Reddit SPX 0DTE Options Trading Event Analysis: $8k to $235k Case Study

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis examines a Reddit event from November 14, 2025, where a 21-year-old student claimed to transform approximately $8,000 into $235,000 through aggressive 0DTE (zero days to expiration) SPX options trading [Event source]. The trader attributed a key decision to “drug-induced intuition” that SPX would open red then recover, and announced plans to transition to safer strategies. Market data confirms SPX experienced significant volatility during the relevant period, with a 1.3% drop on November 13 followed by a 0.93% recovery on November 14 [0]. This event occurs amid explosive growth in 0DTE trading, which now represents 62.4% of total SPX options volume, dominated by retail traders [2].

The described trading strategy aligns with actual market movements during November 10-14, 2025. SPX dropped from 6,826.47 to 6,737.49 (-1.3%) on November 13, closing at its daily low, then recovered to 6,734.11 (+0.93%) on November 14, bouncing from the 6,646.87 low to close near the day’s high of 6,774.31 [0]. This pattern of sharp decline followed by recovery matches the trader’s described approach of betting on SPX opening red then recovering.

The event also referenced PLTR puts, which showed significant volatility during the same period, declining from $193.61 to $174.01 (-10.1%) with a particularly sharp 5.27% drop on November 13 before partial recovery of 4.21% on November 14 [0].

This individual case reflects broader market trends in 0DTE options trading:

- Record Volume: SPX 0DTE options averaged 2.4 million contracts daily in August 2025, representing a record 62.4% of overall SPX volume [2]

- Retail Dominance: Retail traders comprise an estimated 53-60% of SPX 0DTE trading volume [2][3]

- Explosive Growth: 0DTE options trading has grown more than five-fold over the past three years [3]

- Market Records: Total options volume in 2025 is on track to exceed 13.8 billion contracts, marking a sixth straight annual record [1]

