Escalating US-Iran Tensions Impact on Global Oil Markets and Energy Sector Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I have comprehensive data to provide a thorough analysis. Let me compile the findings into a systematic report.

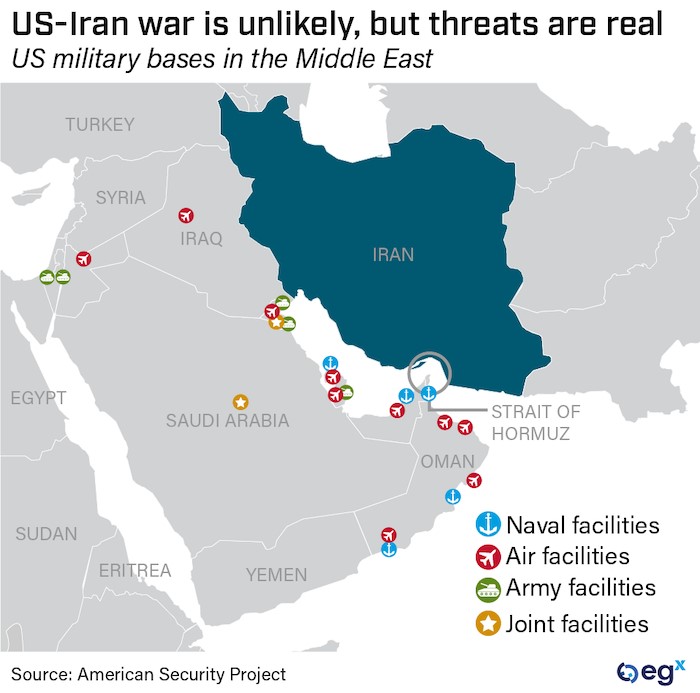

The current US-Iran geopolitical standoff presents significant implications for global oil markets and energy sector investments. With the US military preparing for potential sustained operations against Iran, market participants are assessing supply disruption risks, price volatility scenarios, and investment strategies in the energy sector.

Based on the latest trading data, WTI crude oil prices have exhibited notable volatility reflecting geopolitical tensions [0]:

| Metric | Value |

|---|---|

Latest Close (Feb 13, 2026) |

$57.67/barrel |

Period High |

$66.48/barrel |

Period Low |

$55.76/barrel |

Average Price |

$61.06/barrel |

Oil prices experienced significant upward movement in late January 2026 when US-Iran tensions escalated, with prices jumping from around $57 to above $66 per barrel—a gain of approximately 17% [1][2]. However, prices have since retreated as concerns about immediate supply disruptions have eased [3][4].

The Energy sector is currently

| Sector | Daily Change |

|---|---|

| Utilities | +3.55% |

Energy |

+1.64% |

| Basic Materials | +1.56% |

| Technology | -0.68% |

Major US energy equities, including

Iran is the

- Baseline forecast: Brent crude averaging$55/barrelin 2026 (assuming no Iran-related disruptions)

- Disruption scenario: If Iran’s oil exports are completely removed starting February, Brent could rise to an average of$71/barrelin Q2 2026

- Current war premium: Only modest premium of approximately$4/barrelis currently built into prices [1]

The oil market is currently driven by several competing factors [2][3][4]:

-

Upside pressures:

- US-Iran geopolitical tensions

- Tightening sanctions on Russian oil

- Expectations of lower exports from various producers

-

Downside pressures:

- IEA’s downward revision of 2026 global oil demand growth forecast

- Saudi Arabia increasing crude exports to multi-year highs

- Oversupply concerns

| Factor | Impact |

|---|---|

Integrated Majors (XOM, CVX) |

Potential upside from price volatility; strong free cash flow generation expected [5] |

Exploration & Production (E&P) |

Higher sensitivity to spot prices; could see margin expansion |

Oilfield Services (SLB) |

Activity levels depend on sustained high prices |

Refining |

Margin outlook depends on crack spread dynamics |

Past conflicts in the Middle East have typically generated

- Significant Iranian supply disruption could push Brent to $70-90/barrel range [1]

- Energy sector stocks could continue rally, potentially matching 2022-2023 performance

- Diplomatic resolution could remove risk premium

- Oversupply concerns (Saudi production increases) could pressure prices

- Global demand slowdown (as projected by IEA) limits upside

| Scenario | Probability | Oil Price Impact | Investment Implication |

|---|---|---|---|

Base Case |

Moderate | $55-65/bbl | Energy sector stable; focus on dividend-paying majors |

Escalation |

Low-Medium | $70-80/bbl | Significant upside for E&P and integrated names |

Diplomatic Resolution |

Moderate | $50-60/bbl | Risk premium evaporates; sector correction possible |

Analysts note that

Investors should closely track:

- US-Iran diplomatic developments- Any de-escalation would likely remove the war premium

- Iranian oil export flows- Vessel tracking data showing actual shipment volumes

- OPEC+ production decisions- Saudi Arabia’s pricing strategy signals

- US inventory data- API and EIA weekly reports (recent API data showed 11.1M barrel draw) [2]

- IEA/OECD demand forecasts- Global consumption trajectory

The escalating US-Iran tensions introduce meaningful volatility into global oil markets, with potential for both upside and downside scenarios. Currently, the market has priced in only a modest war premium of approximately $4/barrel, suggesting significant price sensitivity to any actual supply disruptions [1].

For energy sector investors, the current environment favors

[1] BloombergNEF - “Oil Can Hit $91 a Barrel in Late 2026 on Iran Disruption” (https://about.bnef.com/insights/commodities/oil-can-hit-91-a-barrel-in-late-2026-on-iran-disruption/)

[2] ING Think - “The Commodities Feed: Oil rising as US-Iran tensions re-emerge” (https://think.ing.com/articles/the-commodities-feed-us-iran-tensions-re-emerge040226/)

[3] Energy Connect - “Oil Set for Weekly Loss as Iran Concerns Ebb, Wider Markets Drop” (https://www.energyconnects.com/news/oil/2026/february/oil-set-for-weekly-loss-as-iran-concerns-ebb-wider-markets-drop/)

[4] The National - “Oil headed for consecutive weekly loss as US-Iran conflict risks subside” (https://www.thenationalnews.com/business/energy/2026/02/13/oil-headed-for-second-consecutive-weekly-loss-as-us-iran-conflict-risks-subside/)

[5] Energy Connect - “Exxon, Chevron Head for Best Month Since 2022 as Crude Surges” (https://www.energyconnects.com/news/oil/2026/january/exxon-chevron-head-for-best-month-since-2022-as-crude-surges/)

[0] Ginlix API Data (Oil price data, sector performance)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.