BYD (002594.SZ) Popularity Analysis: Growth Driven by Technological Breakthroughs and Overseas Expansion

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

BYD (002594.SZ) has recently become a popular stock in the market, with four core driving factors:

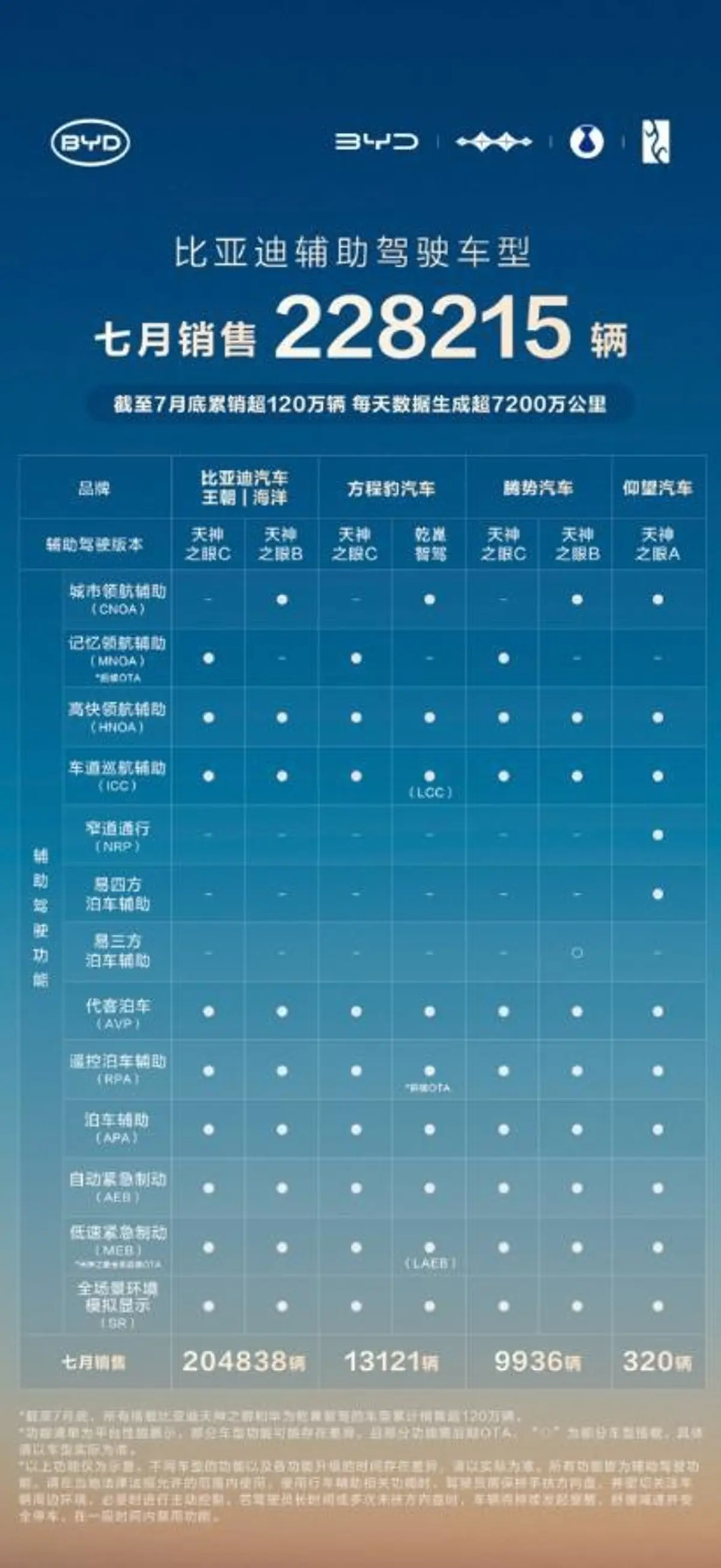

- Breakthroughs in Intelligent Driving Technology: The company’s ‘Tian Shen Zhi Yan (God’s Eye)’ system has accumulated sales of over 2 million units, with 316,800 units sold in October alone, realizing the standard configuration of high-level intelligent driving in all models priced around 100,000 yuan [0][5]. This technology democratization strategy has significantly enhanced product competitiveness and attracted mass-market users.

- Explosive Overseas Market Growth: Overseas sales from January to September reached 701,600 units, a year-on-year increase of 132%, exceeding the total for the entire year of 2024 [0]. Overseas markets have become an important growth engine for the company, especially in Southeast Asia and Europe where performance is outstanding.

- Strong Technological Reserves: Innovative technologies such as the second-generation Blade Battery, Megawatt Fast Charging, and Yun Nian (Cloud Chariot) suspension system have the potential for democratization, providing guarantees for future product iterations [0].

- Policy and Analyst Support: Favorable policies like the ‘Energy-Saving and New Energy Vehicle Technology Roadmap 3.0’ have driven the sector to strengthen [3]. 28 analysts recommend buying, only 2 recommend selling, with an average target price of 129.98 yuan [0].

- Technology Democratization Strategy Takes Effect: Demystifying high-level intelligent driving technology to models priced around 100,000 yuan breaks industry technological barriers and expands the user base [5].

- Accelerated Overseas Expansion: The increasing proportion of overseas sales reduces dependence on the domestic market and enhances risk resistance capabilities [0].

- Clear Analyst Consensus: The high proportion of buy ratings and significant target price premium reflect market confidence in the company’s long-term growth [0].

- Intensified Industry Competition: The new energy vehicle industry shows clear differentiation, and profit pressure is rising [4].

- Technological Iteration Risk: Continuous R&D investment is required to maintain technological leadership [6].

- Monetization of Technological Reserves: Existing innovative technologies like Megawatt Fast Charging and Yun Nian (Cloud Chariot) system can be further democratized to more models [0].

- Overseas Market Penetration: Demand growth in emerging markets provides sustained growth space for the company [0].

BYD has become a market focus through technological innovation and overseas expansion. The current stock price is in the lower-middle part of the 52-week range (87.40-138.99 yuan) [0]. Analyst target prices indicate a 32.95% upside potential, but attention should be paid to risk factors such as industry competition and profit pressure [4].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.