360 (601360) Hot Analysis: AI + Security Strategy Drives Q3 Profit Inflection Point and Market Performance

Unlock More Features

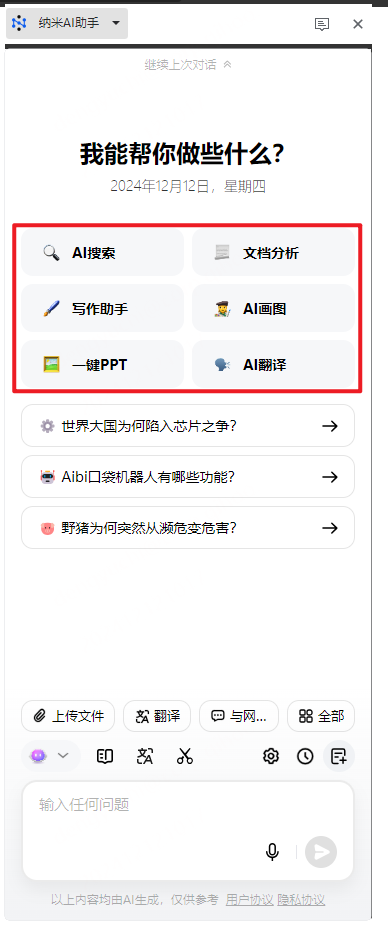

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

360 has recently become a hot stock in the market, mainly due to the emergence of a profit inflection point in Q3 and significant progress in its AI business. The company achieved a net profit attributable to shareholders of RMB 160 million and a non-recurring net profit of RMB 159 million in Q3, successfully turning from loss to profit [1][6]. In terms of AI business, Nano AI Search has 150 million monthly active users, and AI subscription service revenue grew rapidly by 25.51% [1], marking the entry of AI commercialization into the harvest period.

The company’s share price hit the daily limit on November 3 and 17, 2025, with a large net inflow of main funds [3][7]. Market recognition of its dual-drive strategy of AI + Security, combined with the overall activity of the AI application concept sector [4][8], has driven the strong performance of the share price.

360 implements a dual-mainline strategy of AI + Security, launching the Nano AI Super Search Agent and 360 Zhinao Large Model [6]. At the same time, it maintains its leading position in the cybersecurity field, with PC Security Guard MAU reaching 430 million and a market share of approximately 95% [1]. The first three quarters revenue increased by 8.18% year-on-year, and the net cash flow from operating activities improved by 82% year-on-year [6].

Despite the improvement in profitability, the company still faces short-term cash flow pressure, with operating cash flow of -RMB 338 million in the first three quarters, mainly due to AI computing power investment [1]. In addition, attention should be paid to the progress of AI business scaling and market competition risks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.