Hidden Labor Market Weakness: QCEW Revisions Reveal Slower Job Growth Than Reported

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Reddit users in r/stocks and related communities are debating whether the U.S. labor market is deteriorating faster than official data suggests. The post argues that official payroll gains of +27K/month mask a net loss of ~311K jobs/month when accounting for QCEW benchmark revisions and tariff impacts. Key discussion points include:

- Rate cuts vs. automation: Many users argue that further Fed rate cuts won’t spur hiring because cheaper capital primarily fuels AI and automation investments rather than labor expansion

- Methodology concerns: Some commenters criticize the post’s calculations as speculative, noting bold assumptions and conflating spending losses with direct job losses

- Tariff impacts: Discussion highlights tariffs as reducing household spending power and creating corporate cost pressures that may force job cuts or margin compression

- Structural headwinds: Users note persistent offshoring of finance, HR, IT, and customer-service roles as ongoing drags on U.S. hiring

- Inflation debate: Disagreement exists on whether underlying PCE is truly near 2.4% or if lived-inflation remains well above official reports

- Fed constraints: Some argue Fed policy is constrained by debt dynamics and may not prioritize employment maximization

The research validates concerns about labor market weakness but corrects the magnitude:

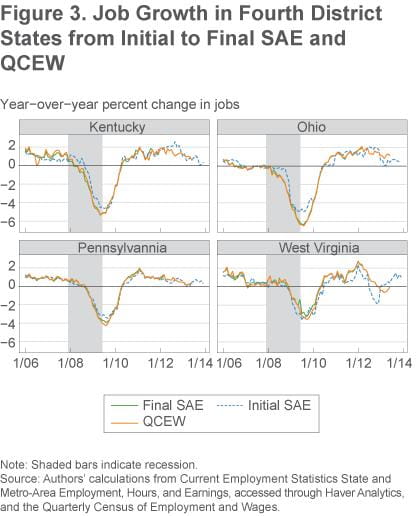

- March 2024: Preliminary revision of -818,000 jobs, later finalized at -598,000 jobs in February 2025

- March 2025: Preliminary revision shows -911,000 jobs for April 2024-March 2025 period

- Impact: Average monthly job growth reduced from ~147,000 to ~70,000 - representing slower growth, not net job losses

- Data quality: QCEW covers 95-97% of jobs versus CES survey covering only ~33% with declining response rates

- Historical context: These revisions are among the largest downward adjustments since the 2009 financial crisis

- Core PCE inflation held at 2.9% for year ending August 2024

- Tariffs on Chinese imports add approximately 0.5 percentage points to core PCE

- Underlying inflation rate may be closer to 2.4% when excluding trade policy effects

- Fed has been cutting rates due to labor market concerns

- Powell describes labor market as “significantly slowing” with “very gradual cooling”

- Fed views labor market deterioration as greater economic danger than inflation above 2% target

- Powell stated further rate cuts are “not a foregone conclusion” with “strongly differing views” among officials

The Reddit community correctly identified significant labor market weakness, but the -311K jobs/month claim appears exaggerated. Research shows job growth slowed by over 50% rather than turning negative. However, the core thesis holds: the labor market is considerably weaker than initially reported, and underlying inflation may be closer to the Fed’s 2% target when tariff effects are excluded.

The Fed’s apparent prioritization of labor market stability over inflation concerns supports the Reddit argument for continued rate cuts, despite Powell’s cautious rhetoric. The automation angle raised by Reddit users also adds important context - even with cheaper capital, structural shifts toward AI may limit employment gains.

- Data reliability: Continued large revisions could further undermine confidence in employment data

- Policy missteps: Fed may overtighten if relying on initially strong employment data that gets revised downward

- Structural unemployment: Automation and offshoring may create permanent labor market dislocation regardless of monetary policy

- Early positioning: Investors who recognize the true weakness may benefit from anticipating more aggressive Fed easing

- Sector rotation: Companies less exposed to automation pressure may outperform in a weaker labor environment

- Inflation beneficiaries: If underlying inflation is truly lower, duration-sensitive investments may benefit from continued rate cuts

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.