Analysis of Reddit Post Claiming Stocks Outperform Homeownership as Primary Wealth Driver

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

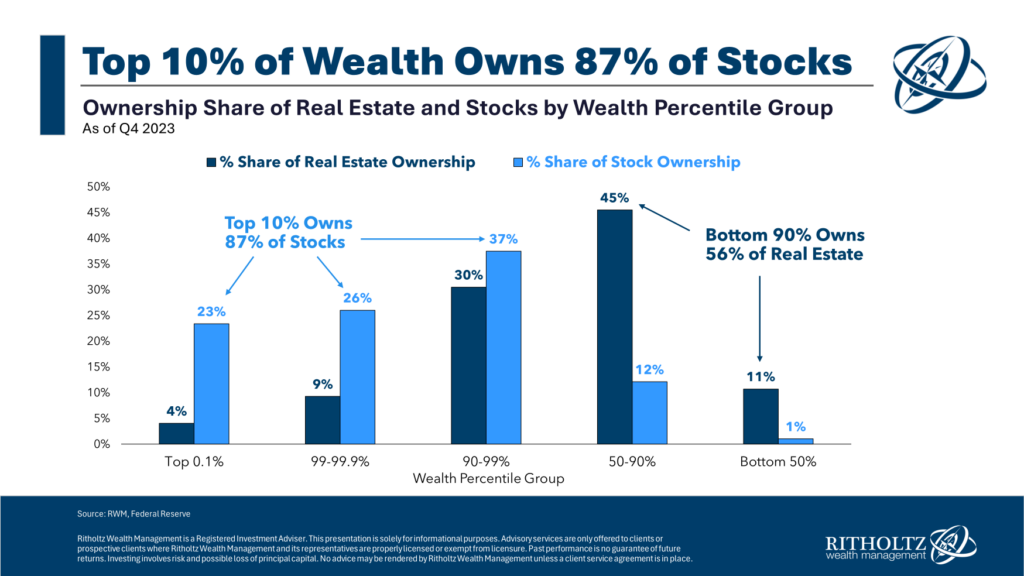

On November 16, 2025, a Reddit post [9] argued that equities—particularly U.S. tech indices—are the primary wealth driver over homeownership, claiming renters investing in stocks accumulate ~4x more wealth than mortgage buyers. This narrative aligns with short-term market performance: the Technology sector rose +2.03% on the event date, while Real Estate was nearly flat (+0.15%) [0]. Medium-term data supports tech’s outperformance: NASDAQ Composite gained 22.35% YoY and S&P500 rose14.64% (2024-2025), far exceeding U.S. home price growth of1.6-1.9% YoY (Aug2025) [0][1][2]. However, aggregate data contradicts the post’s claim: homeowners have43x higher net worth than renters ($430k vs $10k) [5][6], indicating the post’s4x ratio likely reflects a narrow scenario (e.g., renting + investing vs buying with a mortgage) rather than broader population trends.

- Scenario vs Aggregate Discrepancy: The Reddit post’s 4x wealth ratio ignores the broader context of homeowner net worth, which is 43x higher due to factors like forced savings via mortgages and long-term equity accumulation [5][6].

- Sector Alignment: Tech’s outperformance on the event date underscores market sentiment favoring equities over real estate as wealth drivers [0].

- Trade-Offs: Homeownership offers non-financial benefits (stability) and tax advantages (depreciation, capital gains deferral [4]), while stocks provide higher liquidity and historical returns (10.39% annual for S&P500 vs5.5% for housing [4]).

- Oversimplification Risk: The post’s claim may lead to misinformed decisions, as the optimal choice depends on individual circumstances (liquidity needs, risk tolerance, long-term plans) [4].

- Narrative Risk: Widespread adoption of the post’s narrative could cause capital misallocation (e.g., overinvesting in tech without diversification) [0].

- Opportunity: Investors may leverage tech’s strong historical returns while maintaining diversification to mitigate sector-specific risks [0].

- Tech indices (NASDAQ: +22.35% YoY, S&P500: +14.64% YoY) outperformed home price growth (1.6-1.9% YoY) [0][1][2].

- Homeowners have43x higher net worth than renters, reflecting the value of long-term equity accumulation [5][6].

- Both options have distinct benefits: homeownership for stability and tax advantages, stocks for liquidity and higher returns [4].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.