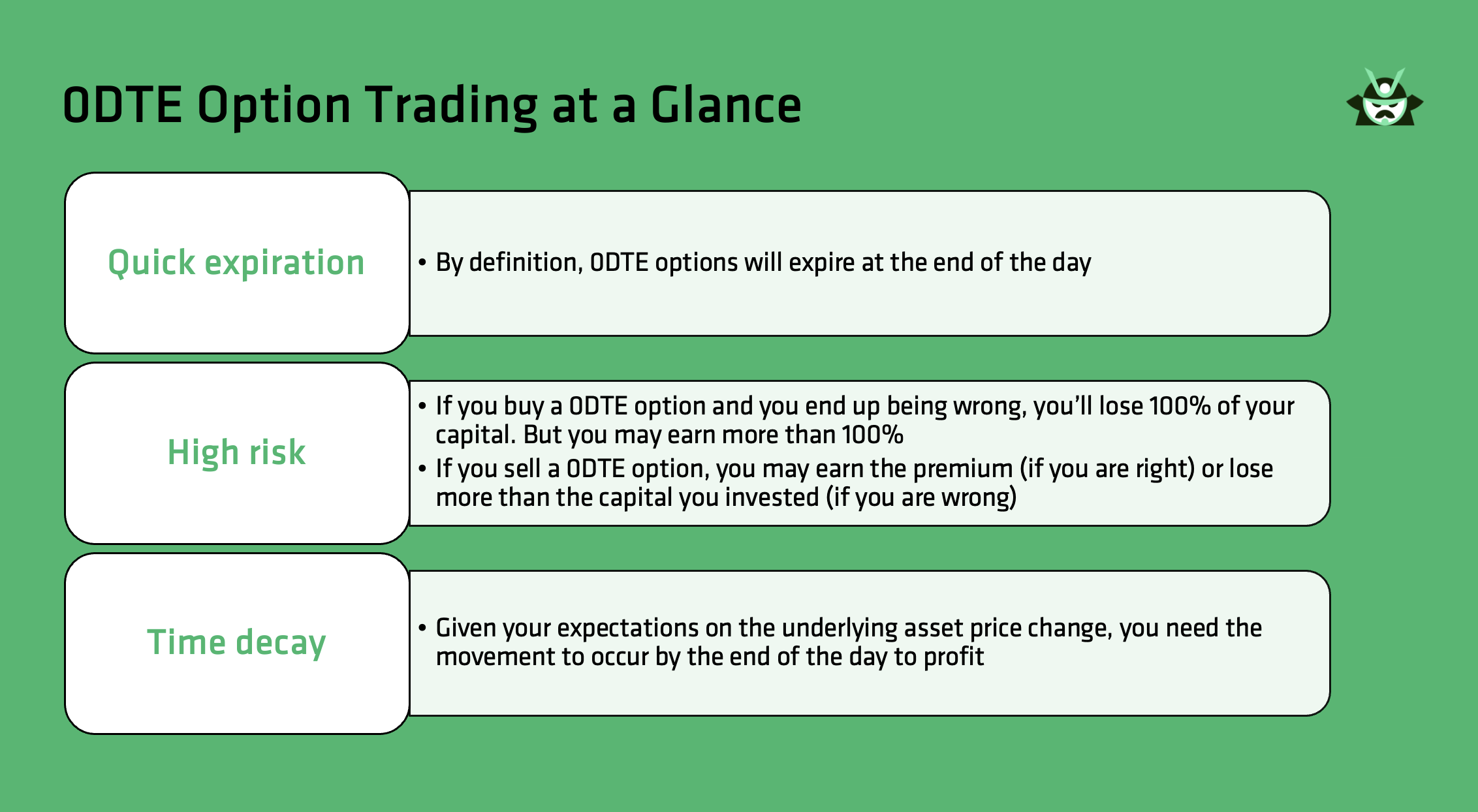

The trading strategy described involves extreme risk characteristics inherent to 0DTE options:

- Extreme Theta Decay: Options lose value rapidly as expiration approaches [4]

- High Gamma Risk: Delta can swing dramatically with small price movements [4]

- Liquidity Concerns: Especially for newly listed same-day contracts [4]

Despite these risks, market structure analysis shows that 95% of 0DTE trades are conducted in limited-risk formats (long options or spreads), with only 4% involving naked short options, reducing systemic risk [3]. However, rapid position unwinding could still create volatility spikes [1].

The event highlights growing regulatory scrutiny around 0DTE trading:

- Investor Protection: Regulators are increasingly concerned about investor protection and market stability [1]

- Gamification Concerns: The “gamification” of trading through social media influence is attracting regulatory attention [1]

- Suitability Standards: Discussions around enhanced disclosure requirements and stricter suitability standards are ongoing [1]

The democratization of sophisticated trading tools has fundamentally altered market dynamics:

- Technology Access: Commission-free trading and real-time data access have lowered barriers to entry [1]

- Social Media Influence: Platforms facilitate rapid strategy dissemination and coordination [1]

- Institutional vs. Retail: While retail traders dominate 0DTE volume, institutions still control larger notional values [2]

The claimed success represents a statistical outlier rather than typical outcomes:

- High Failure Rate: The vast majority of 0DTE options expire worthless

- Verification Challenges: No independent verification of the claimed transformation is available

- Psychological Factors: Attribution to “drug-induced intuition” suggests non-analytical decision-making processes

- Overconfidence Bias: Exceptional gains may lead to increased risk-taking behavior

- Gambling Mentality: Non-analytical decision-making approaches increase loss probability

- Addiction Potential: High-volatility trading can be psychologically addictive

- Complete Capital Loss: 0DTE options can result in 100% loss of premium paid

- Leverage Amplification: Small account sizes can be wiped out quickly

- Margin Calls: Short options strategies can generate unlimited losses

- Monitor 0DTE volume as percentage of total market volume

- Track correlation between 0DTE activity and intraday volatility spikes

- Watch for regulatory announcements regarding options trading restrictions

- Evolution of retail trading patterns and their impact on market dynamics

- Changes in broker risk management policies for high-frequency options trading

- Development of new products or restrictions in response to retail 0DTE growth

- SEC or CFTC statements on 0DTE options trading

- Changes to suitability requirements for complex options strategies

- Implementation of new circuit breakers or trading halts

- Continued growth or stabilization of 0DTE trading volumes

- Development of institutional strategies to manage 0DTE-related risks

- Changes in market-making practices and liquidity provision

This analysis reveals that while the individual Reddit case may represent an extreme outlier, it reflects broader trends in the options market where retail traders have embraced 0DTE strategies with unprecedented volume. The market data confirms that SPX experienced the volatility pattern described in the Reddit post, providing some credibility to the trading narrative. However, the statistical probability of such extreme success remains exceptionally low, with the vast majority of 0DTE positions expiring worthless.

The explosive growth in 0DTE trading, now representing over 60% of SPX options volume, has attracted regulatory attention and raised concerns about investor protection and market stability. While most 0DTE trading occurs in limited-risk formats, the potential for rapid position unwinding to create volatility spikes remains a concern for market participants and regulators alike.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.