Analysis of Heshun Petroleum's Cross-Border Acquisition of Kuixin Technology Triggering a Limit-Up

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

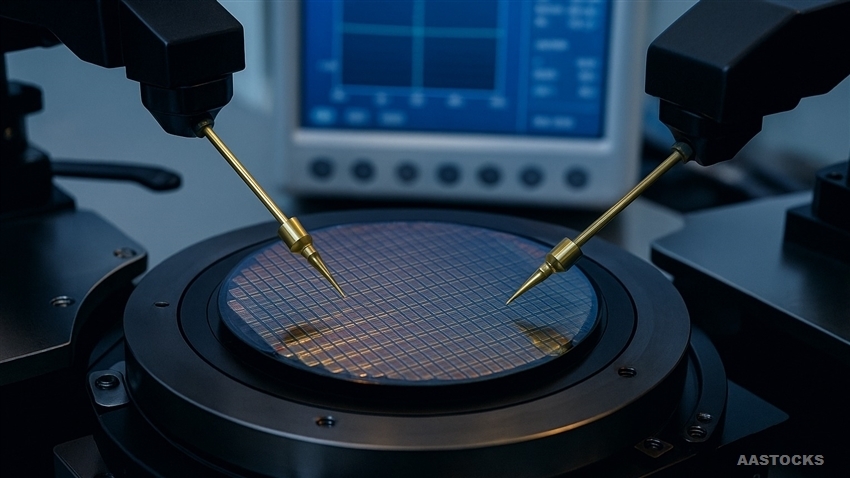

Heshun Petroleum (603353) is a listed company mainly engaged in refined oil wholesale and retail [0]. On November 16, 2025, it announced plans to acquire no less than 34% equity of Shanghai Kuixin Integrated Circuit Design Co., Ltd. with cash and control a total of 51% voting rights through voting rights entrustment [1]. On the day of the announcement, the stock price hit a limit-up, rising by 2.55 yuan (+10.008%) [6]. At the same time, the company intends to terminate its tobacco product retail business, and the proposal to adjust the business scope will be submitted to the shareholders’ meeting for deliberation [2], showing its determination to focus on core operations and strategic transformation. Kuixin Technology focuses on high-speed interface IP and Chiplet solutions, was established in 2021, and has good development prospects [3]. This cross-border layout in the semiconductor industry comes at a time of industry activity, with areas such as Chiplet and IP cores attracting market attention [4], bringing expectations of new performance growth points for the company.

- Valuation Reconstruction Opportunity: From the traditional oil industry to the high-tech semiconductor field, investors re-evaluate the company’s future development prospects [5];

- Clear Strategic Focus: Terminating the tobacco business and acquiring the semiconductor company are advancing simultaneously, and the management’s strategic direction is clear [2];

- Market Sentiment Resonance: Against the backdrop of the overall activity of the semiconductor sector, the cross-border merger and acquisition event amplifies the market’s positive response [4].

- Risk Points: Cross-border integration risks (significant industry differences), uncertainty about the target company’s performance, callback risks after overheated market sentiment;

- Opportunity Points: Growth dividends of the semiconductor industry, valuation improvement space brought by business diversification, long-term development potential after successful strategic transformation.

Heshun Petroleum enters the semiconductor field through the acquisition of Kuixin Technology, while optimizing its business structure; this strategic adjustment triggered a limit-up in the stock price. Investors need to pay attention to subsequent acquisition progress, the integration effect of the target company, and changes in semiconductor industry trends, and rationally evaluate investment value.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.