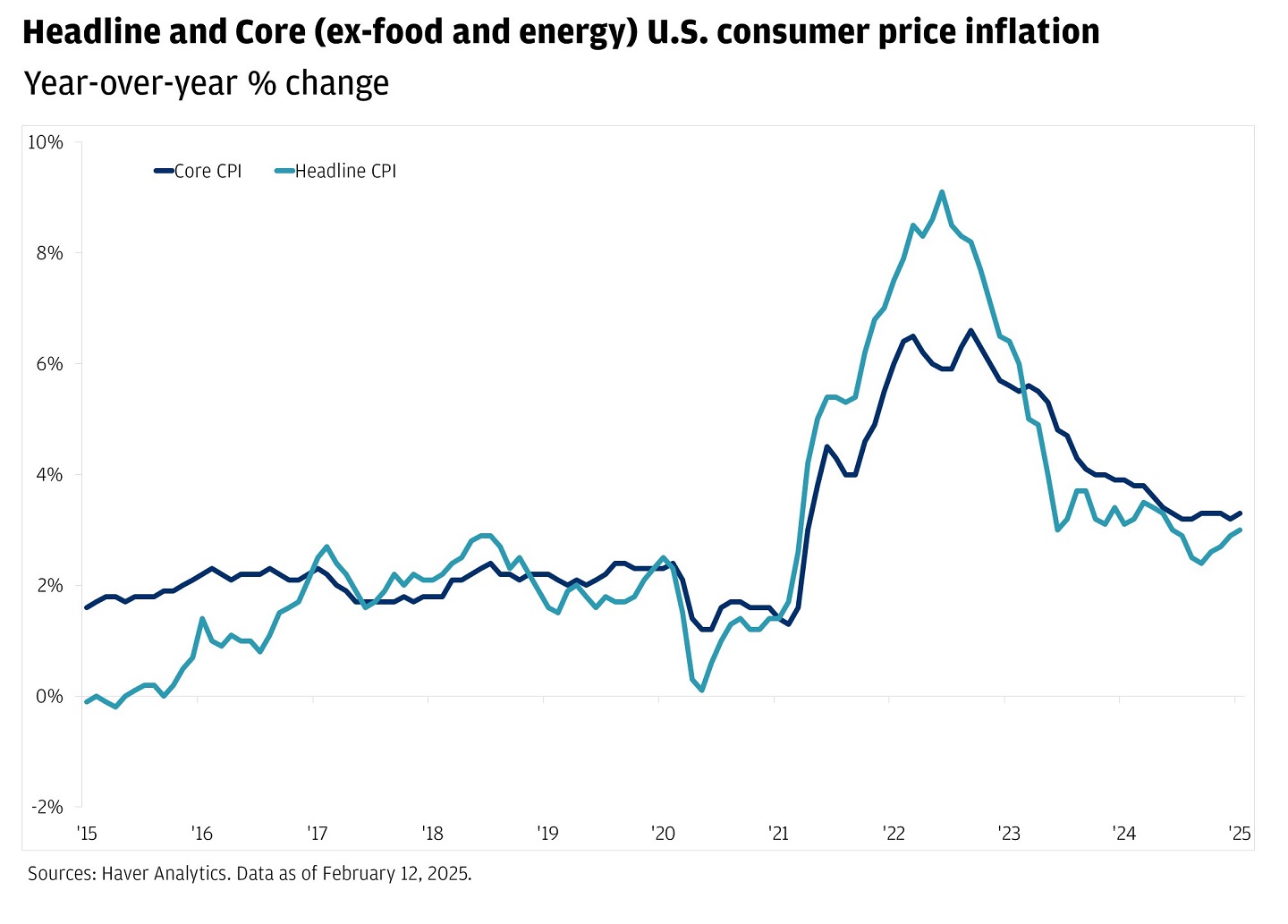

The January 2026 CPI data represents a significant milestone in the Federal Reserve’s battle against post-pandemic inflation. The headline inflation rate of 2.4% marks the lowest level since March 2021, falling from 2.7% in December 2025 [1][2]. This decline was primarily driven by two key factors: slowed apartment rental price growth and falling gas prices, which together accounted for the majority of the downward pressure on the index.

The core CPI, which excludes volatile food and energy prices, fell to 2.5%—its smallest increase since March 2021 [1]. This suggests that the disinflationary trend is becoming more broad-based rather than being driven solely by energy price fluctuations. Treasury yields immediately fell following the report, indicating that markets are pricing in the potential for future Federal Reserve rate cuts [3].

However, the economic picture remains nuanced. The January jobs report showed 130,000 positions added, with unemployment ticking to 4.3% [3]. This stronger-than-expected labor market data complicates the Fed’s policy trajectory. Morningstar analysts note that the combination of firm inflation data and solid jobs growth means the Fed is “extremely unlikely to cut the federal-funds rate in March” [5].

- Lower inflation creates potential for future rate cuts, which could benefit rate-sensitive sectors including real estate and financials

- Consumer purchasing power may gradually improve as price pressures ease

- The declining trend, if sustained, could restore confidence in the economic outlook

- The Fed may remain cautious about rate cuts despite positive inflation data due to persistent labor market strength

- Tariff pass-through effects remain unpredictable and could reignite price pressures in specific sectors

- The cumulative 25% price increase over five years still weighs on consumer budgets, limiting real disposable income growth

- February inflation data will be critical in confirming whether this represents a sustained trend rather than a one-month anomaly

This analysis is based on the Fast Company report [1] published on February 13, 2026, which cited Bureau of Labor Statistics data. The CPI decline to 2.4% represents meaningful progress toward the Fed’s 2% target, though the path forward remains uncertain. Market participants should monitor the Fed’s March meeting decision, upcoming labor market data, and the trajectory of rental prices—which served as the primary inflation driver in January. Treasury yield movements following the report suggest markets anticipate easier monetary policy ahead, though the timing of actual rate cuts depends on whether the disinflationary trend proves sustainable.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.