Analysis of Concentration Risk in 49% Portfolio Allocation to VOO (S&P500 ETF)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

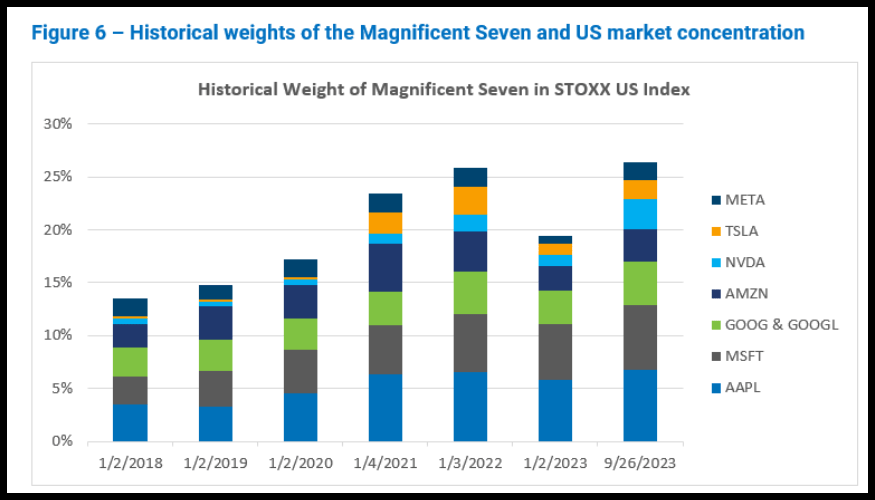

An investor holds $89k in total portfolio value, with 49.1% ($43.6k) allocated to the Vanguard S&P500 ETF (VOO) and $15k in unrealized gains [User Query]. VOO tracks the S&P500 Index, which exhibits significant concentration risk: the ‘Magnificent Seven’ tech giants account for ~36% of the index weight [3], and the top 10 companies represented ~35% of the index by late 2023 [7]. This index-level concentration means VOO itself is exposed to large-cap stock performance [4].

A 49% allocation to a single ETF amplifies this risk. The Wealth Advisor notes simplicity can mask concentration risk until volatility hits [1], and ETF Trends references products like SPXD to mitigate S&P500 concentration, confirming VOO’s exposure [2]. Risk severity depends on the remaining portfolio: non-correlated assets reduce risk, while other US equities increase it.

- Two Layers of Risk: VOO carries index-level (top stocks) and portfolio-level (single position) concentration risk.

- Market Validation: New ETFs targeting S&P500 concentration confirm VOO’s inherent risk [2].

- Context Dependency: Risk severity hinges on overall portfolio diversification and investor risk tolerance.

- Tech downturn volatility: VOO’s heavy exposure to the Magnificent Seven may increase volatility if these firms underperform [3][5].

- US large-cap overexposure: The 49% allocation ties performance to US large-caps, risking losses during market rotations [1].

- Rebalancing: Reducing VOO allocation to 10-20% (typical for balanced portfolios) mitigates risk.

- Diversification: Adding non-correlated assets (bonds, international stocks) lowers overall concentration.

The investor’s 49% VOO allocation is a material concentration risk due to index and portfolio-level factors. Risk severity depends on remaining portfolio composition. Investors should monitor Magnificent Seven performance [3][7], track sector rotations [2], and consider rebalancing/diversifying to align with risk tolerance.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.