Analysis of Yunnan Coal Energy (600792) Strong Performance: Driving Factors, Technical Aspects, and Industry Background

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

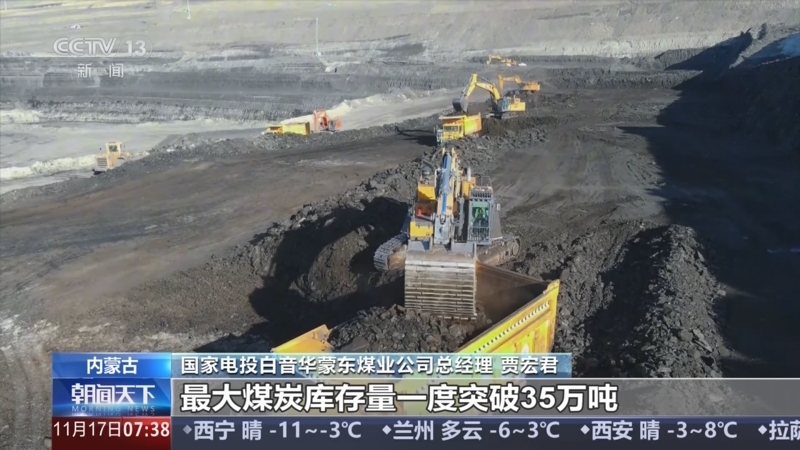

This analysis is based on the tushare Strong Stock Pool event (November 17, 2025). Yunnan Coal Energy (600792) rose 6.53% that day, closing at 5.71 yuan, with a turnover rate of 14.21% and a transaction volume of 883 million yuan [0]. Its strong performance is mainly driven by the overall rise in the coal sector, demand driven by cold winter expectations, policy supply regulation, and high utilization rate of the company’s Anning 200,000-ton coking project [0][2][3]. The technical aspect shows a strong buy signal, but the fundamentals are still in loss [0].

- Industry Linkage: The coal and coking processing sectors have continued to rise recently, and Yunnan Coal Energy, as a component stock, has benefited significantly [3];

- Demand Side: Cold winter expectations have increased demand for coal and coke, pushing prices upward [0][2];

- Supply Side: The policy of “anti-involution” regulation optimizes the supply structure and eases production capacity pressure [0];

- Company Level: The Anning 200,000-ton coking project maintains a high capacity utilization rate, supporting the business [0].

- Technical Aspect: Current technical analysis gives a strong buy rating, with a 52-week stock price range of 2.78-5.36 yuan, and significant year-to-date growth [0][9];

- Fundamental Aspect: 2025Q1 revenue was 1.281 billion yuan, net loss was 91.5874 million yuan, the loss narrowed year-on-year but did not turn profitable [0].

The strong performance of Yunnan Coal Energy more reflects the industry’s β attribute: sectoral opportunities mask the company’s short-term fundamental weaknesses [0][2]. Cathay Pacific CSI Coal ETF increased its holdings by 10.361 million shares in the third quarter (holding 1.64%), showing institutional confidence in the sector [0].

- Fundamental Loss: The company has not yet made a profit, and its sustained profitability is in doubt [0];

- Sector Volatility: If cold winter expectations fall short or policies are adjusted, the sector may correct [0].

- Policy Dividends: The advancement of supply-side reforms and the increase in industry concentration are beneficial to leading enterprises [2];

- Trading Opportunities: Under the strong technical aspect, there may be short-term trading opportunities [0][9].

The strong performance of Yunnan Coal Energy (600792) is the result of the combined effect of industry cycles, policy regulation, and market sentiment. Investors need to pay attention to the divergence between technical and fundamental aspects: technical signals are positive but fundamentals still have pressure. It is recommended to comprehensively judge based on industry trends and subsequent performance improvements [0][2][3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.