Retail Trader's Stop-Loss Triggered by Liquidity Sweep: Lessons on Stop Placement

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

A retail trader shorted near 24970, was stopped out by an upward spike, then watched price fall to their target [0]. Comments highlight:

- No-Condition7100 advised placing stops above the swing high (25180-25200) to avoid premature exits.

- Candles_and_emas framed this as a common bear-market liquidity sweep pattern.

- CampEast2700 identified the move as a liquidity sweep.

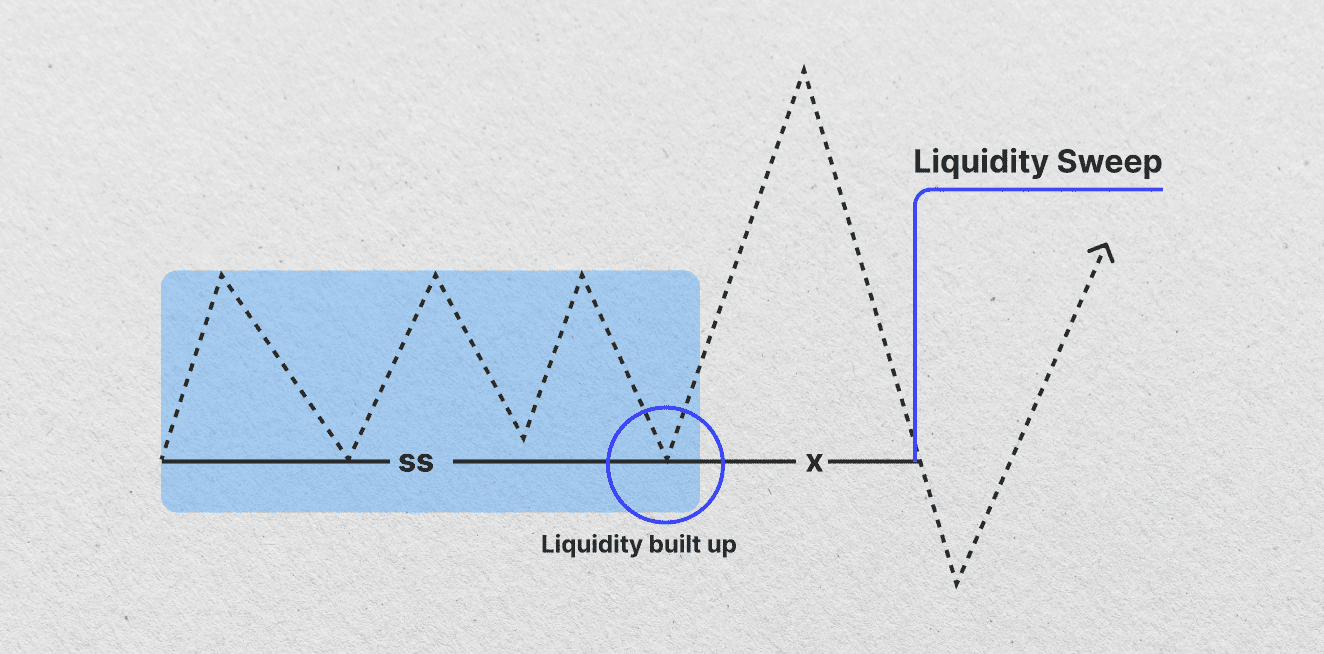

Liquidity sweeps are institutional maneuvers to trigger retail stop-losses at predictable levels (e.g., swing highs, round numbers) before reversing direction [2]. Optimal stop placement includes:

- ATR-based stops (1.5x-2x ATR) to account for normal volatility [6].

- Stops above resistance/swing highs (not obvious levels) [1].

- Trailing stops to lock in gains while protecting positions [7].

- Multi-timeframe analysis to identify key levels [5].

Both Reddit and research confirm the trader’s stop-out was likely due to a liquidity sweep. Reddit’s swing high stop advice aligns with research’s recommendation to avoid obvious stop levels [1]. Research adds data-driven strategies (ATR, trailing stops) to Reddit’s anecdotal insights, providing actionable steps for the trader.

- Risks: Premature stop-outs from institutional liquidity sweeps targeting predictable retail stops [2].

- Opportunities: Using volatility-based stops (ATR) and multi-timeframe analysis to reduce stop-hunt vulnerability while capturing intended trade moves [5,6].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.