Analysis of Yaxing Chemical (600319) Resumption and Limit-Up: Driven by Asset Restructuring Expectations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

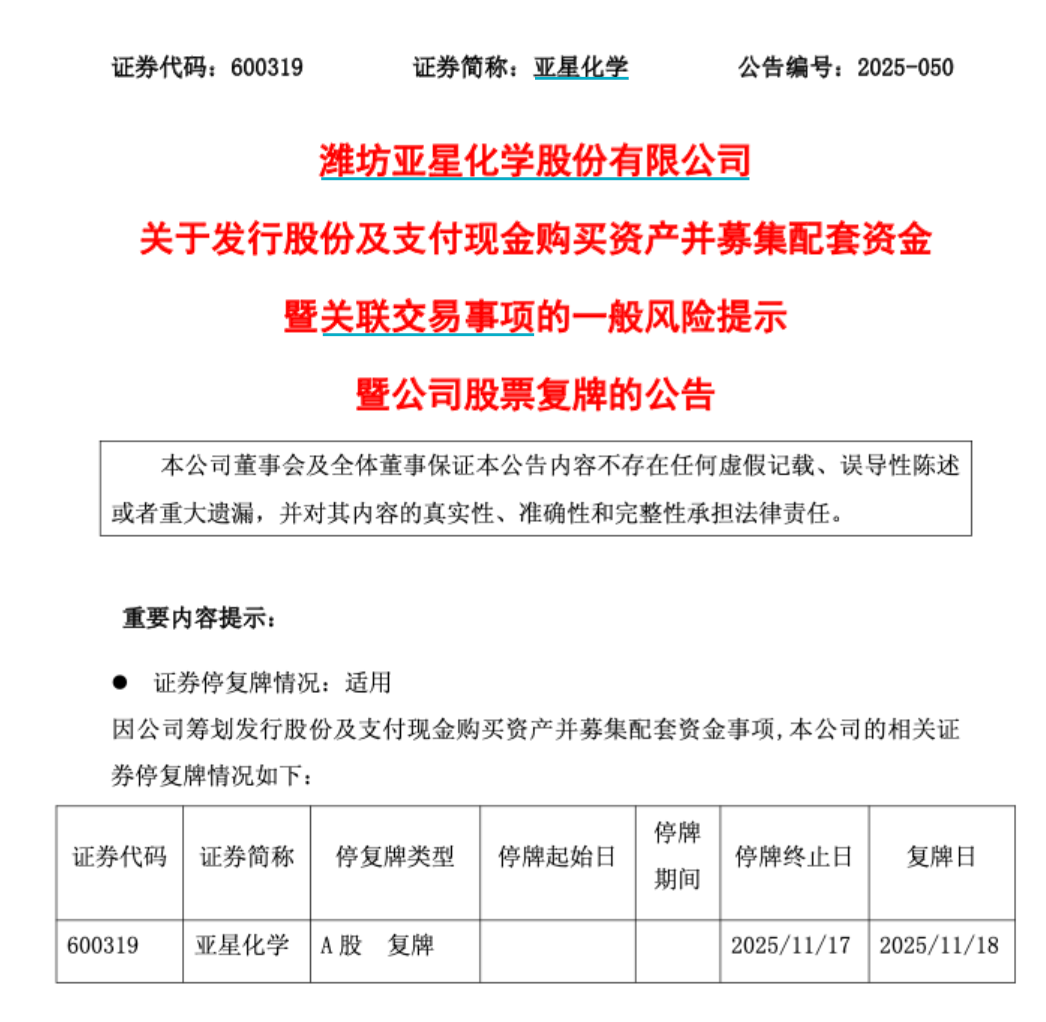

Yaxing Chemical (600319) resumed trading with a one-word limit-up after its suspension on November 18, 2025, mainly driven by the major asset restructuring plan [0][1][2]. The company released the plan on the evening of November 17, proposing to acquire 100% equity of Tianyi Chemical [1][6] at an issuance price of 5.83 yuan/share [0]. As a leader in the brominated flame retardant segment, Tianyi Chemical has a domestic market share exceeding 50% [0][4]. This acquisition aims to help Yaxing Chemical expand into the new materials field and build a multi-polar linkage structure of “chlor-alkali + PVDC new materials + brominated flame retardants” [0][3]. Yaxing Chemical lost 144 million yuan in the first three quarters of 2025 and is in a state of continuous losses [0][3]. This acquisition is a key measure for its transformation. In addition, the chemical sector has ushered in rotation opportunities due to the “anti-involution” policy and supply-demand improvement [0][8], further supporting the stock price performance.

- Cross-domain Synergy Effect: The asset restructuring combines traditional chlor-alkali business with the high-growth new materials field, which is expected to form synergy in technology, channels, and customer resources [0][4];

- Typical Case of State-owned Enterprise Transformation: As an established chemical state-owned enterprise, Yaxing Chemical realizes business upgrading through mergers and acquisitions, reflecting the trend of asset restructuring driving traditional industry transformation in state-owned enterprise reform [0][7];

- Market Sentiment Resonance: During the suspension period, the market had high expectations for asset restructuring. The limit-up after resumption releases accumulated sentiment, while the overall recovery of the chemical sector amplifies the stock price performance [0][5][8].

- Integration Risk: The effect of business integration after the acquisition is uncertain, which may affect the release of synergy [0][3];

- Fundamental Pressure: The company has been losing money continuously, and it is difficult to reverse the performance decline in the short term. It is necessary to pay attention to the subsequent profit improvement [0][3];

- Policy Risk: Changes in environmental protection and safety policies in the chemical industry may affect the development pace of new businesses [0][8].

- New Materials Track Growth: The demand for brominated flame retardants rises with the growth of new energy and electronics industries, and Tianyi Chemical’s leading position is expected to bring stable returns [0][4];

- Sector Rotation Window: Under the “anti-involution” policy of the chemical sector, high-quality transformation enterprises are expected to receive sustained capital attention [0][8].

Yaxing Chemical (600319) resumed trading with a limit-up due to the asset restructuring plan, and the acquisition of 100% equity of Tianyi Chemical is the core driving factor. This acquisition aims to expand into the new materials field and improve the continuous loss situation. Market sentiment is positive, but integration risks and fundamental pressure need to be noted. Subsequent progress of the acquisition and business synergy effect should be tracked.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.