POET Technologies: Photonics Play with AI Data Center Catalysts

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit discussion around POET Technologies centers on the company’s potential as an AI photonics play with asymmetric upside opportunities. Key themes from the community include:

- Bullish Options Strategy: Multiple users (Perihelion3, tpjunkie, MyboiHarambe99, MediocreDesigner88) are accumulating shares and call options, particularly Jan 2026/2027 $10 calls, attracted by the AI narrative and potential for 5-10x returns 1

- Technical Analysis: PracticalAnywhere225 identifies technical support near $6.15, with SWATSWATSWAT waiting for increased volume before entering positions 1

- Skepticism and Risks: Jerikolol questions the frequency of DD posts urging results over hype, while DickelPick69 notes the 20F filing reads like a penny stock. DryGeneral990 reports being underwater at $9 cost basis, and jenphilip155 and PaperHands_BKbd warn about dilution concerns and warrant overhang 1

POET Technologies is positioned as a chip-scale photonic integration solutions provider with several key developments:

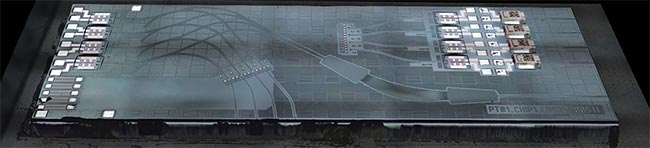

- Optical Interposer platform enables seamless integration of electronics and photonics on a single chip

- Targets high-growth AI data center, data center networking, and high-performance computing markets

- Technology eliminates wire bonds, enabling monolithic photonics-electronics integration

- Holds foundational patents on chip-scale optical assembly and integration

- Financing: $150M oversubscribed registered direct offering closed in October 2025, fully subscribed by two new investment managers, with pro-forma cash position exceeding $300M

- Production Order: $5M production order for 800G POET Infinity™ optical engines with shipments scheduled for H2 2026

- Strategic Partnerships:

- Semtech collaboration resulted in 1.6T Rx engines launched September 30, 2024

- Acquired significant equity stake in Sivers Photonics

- Foxconn Interconnect Technology partnership for 800G and 1.6T optical transceiver modules (May 2024)

The Reddit enthusiasm for POET aligns with fundamental developments, particularly the strong cash position post-financing and tangible production orders. However, community concerns about dilution and penny stock characteristics warrant consideration.

- Reddit’s focus on AI data center connectivity matches POET’s core market positioning

- The asymmetric upside thesis through long-dated calls is supported by the company’s strong cash runway ($300M+) and upcoming production catalysts

- Technical support levels identified by Reddit users ($6.15) provide reasonable entry points

- Reddit posts may underemphasize the timeline risk, with major shipments not expected until H2 2026

- Community focus on near-term option plays may overlook the longer-term technology adoption curve in photonics

- Strong cash position provides runway for technology development and market penetration

- Multiple revenue streams through partnerships with established players (Semtech, Foxconn)

- AI data center expansion creates growing demand for high-speed optical connectivity solutions

- First-mover advantage in chip-scale photonic integration with patent protection

- Execution risk on production timeline (H2 2026 shipments)

- Competition from larger photonics and semiconductor companies

- Market volatility typical of small-cap technology stocks

- Potential dilution from future financing needs despite current cash position

- Technology adoption risk in conservative data center infrastructure markets

POET presents a high-risk, high-reward opportunity in the AI infrastructure space. The company’s strong financial position and strategic partnerships provide credibility to the technology thesis, while the long-dated call options mentioned by Reddit users offer asymmetric upside potential. However, investors should be prepared for volatility and potential timeline delays in revenue realization.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.