Trader Quiz: Breakout Gap Strategy Debates & Risk Management Insights

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

- Community consensus: Top comment (126 upvotes) advised doing ‘nothing’ and waiting for a pullback to avoid chasing the breakout [1].

- Split opinions on shorting: Some saw the move as parabolic (short on reversal signals), while others noted context dependency (fundamentals vs. technicals) [1].

- Contextual entry tactics: Recommendations included waiting for a 0.5-0.61 retracement to the 20 EMA or checking order flow before entering [1].

- Aggressive alternative: A minority proposed an aggressive long with a tight stop-loss below the gap candle [1].

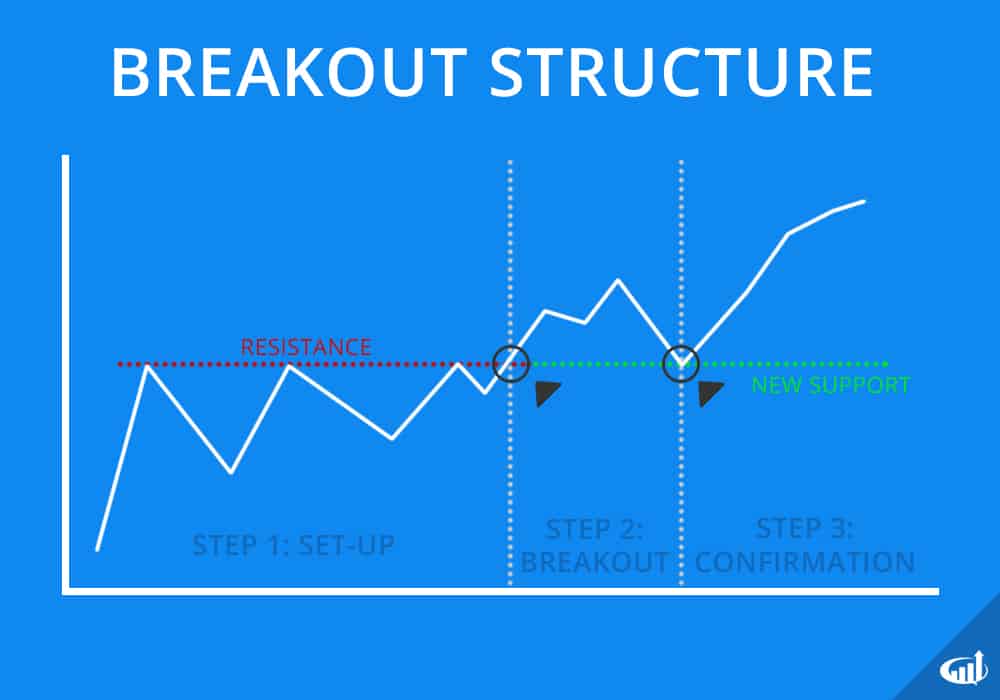

- Breakout validity requires consolidation patterns plus momentum to reduce false breakout risk [2].

- Second-leg moves often lead to traps; stop-losses should be placed just inside previous support/resistance zones [2].

- Gaps act as support/resistance zones and price magnets, influencing future price movement [2].

- Minimum 1:2 risk-reward ratio is recommended for breakout strategies to offset trap risks [2].

- Indicators like ATR, Bollinger Bands, and RSI help validate breakouts and reversals [2].

- Reddit’s pullback preference aligns with research’s caution on chasing breakouts (reduces false breakout exposure) [1,2].

- Both sources emphasize context: Reddit focuses on order flow/EMA retracements, while research highlights technical indicators to confirm validity [1,2].

- The shorting debate reflects research’s context-dependent approach (fundamentals justify the breakout or not) [1,2].

- Risks: Bull trap (false breakout) leading to losses if entering early; lack of context (e.g., order flow) increasing trap exposure [1,2].

- Opportunities: Validated pullback entries (e.g., retrace to 20 EMA) with 1:2 risk-reward; shorting on reversal signals if fundamentals don’t support the breakout [1,2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.