AI Bubble Debate: Why Billions Continue to Flow Despite Valuation Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit users highlight divided perspectives on AI investments: (1) Bubbles are defined by inflows—without them, no bubble exists; (2) Many investors reject the bubble narrative, citing justified valuations (e.g., Nvidia’s growth); (3) Even if a bubble, investors ride momentum to profit (timing crashes is hard); (4) Three investor camps: no bubble belief, expectation of delayed burst, or undecided; (5) Disputes over bubble claims, noting high but growth-supported P/E ratios for leaders like NVDA.

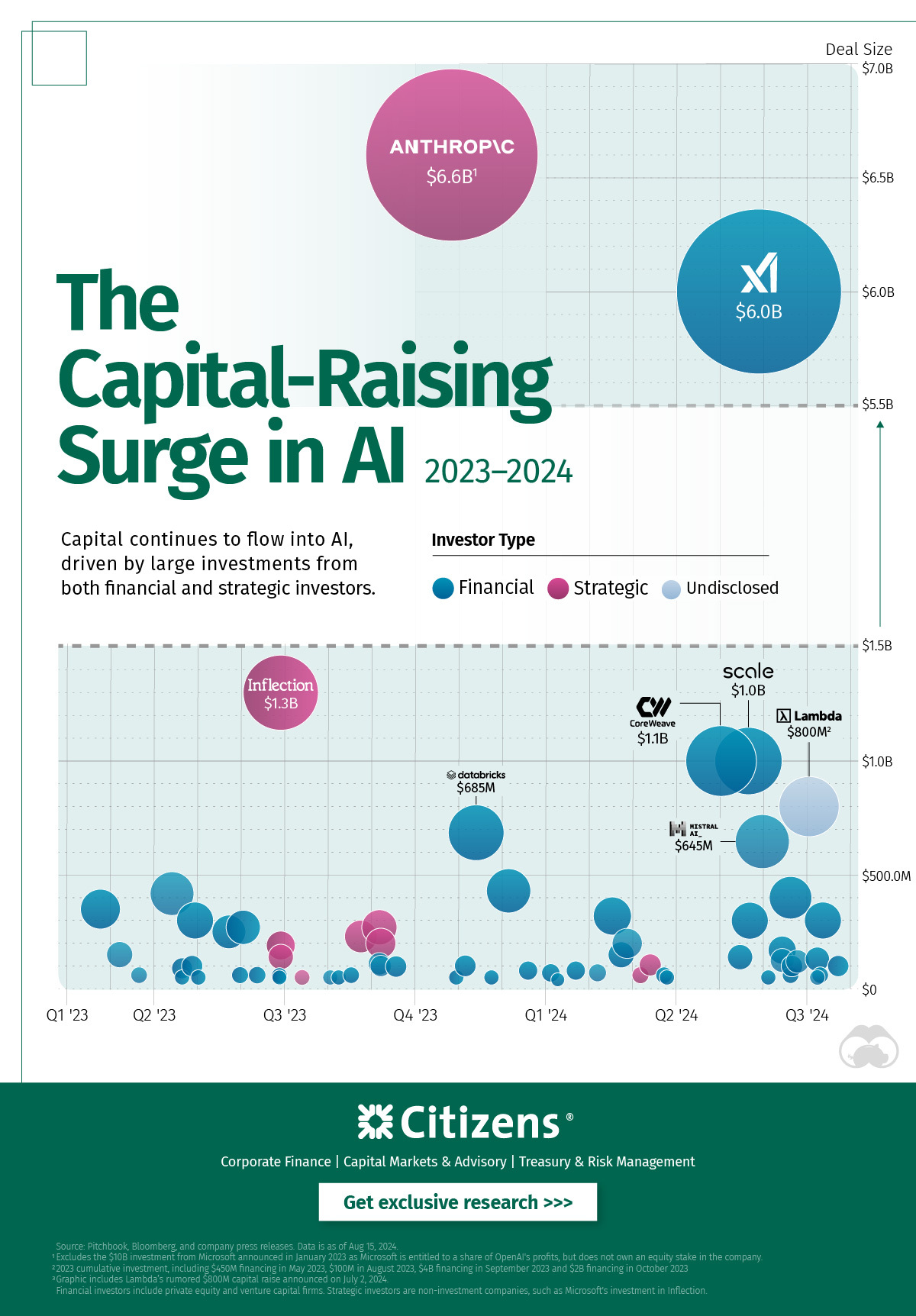

2025 AI venture capital (VC) funding reached $89.4B, accounting for 34% of total VC capital despite AI companies making up only 18% of deals. Key mega-rounds include OpenAI’s $40B (March) and Anthropic’s $13B at $183B valuation (September). Foundation model builders command 50-100x revenue multiples vs. 20-40x for enterprise AI. A Bank of America October survey found 54% of fund managers view AI stocks as bubbly (up from 41% in September). Michael Burry labeled AI a bubble, criticizing GPU accounting at META and ORCL. McKinsey projects AI could generate $340B annually for global banking, while Palantir’s Alex Karp notes only sophisticated AI apps justify costs. Major hyperscalers are set to spend $470B on AI in 2025 (Morgan Stanley).

Reddit’s momentum argument aligns with research’s high funding levels despite bubble warnings. Both sources confirm divided expert/investor views: genuine transformative value (e.g., banking sector gains) clashes with overvaluation risks (50-100x P/E ratios). Reddit’s “ride the wave” sentiment mirrors research’s observation of sustained inflows even amid bubble fears.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.