Berkshire's Q3 2025: Record $381B Cash Hoard Signals Buffett's Market Caution

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit discussion revealed several speculative theories about Berkshire’s massive cash accumulation:

- Posthumous strategy: User Fly-Discombobulated speculates Buffett is hoarding cash to fund a massive posthumous buyback if BRK stock crashes after his death

- Treasury positioning: Nostalg33k notes the cash is largely in US Treasuries, positioning Berkshire for gains if rates fall

- AI energy focus: annoyed_meows expects successor Abel to deploy cash into energy to power AI demand

- Market correction anticipation: NakedPatrick argues Buffett is anticipating a major correction and prefers safety over chasing upside

- Criticism of strategy: Ni987 criticizes Buffett as stubborn and missing growth waves beyond Apple

- Cash accumulation timeline: listenheredammit questions whether Buffett has been sitting on cash for years already

- Operating earnings surged 34% to $13.485 billion from $10.09 billion in Q3 2024

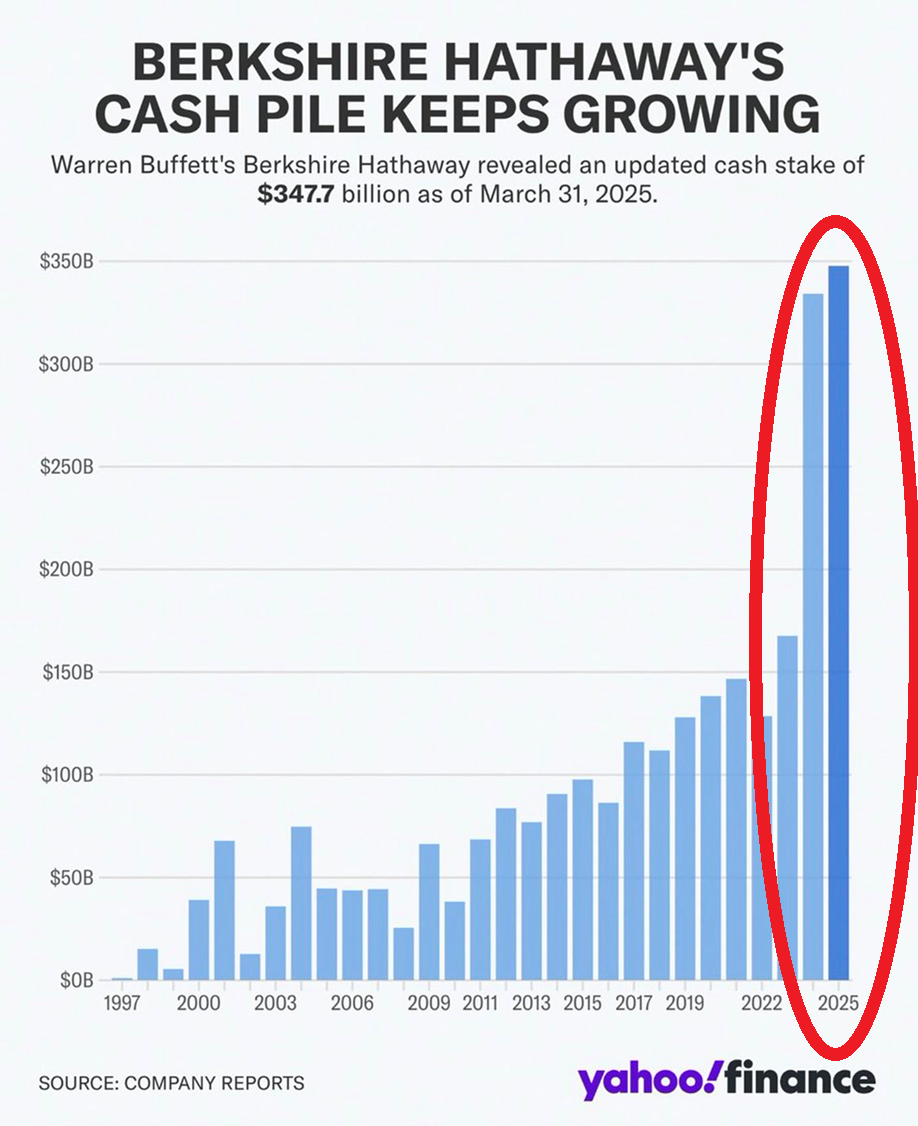

- Cash and Treasury holdings reached record $381.7 billion, up from $325.2 billion year-over-year

- Insurance underwriting profit skyrocketed over 200% to $2.37 billion

- No share repurchases occurred during the quarter

- Berkshire suspended buybacks for five consecutive quarters by late 2024

- Company has been net seller of stocks for 10-12 consecutive quarters, selling $174 billion more than purchased

- Cash represents approximately 40% of Berkshire’s market capitalization

- Previous buyback program saw $78 billion spent over 24 consecutive quarters (2018-2024)

- Buffett halted buybacks as Berkshire stock traded at 1.5-1.64 times book value, above his preferred 1.3x threshold

- Strict buyback discipline maintained, only repurchasing when stock trades below conservative intrinsic value estimates

Reddit speculation aligns partially with research findings while adding unique perspectives:

- Both Reddit and research confirm Buffett’s heightened market caution

- Agreement that cash accumulation represents “dry powder” for future opportunities

- Recognition that strategy reflects valuation concerns rather than lack of opportunities

- Reddit focuses on speculative scenarios (posthumous buybacks, AI energy investments)

- Research emphasizes disciplined value investing and market timing

- Reddit criticism of “missing growth” contrasts with research showing strategic patience

- This was Buffett’s final earnings report before stepping down, adding significance to capital allocation decisions

- Record cash position provides maximum flexibility for opportunistic investments during market dislocations

- Successor Abel will inherit unprecedented financial firepower for strategic deployments

- Substantial capital available for large-scale acquisitions during market corrections

- Treasury-heavy cash position benefits from potential rate cuts

- Strong operating earnings growth demonstrates core business resilience

- Insurance underwriting turnaround provides additional capital generation

- Extended period of cash holdings could drag on returns if markets remain elevated

- Succession transition may impact investment strategy and timing

- Opportunity cost of missing potential investments while waiting for better valuations

- Market perception of Berkshire as “too cautious” could affect investor sentiment

- Berkshire positioned as defensive play with significant upside potential during market downturns

- Cash-heavy strategy suggests Buffett sees current market valuations as stretched

- Strong earnings growth despite conservative allocation demonstrates business quality

- Successor Abel’s deployment strategy will be critical watchpoint for future performance

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.