Fractyl Health (GUTS) Analysis: Reddit-Driven Surge & Clinical Catalyst Outlook

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Reddit post (2025-11-18) presenting a bullish case for Fractyl Health (GUTS) [0]. The post coincided with a 13.49% intraday price surge to $1.43, with volume 1.79x the 30-day average, outperforming the Healthcare sector’s 0.5068% gain [0,6]. No official company news was released that day, suggesting retail influence drove the movement [5].

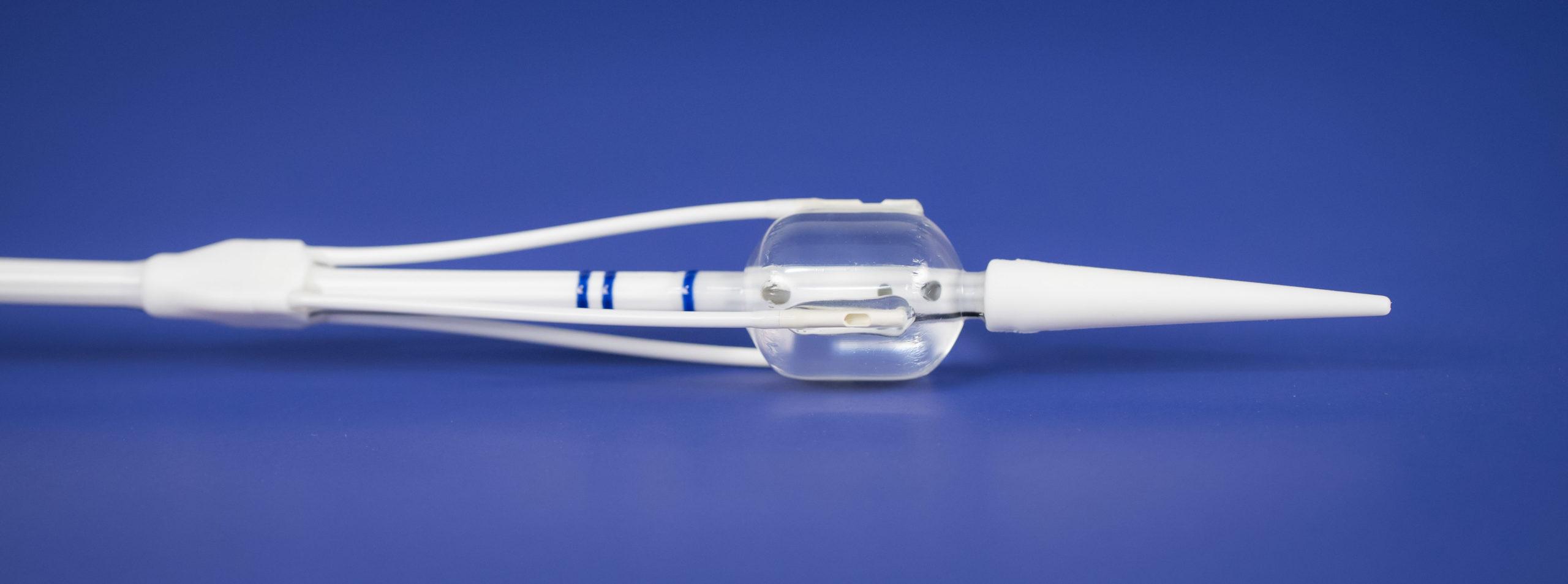

Fractyl’s ReVita endoscopic procedure showed positive results: maintaining weight (0.46% change) vs. expected 5-6% regain after GLP-1 discontinuation [2]. The company has a cash runway to early 2027 ($77.7M as of Q3 2025) [4] and upcoming catalysts in H2 2026 (pivotal data, FDA PMA submission) [4]. Analyst targets average $6.90, implying 447% upside [3].

- Retail Impact: Penny stocks like GUTS are highly sensitive to social media sentiment—this Reddit-driven surge underscores retail investors’ ability to move low-float biotech stocks [0,1].

- Catalyst Alignment: The 2026 pivotal data and PMA submission timeline aligns with analyst upside expectations, creating a potential multi-quarter narrative [3,4].

- Dilution Trade-off: While cash runway is sufficient, recent $60M offering (Sept 2025 at $1/share) dilutes shareholders, balancing near-term stability with long-term value risks [4].

- 447% upside from analyst targets [3].

- ReVita addresses an unmet need in post-GLP-1 weight maintenance [2].

- 2026 catalysts could unlock significant value [4].

- Clinical Trial Risk: Pivotal data failure may lead to sharp price declines [2,4].

- Dilution: Future offerings may erode shareholder value [4].

- Volatility: Penny stock status makes GUTS prone to rapid reversals [0,1].

- Profitability: Negative EPS (-$2.32 TTM) and Q3 net loss of $45.6M raise sustainability concerns [1,4].

- Market Cap: $103.24M [1].

- Cash Runway: Early 2027 [4].

- Catalysts: H2 2026 pivotal data & FDA PMA submission [4].

- Analyst Upside: 447% from current levels [3].

- Recent Performance: +13.49% intraday (2025-11-18), +41.58% over 3 months [0,1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.