Market Volatility Creates Opportunity: Contrarian Risk-On Case Amid Macro Improvements

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The original Reddit post “Do not fold now” argues against panic selling during the recent market downturn, contending that macro conditions are actually improving with falling rates and easing US-China tensions. The author suggests hyperscalers support indices at reasonable valuations while mid-caps present compelling buying opportunities, advocating a contrarian risk-on approach when others are fearful.

Reddit community responses show mixed sentiment:

- Some users like ForeverInTheSun82647 advocate daily DCA into long positions and waiting for rebound

- Others like thec4nman expect more downside, with luv2block listing bearish signals including insider selling

- Pibbleberrier argues high-growth names are driven by sentiment rather than fundamentals, challenging the OP’s thesis

- Analbuttlick notes extreme fear despite only 2.5% drop from all-time highs with 15% YTD returns, suggesting market overreaction

- Several users reported specific purchases including mega-caps (NVDA, AMZN, META, MSFT, TSM) and beaten-down smaller stocks

Current market data validates some of the Reddit post’s macro observations while highlighting significant risks:

- Federal Reserve has implemented two rate cuts in 2025 (September and October), bringing benchmark to 3.75%-4.00%

- US-China tensions have eased substantially following preliminary trade agreement on October 30, 2025

- Both countries suspended tariffs and export controls through November 2026

- Probability of December Fed rate cut has dropped to 50-53% from 95% due to economic uncertainty

- Bitcoin dropped below $95,000 on November 14, marking 6-month lows and 13% monthly decline

- AI stocks face significant valuation concerns and “bubble” warnings from prominent investors

- Global markets experienced major selloffs driven by dual concerns over AI valuations and monetary policy uncertainty

- Underlying strategic competition between US and China continues in semiconductors and rare earths

The Reddit post’s contrarian thesis has merit but requires nuance. While macro conditions have indeed improved with rate cuts and trade de-escalation, the market faces significant headwinds from AI valuation concerns and monetary policy uncertainty. The extreme fear noted by Reddit users appears disproportionate to the 2.5% decline from ATH, suggesting potential overreaction that could create opportunities.

However, the risk-off sentiment is not unfounded - AI stocks genuinely face bubble concerns, crypto has seen substantial declines, and Fed policy uncertainty remains elevated. The most prudent approach may be selective risk-on exposure rather than broad market bets.

- Fed policy uncertainty with December rate cut probability dropping dramatically

- AI stock bubble concerns potentially triggering broader tech selloff

- Cryptocurrency weakness spilling into risk assets

- Persistent underlying US-China strategic competition

- Beaten-down mid-cap growth stocks at attractive valuations

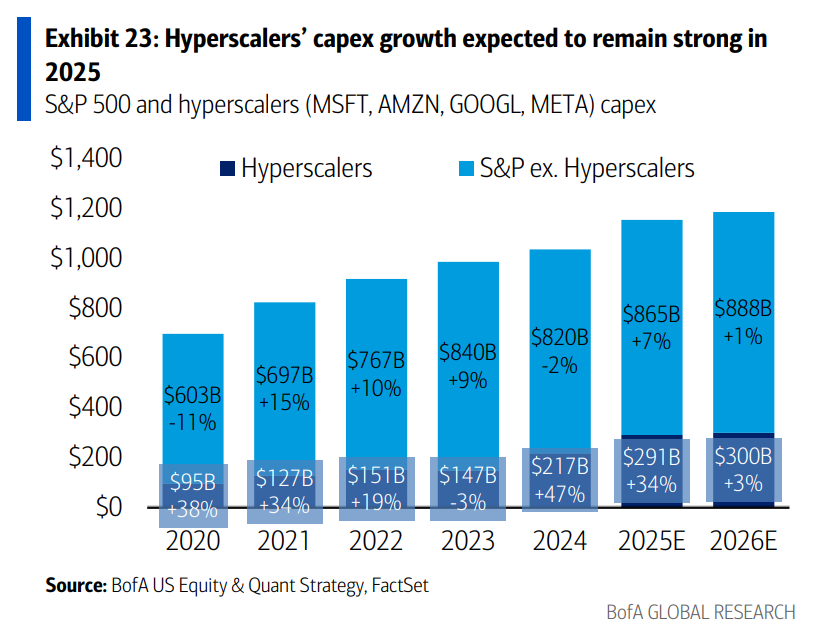

- Select hyperscalers supporting indices with reasonable fundamentals

- Contrarian plays in oversold segments during extreme fear periods

- Beneficiaries of improved US-China trade relations

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.