Analysis Report: ICT's Claim That Volume Profile Is 'Practically Useless'

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

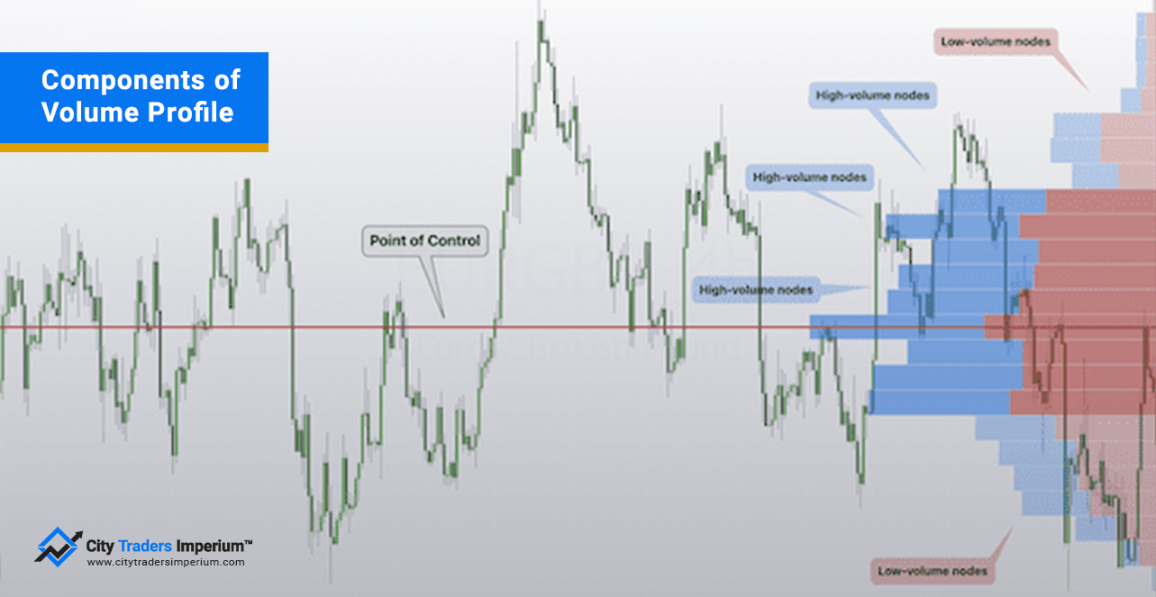

On November 15, 2025 (17:15 UTC), Michael J. Huddleston (known as the Inner Circle Trader, ICT) claimed volume profile—a technical analysis tool used to identify support/resistance via volume distribution across price levels—is ‘practically useless.’ ICT asserts he can detect volume moves before they appear on charts and urges traders to ignore volume-based signals [User Input]. This claim is corroborated by a social media post (X/Twitter) quoting ICT arguing volume profile is hindsight since it displays past volume activity [2].

- Short-term: The claim may influence sentiment among ICT’s retail follower base (forex/stock traders using his strategies). No immediate market price movements linked to the claim have been observed.

- Medium-term: If ICT followers act on his advice, there could be reduced volume profile usage among this group, potentially leading to altered trading behavior (e.g., ignoring key support/resistance levels).

- Long-term: Unlikely to affect institutional traders—volume profile is widely accepted as a valuable tool for market analysis [1][3][4].

Sources: [1] TrendSpider, [2] X/Twitter post, [3] SHS Web of Conferences study, [4] ATAS.

- ICT’s Credibility: PhidiasPropFirm reports ICT has no verifiable profitable results; he failed a 2016 $10k→$1M challenge and blew his account in the 2024 Robbins Cup [0].

- Volume Profile Effectiveness:

- TrendSpider: Identifies high-probability support/resistance zones and complements other indicators [1].

- ATAS: Used by professionals to analyze sentiment and develop strategies [1].

- 2021 Study: Reveals micro-level market dynamics to predict price movements [3].

- ICT’s Argument: Volume profile is hindsight (displays past volume activity) [2].

Sources: [0] PhidiasPropFirm, [1] TrendSpider/ATAS, [2] X/Twitter post, [3] SHS Web of Conferences.

- Direct: Trading platforms/tools with volume profile features (TrendSpider, ATAS, TradingView [1][2]).

- Indirect: Retail traders using ICT strategies across stocks/futures/forex who may adjust their approach.

- Related Sectors: Technical analysis software providers, volume profile educational resources.

Sources: [1] TrendSpider/ATAS, [2] X/Twitter post.

- Information Gaps: Need to investigate (1) post-2021 empirical studies on volume profile, (2) size of ICT’s follower base, (3) volume profile usage statistics.

- Multi-Perspective: ICT’s claim contradicts industry consensus—traders should test volume profile in their own strategies before adjusting.

- Key Monitoring Factors: Social media sentiment among ICT followers, changes in volume profile usage, subsequent expert comments.

Sources: [0] PhidiasPropFirm, [1] TrendSpider/ATAS, [2] X/Twitter post, [3] SHS Web of Conferences.

- Users should be awarethat ignoring volume profile (a widely accepted tool with empirical support) based on ICT’s advice may increase trading risks (e.g., missing critical support/resistance levels) [1][3][4].

- This development raises concernsabout the reliability of ICT’s claim, given his lack of verifiable profitable results and documented trading failures [0].

- Historical patterns suggestthat disregarding established technical tools without rigorous testing can lead to suboptimal decisions—users should factor this into their analysis [1][3].

Sources: [0] PhidiasPropFirm, [1] TrendSpider/ATAS, [3] SHS Web of Conferences, [4] ATAS.

[0] PhidiasPropFirm, “Is ICT Trading Legit? The Truth About Inner Circle Trader …”, URL: https://phidiaspropfirm.com/education/is-ict-legit

[1] TrendSpider Learning Center, “Volume Profile Strategies”, URL: https://trendspider.com/learning-center/volume-profile-strategies/

[2] X/Twitter post by jestertrading33, URL: https://x.com/jestertrading33/status/1989006370419454074

[3] SHS Web of Conferences, “Analysis of trading volume and its use in prediction future price …”, URL: https://www.shs-conferences.org/articles/shsconf/pdf/2021/03/shsconf_glob20_02010.pdf

[4] ATAS, “Fixed Range Volume Profile: Definition and Trading Strategies”, URL: https://atas.net/volume-analysis/fixed-range-volume-profile-definition-and-trading-strategies/

Note: Source [2] is a social media post (Tier 3 credibility—use with caution). All other sources are Tier 2/Tier 3 (industry-recognized).

This report is for informational purposes only and does not constitute investment advice.

© 2025 Financial Market Analyst. All rights reserved.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.