U.S. Jobs Report Tops Expectations; Japan Election Signals Fiscal Expansion

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

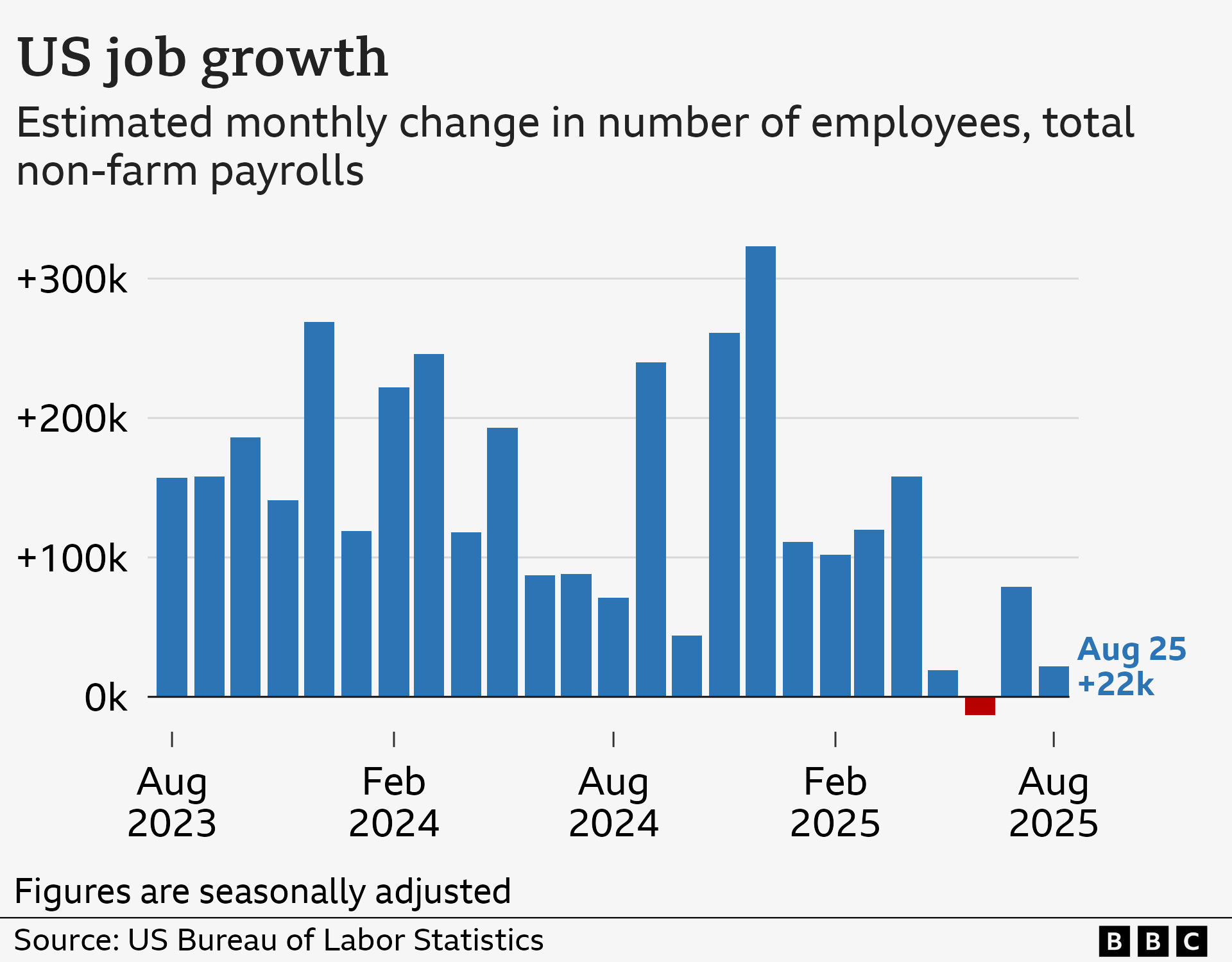

The January 2026 employment data represents a significant upside surprise, with nonfarm payrolls adding 130,000 jobs against consensus forecasts [1][2]. This “blowout” jobs report signals continued labor market resilience as the U.S. economy navigates 2026. The unemployment rate holding steady at 4.3% suggests the labor market remains near full employment without significant deterioration [2].

Healthcare sector employment accounted for more than half of total job gains, highlighting the structural growth in medical services and aging demographics driving long-term employment trends [2]. This concentration in healthcare contrasts with more mixed sector performance, suggesting uneven labor demand across industries.

The concurrent Japanese election results carry substantial macroeconomic significance. Prime Minister Sanae Takaichi’s LDP secured a landslide “supermajority,” providing a clear mandate for fiscal expansion and increased public spending [3][4]. This political outcome strengthens expectations for further Bank of Japan rate hikes, creating a stark monetary policy divergence with the Federal Reserve’s anticipated easing cycle.

BNP Paribas Wealth Management characterized the outcome as “reinforcing Takaichi’s castle” for fiscal expansion, while Columbia Threadneedle noted the sharp contrast with UK political dynamics in a “tale of two supermajorities” [3][4]. This policy divergence could narrow yield differentials between U.S. and Japanese bonds, potentially affecting currency flows and global capital allocation.

The February 13, 2026 market reaction reflected nuanced investor positioning [0]:

- S&P 500: +0.03% (essentially flat)

- NASDAQ: -0.07% (slight weakness)

- Dow Jones: +0.12% (modest gain)

- Russell 2000: +1.01% (significant small-cap rally)

This mixed response initially suggested the market initially cut expectations for Fed rate cuts upon seeing strong headline numbers, but subsequent analysis revealed more complex positioning [7]. The small-cap outperformance indicates potential rotation toward domestic-focused equities that may benefit from robust employment growth.

The contrasting monetary policy trajectories—Federal Reserve moving toward rate cuts while the Bank of Japan continues hiking—represent a significant macro environment shift. Historical patterns suggest such divergences can trigger substantial currency movements and capital reallocation between markets. The narrowing yield differential could strengthen the yen against the dollar, affecting Japanese exporters and U.S. multinational earnings.

Analysts note that if inflation remains stable alongside this job growth, the “no landing” scenario could become market consensus [5]. This would represent a departure from the expected “soft landing” narrative and could drive continued equity rally, particularly in industrial and healthcare sectors positioned to benefit from sustained economic momentum [5].

The key validation point will be upcoming CPI and PPI releases, which will determine whether robust employment can coexist with contained inflation—a combination that would support the “no landing” thesis.

The Russell 2000’s +1.01% gain on February 13 suggests investors are repositioning toward smaller domestic companies that may benefit from continued economic strength [0]. Healthcare and industrial stocks appear positioned for continued strength if the growth narrative holds [5], though investors should monitor whether this rotation proves sustainable or represents tactical positioning.

This analysis synthesizes findings from the January 2026 U.S. employment report and concurrent Japanese election results to provide investors with a comprehensive view of near-term economic and market dynamics.

The U.S. labor market demonstrated resilience with 130,000 jobs added, beating expectations and maintaining unemployment at 4.3% [1][2]. Japan’s political outcome signals fiscal expansion potential that could accelerate monetary tightening [3][4]. Combined, these developments support a “no landing” economic narrative if inflation remains contained [5].

Market participants should monitor Federal Reserve communications for updated rate cut timing expectations, track Treasury yield movements as markets recalibrate between “soft landing” and “no landing” scenarios, and observe sector rotation patterns with particular attention to small-cap and cyclical sectors [0][5][6]. Upcoming inflation data will serve as a critical validation point for the sustained growth thesis.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.