Analysis of Reddit Claim: Stocks vs Homeownership as Primary Wealth Driver

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

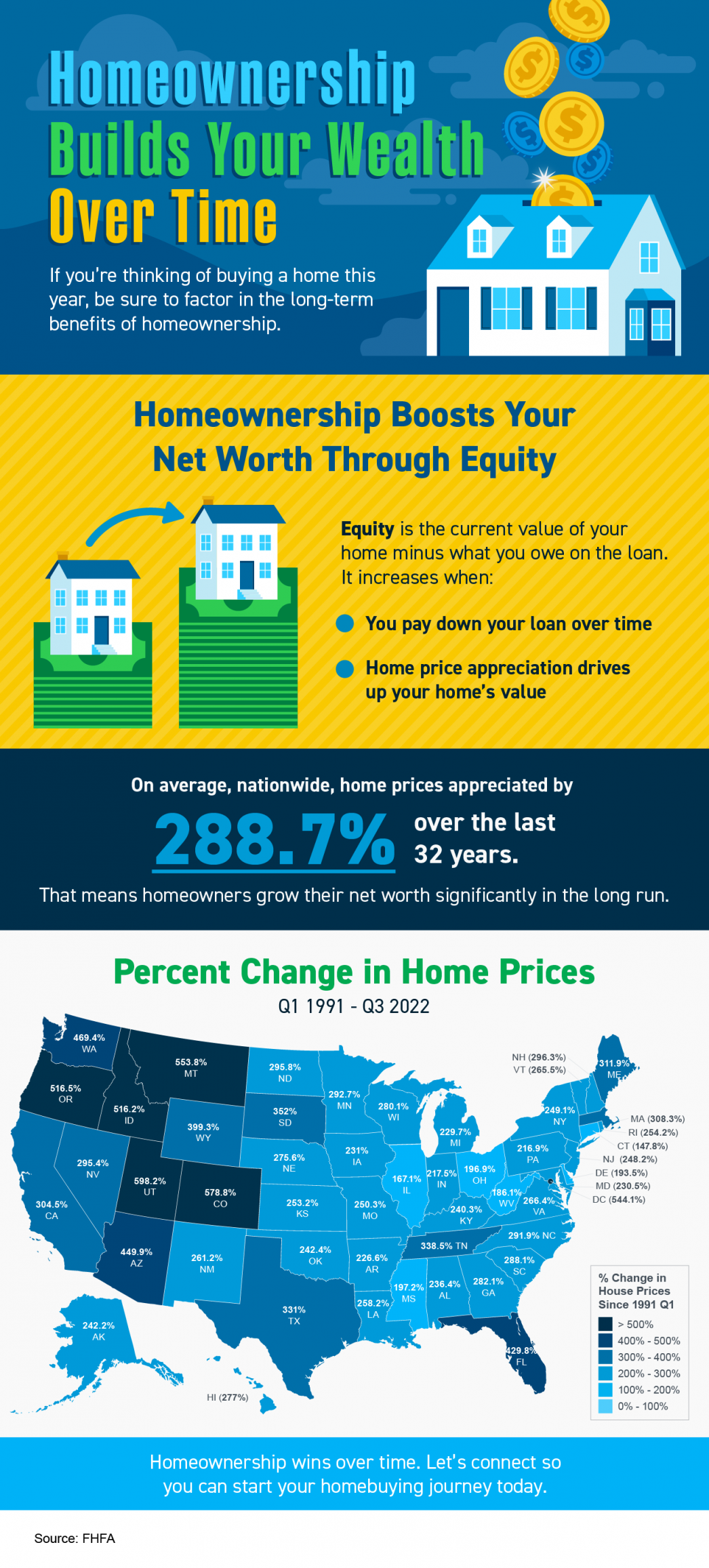

This analysis examines a Reddit post [6] claiming stocks (especially U.S. tech indices) are a better wealth driver than homeownership, with renters-investors accumulating 4x more wealth than mortgage buyers. Long-term return data shows tech indices outperform housing: Nasdaq Composite delivered a 2111% return (1995-2025) vs S&P Case-Shiller home price index’s 308% (1990-2024) [2][5]. However, the National Association of REALTORS® (NAR) reports homeowner median net worth is 40x higher than renters ($400k vs $10k) [1], conflicting with the Reddit claim—likely due to methodological differences like leverage (mortgages use 5-20% down), transaction costs, and tax implications (mortgage interest deductions) [4].

- Methodological Rigor Matters: The Reddit post’s hypothetical scenario ignores critical factors like leverage and behavioral biases (not all renters invest the rent-mortgage difference) [1][3].

- Volatility vs Stability: Tech indices (e.g., Nasdaq 100) have higher returns but greater volatility (39.48% decline in 2022) compared to housing’s lower volatility [3][4].

- Forced Savings: Homeownership’s forced savings via mortgage payments contributes to wealth accumulation, a factor not accounted for in the Reddit post [1].

- Risks: Tech sector volatility [3], housing leverage risk (underwater mortgages during downturns [5]), behavioral biases (renters failing to invest [1]).

- Opportunities: Diversification across asset classes (equity + real estate), considering both growth (tech) and stability (housing) in portfolios.

- Tech indices (Nasdaq Composite:2111% 30-year return) outperform housing (308% 30-year return) [2][5].

- Homeowner net worth is 40x higher than renters (NAR data) [1], but Reddit’s 4x claim for renters-investors lacks methodological rigor.

- Critical factors to consider: leverage, transaction costs, tax implications, and behavioral habits.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.