High-Risk SPX 0DTE Options Trading Case Study: The Falling Knife Project Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

A Reddit user’s report of a 55.2% return ($13.8k gain) over two months on a $25k SPX account using 0DTE options [0] highlights the leveraged potential of short-term options trading. The SPX index gained only 1.98% during the same period (Sept-Nov 2025) [6], underscoring the strategy’s high-risk, high-reward nature. 0DTE options now account for over 50% of SPX options volume, with retail traders making up half of this activity [1]. Sector performance data shows Tech (+2.03%) and Utilities (+2.16%) sectors drove SPX gains on Nov15 [7], which may align with the user’s directional bets.

- Sustainability Gap: The user’s goal to reach $750k in 24 months requires an 180% annual compound growth rate—rarely achievable in leveraged trading [0].

- Transaction Costs: 0DTE traders face 300–350 bps annual transaction costs due to slippage and spreads [3], which erode short-term returns.

- Regulatory Scrutiny: FINRA’s focus on retail 0DTE trading may lead to new restrictions [2], impacting strategy viability.

- High Transaction Costs: Erode returns for frequent traders [3].

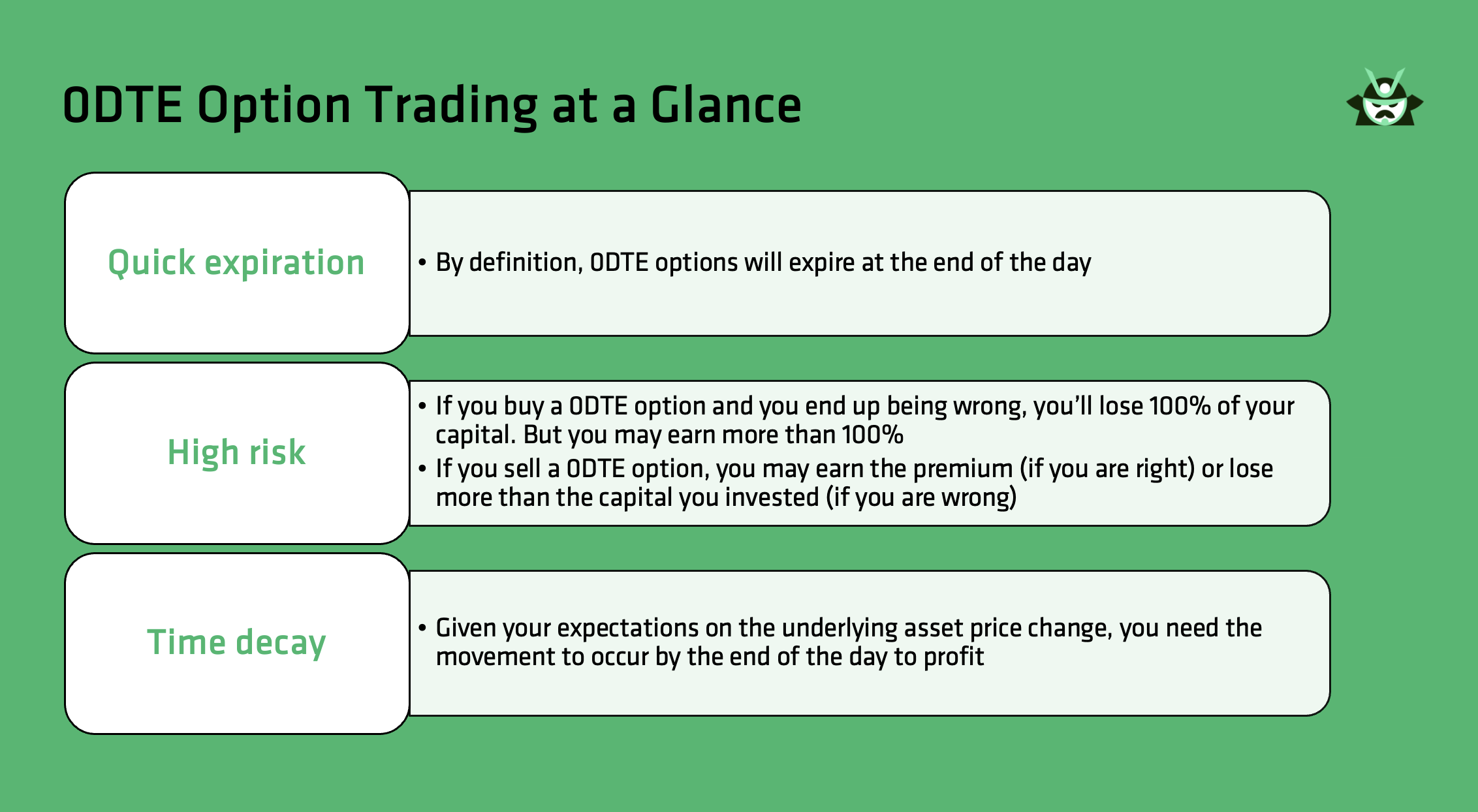

- Time Decay: Rapid value loss in 0DTE options limits holding periods [4].

- Market Volatility: Spikes in VIX can reverse gains quickly [0].

- Regulatory Changes: Potential restrictions on retail 0DTE trading [2].

- Short-Term Gains: Limited to favorable market conditions (low volatility) [6], but not generalizable for long-term goals.

- User Performance:55.2% return over two months (Sept-Nov2025) [0].

- SPX Benchmark:1.98% gain during the same period [6].

- Required Growth:180% annual rate to reach $750k in 24 months [0].

- Transaction Costs:300–350 bps annual for 0DTE traders [3].

- Data Gaps: Missing details on user’s exact strategy, risk management, and drawdown history [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.