Eli Lilly Obesity Pipeline Update Analysis Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

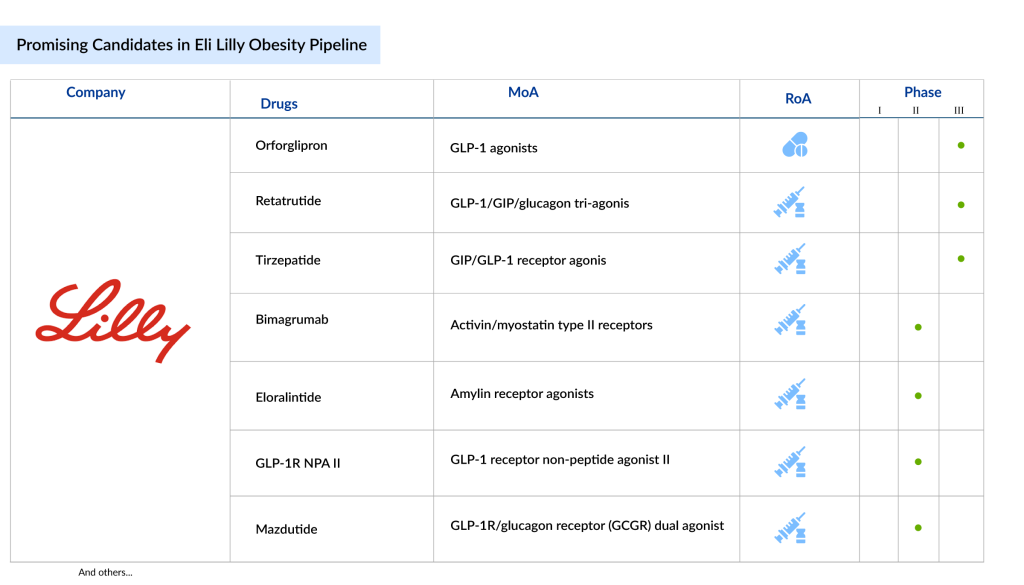

On November 18, 2025, an update highlighted Eli Lilly’s (LLY) robust obesity pipeline, featuring key assets:

- Orforglipron: Oral small-molecule GLP-1 agonist positioned for low-cost access via the TrumpRx/Medicare pathway (pending FDA approval, Medicare beneficiaries will pay ≤$50/month [2]).

- Retatrutide: Injectable triple agonist (GLP-1/GIP/GCG) with Phase 3 data pending and a push for biologic classification to secure 12-year exclusivity [1].

- Additional assets: Eloralintide (amylin agonist), mazdutide (AUD/MASH expansion), brenipatide (early-phase), and bimagrumab (muscle-retention combo) [4].

The update emphasized the pipeline’s strength as a driver of the investment thesis despite LLY’s all-time high valuation [4].

- LLY Stock Performance: LLY rose +0.82% to $1030.05 in after-hours trading on November 18, aligning with the Healthcare sector’s +0.85% gain that day [0].

- Sector Alignment: The Healthcare sector was the 4th best-performing sector on November 18, reflecting investor optimism about LLY’s pipeline [0].

- LLY’s stock has surged +28.30% in the past month and +32.39% YTD, driven by pipeline progress and expanding access to obesity drugs [0].

- Analyst consensus remains bullish: 70.5% of analysts rate LLY as “Buy,” though the consensus target ($889.00) indicates 13.7% downside from current levels [0].

| Metric | Value | Source |

|---|---|---|

| LLY After-Hours Price (11/18) | $1030.05 (+0.82%) | [0] |

| Market Cap | $925.28B | [0] |

| Volume (11/18) | 3.42M (vs avg.3.85M) | [0] |

| P/E Ratio | 50.18x | [0] |

| Net Profit Margin | 30.99% | [0] |

| Healthcare Sector Change (11/18) | +0.85% | [0] |

| Analyst Buy Rating % | 70.5% | [0] |

- Eli Lilly (LLY): Primary beneficiary of pipeline progress.

- Healthcare: Pharmaceutical subsector focused on GLP-1/obesity therapies.

- Payers: Medicare/Medicaid (via orforglipron’s $50/month cap [2]) and pharmacy benefit managers (PBMs).

- Novo Nordisk (Wegovy): Key rival in the obesity drug market.

- Exact timeline for orforglipron’s FDA submission (rumored late 2025 [1]) and retatrutide’s Phase3 data release (2026 [1]).

- Details on retatrutide’s biologic classification application outcome.

- Patient uptake projections for orforglipron under Medicare.

- Bull Case: Pipeline diversification (oral + injectable assets) and expanding access via Medicare could drive long-term revenue growth.

- Bear Case: High valuation (P/E=50x) leaves little room for disappointment if pipeline milestones are delayed.

- Orforglipron’s FDA submission/approval status.

- Retatrutide’s Phase3 results and biologic classification outcome.

- Medicare access rollout for orforglipron (April2026 pending approval [2]).

- Competitive responses from Novo Nordisk.

Users should be aware that Eli Lilly’s current P/E ratio of50.18x is significantly above the industry average (15-20x for large-cap pharma), increasing vulnerability to market corrections if pipeline milestones are not met [0].

This development raises concerns about potential regulatory delays in FDA approvals for key assets like orforglipron and retatrutide. A denial of retatrutide’s biologic classification could reduce its exclusivity period from12 to5 years, impacting long-term revenue [1].

Historical patterns suggest intense competition in the GLP-1 space (e.g., Novo Nordisk’s Wegovy) can erode market share if LLY’s pipeline drugs do not deliver superior efficacy or pricing [0].

[0] Ginlix Analytical Database (get_stock_realtime_quote, get_company_overview, get_sector_performance)

[1] Yahoo Finance, “Can Lilly’s Next-Gen Obesity Drugs Help Sustain Its Market …” (URL: https://finance.yahoo.com/news/lillys-next-gen-obesity-drugs-135300254.html)

[2] Prnewswire, “Lilly and U.S. government agree to expand access to obesity …” (URL: https://www.prnewswire.com/news-releases/lilly-and-us-government-agree-to-expand-access-to-obesity-medicines-to-millions-of-americans-302607652.html)

[3] News-Medical, “Oral GLP-1 Pills for Weight Loss: How Orforglipron Works” (URL: https://www.news-medical.net/health/Oral-GLP-1-Pills-for-Weight-Loss-How-Orforglipron-Works.aspx)

[4] User-provided event content.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.