Furi Co., Ltd. (002083.SZ) Short-Term Surge Analysis: Speculation-Driven vs. Fundamental Divergence

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Furi Co., Ltd. (002083.SZ) recently became a hot stock driven by the skyrocketing price of lithium battery electrolyte additive VC and market speculation. From November 3 to 17, 2025, it recorded a cumulative gain of 112.35% and achieved eight consecutive limit-ups [0]. The company’s main business is home textiles, and its subsidiary Furi New Energy is involved in VC business. However, this business contributes only 4.38% of total revenue and incurred a loss of 30.32 million yuan in the first three quarters [0].

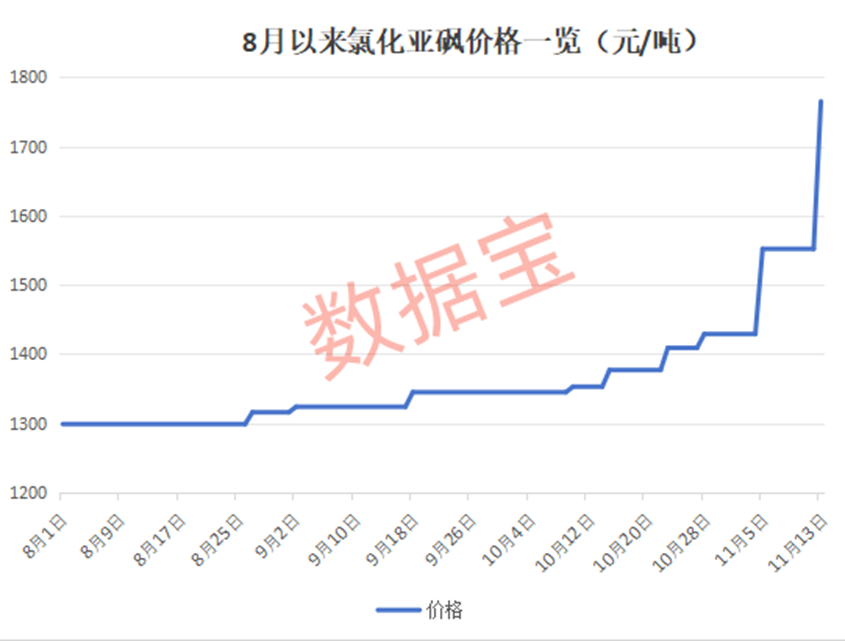

VC price rose from 45,000 yuan/ton to over 100,000 yuan/ton, an increase of 150% [0], driving the overall strength of the lithium battery sector and a wave of limit-ups [9]. Dragon and Tiger List data shows that individual investors dominated the trading. On November 17, the turnover rate was 0.65% and the trading volume was 61,200 lots [0]. The company has repeatedly issued risk warnings, stating that the stock price may have irrational speculation [5], clarified that it has nothing to do with homophonic names [1], and indicated that Furi New Energy has no expansion plans for the time being [2][7].

- Fundamental and Stock Price Divergence: The company’s first three quarters revenue was 3.841 billion yuan (down 4.45% YoY), net profit was 296 million yuan (down 12.05% YoY) [0]. The VC business has a small share and is loss-making, so the stock price rise lacks fundamental support.

- Speculation-Driven Clearly: Short-term speculative sentiment is active [8], and funds are rotating from AI tech sectors to low-position sectors like lithium batteries [0] to seek catch-up opportunities.

- Sector Linkage Effect: The lithium battery sector is driven by the expectation of rising lithium carbonate prices [0], performing strongly overall and driving up related stocks.

- The stock price is seriously deviated from fundamentals, with potential correction risks [5];

- VC business has a low share and cannot sustain the stock price;

- Significant volatility may occur after market speculation subsides.

- If the lithium battery sector continues to strengthen, it may maintain short-term heat, but need to be alert to speculation risks;

- If the company expands VC business scale in the future, it may improve its performance structure, but currently there are no expansion plans [2][7].

The recent surge in Furi Co., Ltd.'s stock price is mainly driven by market speculation and rotation in the lithium battery sector, rather than fundamental improvement. Investors should pay attention to the divergence between the company’s fundamentals and stock price, as well as changes in market speculative sentiment. The company has repeatedly issued risk warnings; investors should view short-term market conditions rationally and note investment risks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.