S&P 500 Q3 2025 Earnings Analysis: 13.8% Growth Driven by Technology Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit discussions on r/stocks show mixed sentiment despite strong earnings data. Key takeaways include:

- Contrarian sentiment: User subpar321 notes that Reddit sentiment contradicts the positive earnings data, expecting beat rates similar to Q2 2025 (~81%) [1]

- Analyst skepticism: grackychan suggests analysts may be “sandbagging” expectations, making earnings beats easier to achieve [1]

- Bullish positioning: cooldaniel6 expresses bullish sentiment with “So calls” indicating options positioning [1]

- General concerns: xEncrypterx provides generic bubble commentary, suggesting some market participants remain cautious [1]

Research verification confirms several key data points while revealing some discrepancies:

- S&P 500 Q3 2025 blended earnings growth: 13.8% (LSEG IBES data) [2]

- Earnings beat rate: 83% of companies exceeded expectations [2]

- This beat rate would rank as the sixth highest on record if maintained (Ned Davis Research) [2]

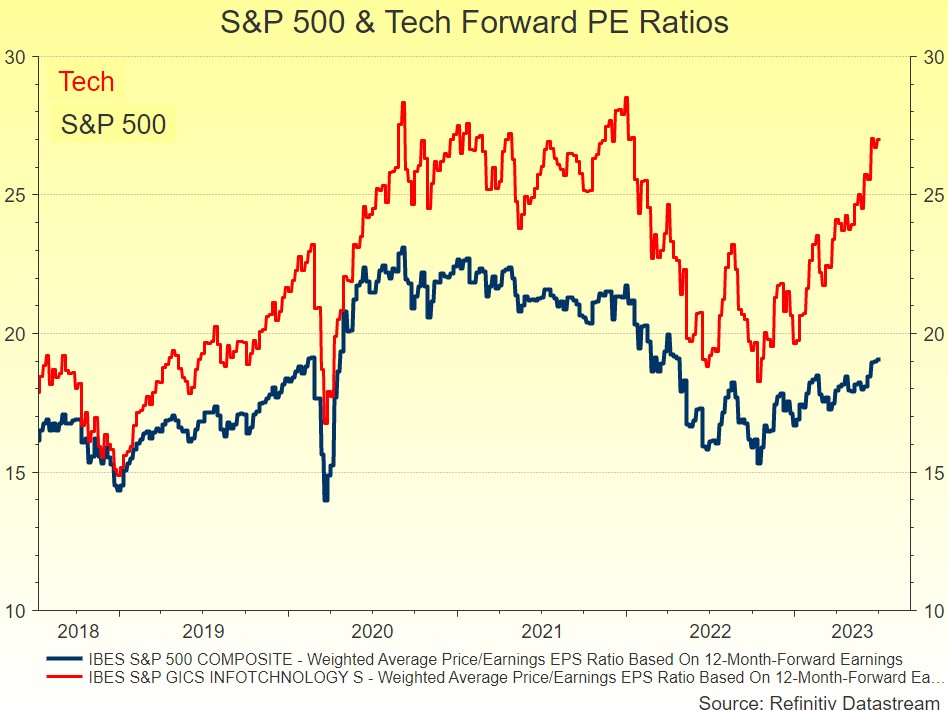

- Technology sector confirmed as primary growth driver [3]

- Consumer Discretionary and Healthcare sectors also contributed positively [3]

- Exact 83.2% beat rate and 315 reporters figure could not be verified [2]

- Real Estate and Financials sector leadership claims lack supporting evidence [3]

- Forward growth estimates of 7.7% (Q4 2025) and 12.4% (Q1 2026) appear to be Magnificent 7-specific, not S&P 500 broad [3]

- Some sources report 10.7% YoY growth, conflicting with 13.8% figure [3]

- Information Technology: Significant contributor to earnings growth [3]

- Communication Services: Detractor due to Meta’s earnings miss [3]

- No specific earnings data found for Real Estate and Financials sectors [3]

The strong Q3 2025 earnings performance (13.8% growth, 83% beat rate) represents a significant outperformance versus historical averages. However, Reddit skepticism appears warranted regarding some specific claims in the original post.

- The core earnings growth story (13.8% growth, 83% beat rate) is verified across multiple sources

- Technology sector leadership is confirmed, but Real Estate and Financials claims lack verification

- Forward guidance estimates appear misattributed from Magnificent 7 to broader S&P 500

- Reddit’s contrarian sentiment may reflect awareness of these data quality issues

The strong earnings beat rate suggests analysts may indeed be conservative in their estimates, supporting Reddit’s “sandbagging” thesis. However, the apparent data quality issues (unverified sector claims, misattributed forward guidance) warrant caution in trading decisions based solely on headline figures.

- Technology sector strength appears sustainable based on verified data

- High beat rate suggests potential for continued earnings surprises

- Options positioning (Reddit calls sentiment) could capitalize on momentum

- Forward guidance uncertainty due to data attribution issues

- Communication Services weakness (Meta miss) could signal broader tech sector risks

- Reddit skepticism and bubble concerns may indicate market topping patterns

- Q4 2025 growth moderation (7.7% for Magnificent 7) suggests potential slowdown

Focus on verified Technology sector strength while maintaining caution regarding unverified sector claims. The high earnings beat rate provides a tailwind, but forward-looking estimates require careful verification of attribution.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.