S&P500's Narrow Leadership: 1 Year Post Trump Re-Election Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 17, 2025, Seeking Alpha published an article titled “S&P 500 Tale Of The Tape: 1 Year Since Trump’s 2024 Election, A Deceiving Stock Market” [1]. The article highlights that the S&P500’s strong performance over the past year has been driven by an extremely narrow set of top stocks, creating a “deceiving” market where index returns do not reflect broader constituent company performance. The author recommends a long-with-hedges strategy instead of directional index bets [1].

The event underscores critical concentration risk in the S&P500:

- Misleading Index Performance: Cap-weighted S&P500 (^GSPC) rose ~14.19% year-over-year, while equal-weighted (^SPXEW) gained only ~3.53% [0], a 10.66pp gap confirming narrow leadership.

- Investor Perception Risk: Cap-weighted ETF holders (e.g., SPY) may overestimate market health as most stocks lag.

- Sector Disparity: Communication Services (+39.7% [3]) and tech led gains, while Health Care (+1.1% [3]) lagged significantly.

- Index Returns: ^GSPC (+14.19%), ^SPXEW (+3.53%) [0].

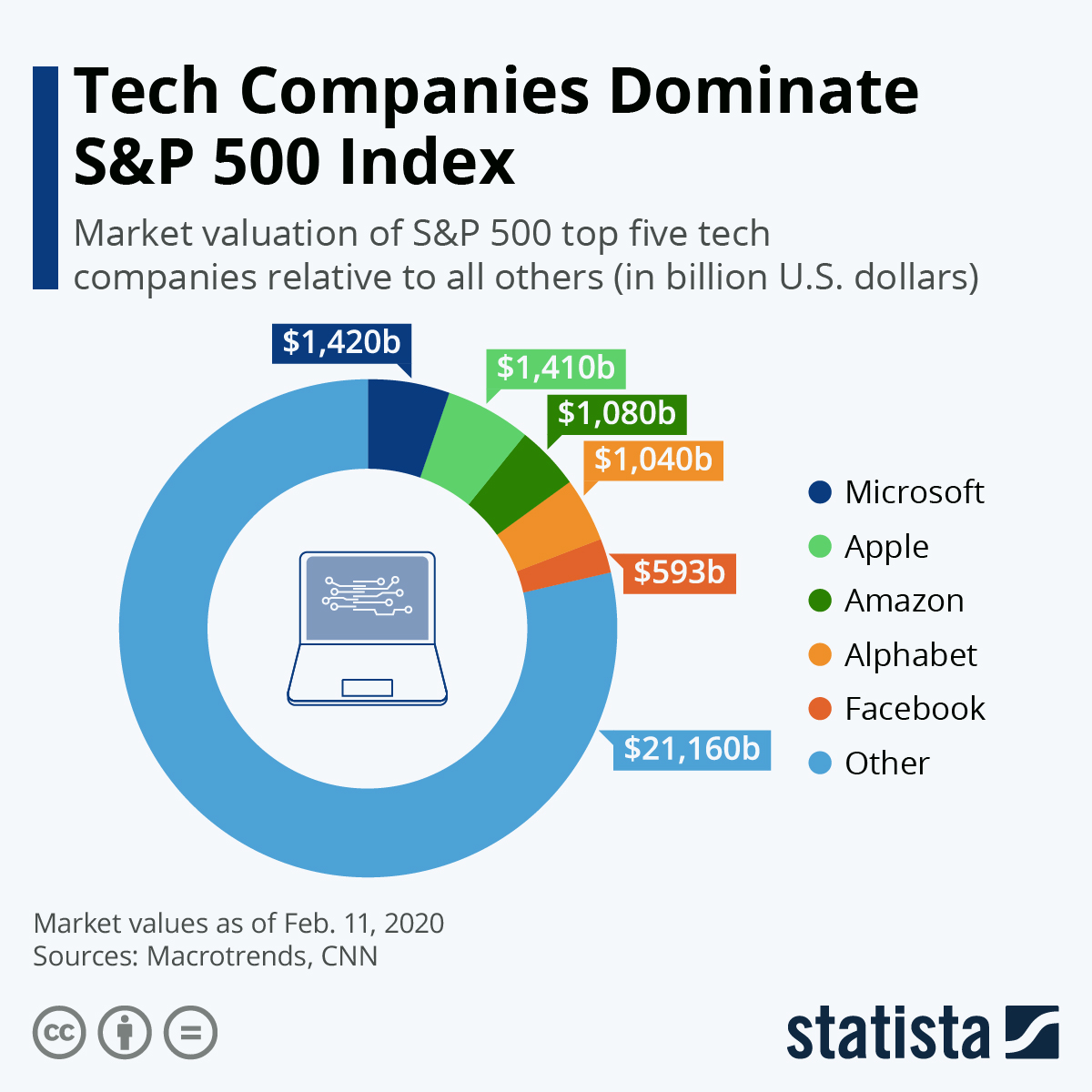

- Top Stock Concentration: NVDA (7.64%), AAPL (6.57%), MSFT (6.09%)—top three account for ~20% of index weight [2].

- Sector Returns: Communication Services (+39.7%), Health Care (+1.1%) [3].

##4. Affected Instruments

- ETFs: SPY (cap-weighted), RSP (equal-weighted), QQQ (tech-heavy), XLK (tech), XLV (healthcare), XLU (utilities), XLB (materials).

- Stocks: NVDA, AAPL, MSFT (top contributors).

##5. Context for Decision-Makers

- Sustainability of narrow leadership.

- Outlook for top stocks (NVDA, AAPL, MSFT).

- Catalysts for sector rotation to lagging areas.

- ^GSPC vs ^SPXEW gap narrowing (broader participation signal).

- Volatility in top stocks (risk to index).

- Lagging sector performance improvements.

##6. Risk Considerations

- Concentration Risk: Index vulnerability to top stock declines (e.g., a 10% NVDA drop subtracts ~0.76% from the index).

- Misleading Returns: Investors relying on cap-weighted indices may face unexpected losses if concentration risk materializes.

- Hedging Need: Hedges (options, inverse ETFs) can mitigate concentration risk for cap-weighted fund holders.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.