Successful Day Traders: Routines, Strategies, and Lifestyle Insights from Reddit and Research

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Reddit users in r/Daytrading highlight that successful day traders often limit active trading to the first 30–45 minutes or 1–3 hours post-market open [1]. Alert-driven trading is common, with engagement only when predefined signals trigger [1]. Weekends split between unplugging (light review) and macro prep (earnings calls, crypto) [1]. Success ties to clear plans [1], though some note many ‘successful’ traders sell courses/mentorship [1].

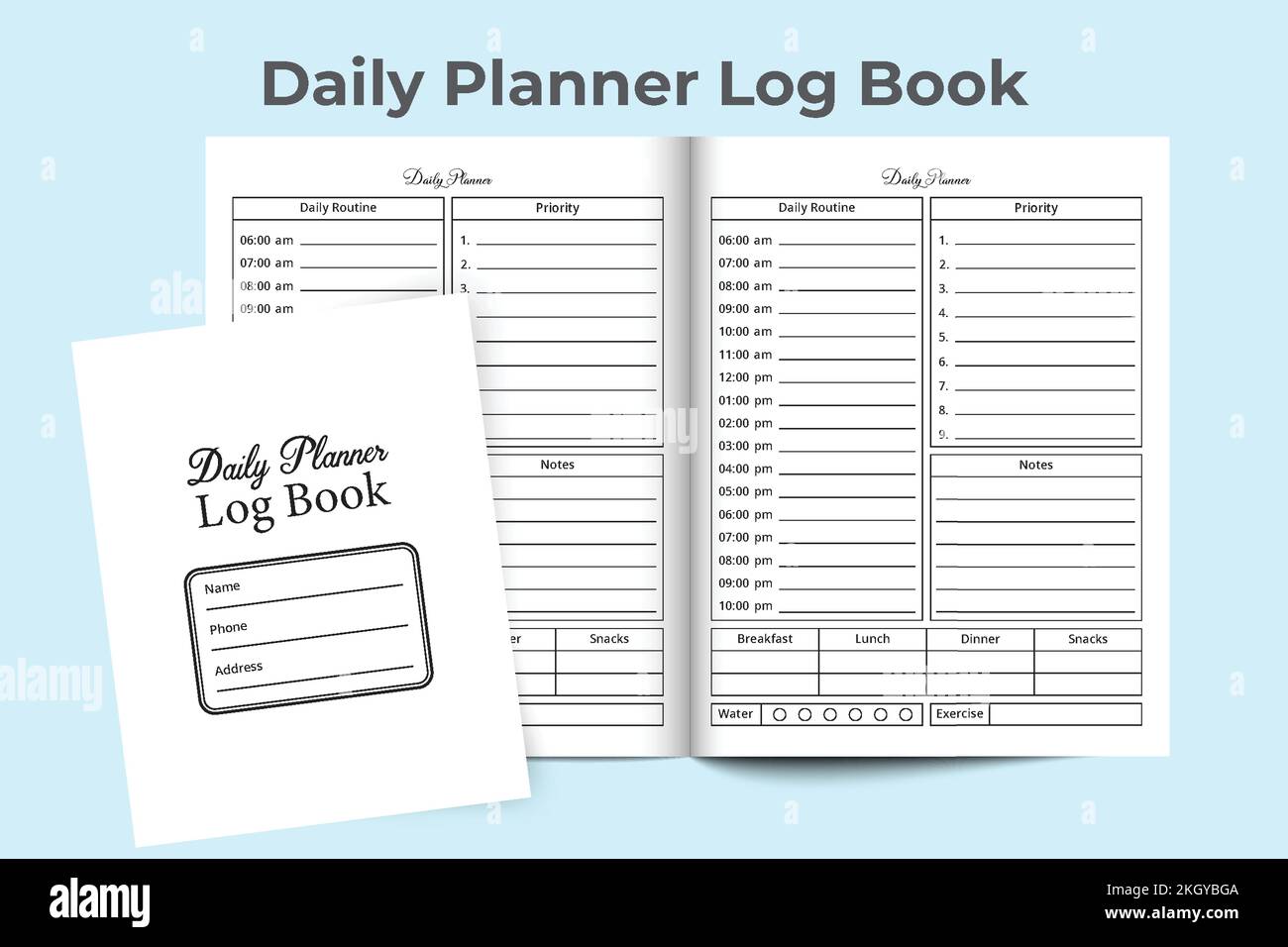

Structured daily routines: pre-market prep (8:00–9:00 AM UTC), midday reviews, evening summaries [4]. Trading focuses on first 1–2 hours post-open (peak volatility) [2], with tight stop-losses [2]. Multiple indicators and detailed logs drive improvement [2]. Weekends include 2-hour Sunday analysis, trade reviews, backtesting, and chart updates [3][5]. Psychological conditioning/exercise are key [3].

Agreements: Short trading windows during peak volatility [1][2]. Contradictions: Reddit’s weekend unplugging vs research’s structured prep (casual vs pro traders) [1][3]. Implications: Prioritize structured routines/risk management; verify success claims (avoid scams) [1][2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.