Reddit Trader's Profitability Journey: Key Strategy Shifts and Industry Context

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

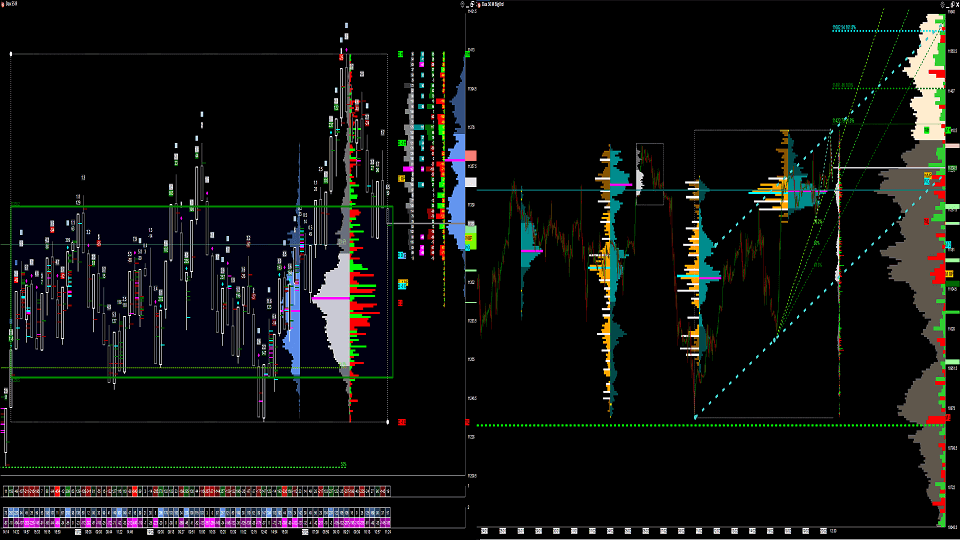

A Reddit trader’s one-year journey to profitability highlights key strategy shifts that align with industry best practices [0]. The move from scalping to higher timeframes reduces transaction costs and stress, as scalping’s frequent trades often erode gains through fees [3]. Integrating order flow analysis provides real-time visibility into supply and demand dynamics, avoiding lagging indicators [1], while volume profile identifies critical support/resistance zones [2]. Disciplined practices like journaling help refine behavioral patterns and strategy [4].

Cross-domain connections emerge: combining order flow and volume profile enhances decision-making by merging real-time sentiment with historical price action [5]. Journaling is not just record-keeping but a tool for behavioral improvement, addressing psychological barriers to profitability [4]. Higher timeframes balance risk and reward, making them suitable for traders seeking sustainable returns [3].

Risks include the lack of specific parameters (e.g., exact timeframes, stop-loss sizes) which could lead to inconsistent application of these strategies [0]. Opportunities lie in adopting structured approaches like order flow/volume profile integration and disciplined journaling, which industry sources confirm contribute to long-term success [1,2,4].

The trader’s success stems from a mix of technical tool adoption and behavioral discipline. Industry insights validate these changes, emphasizing the value of higher timeframes, integrated analysis tools, and consistent self-reflection. While the trader’s experience is personal, it offers actionable context for traders exploring similar strategies.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.