Tesla Day Trading Reality Check: 100% Win Rate Claims vs. 97% Failure Rate Reality

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit trading community provides strong warnings against quitting a stable engineering job for day trading Tesla:

- Consensus Advice: Keep the job and accumulate at least one year of savings before considering any career change [Reddit]

- Risk Warnings: Leveraged single-stock exposure with no stop-loss is extremely risky; one deep sell-off or margin call could wipe out all gains [Reddit]

- Validation Required: Multiple users suggest replicating results for several more months and backtesting without leverage to validate robustness [Reddit]

- Reality Check: 100% win streaks are unsustainable; markets eventually humble every trader [Reddit]

- Nuanced View: Some acknowledge that scalping familiar tickers can work if you protect capital and avoid greed, but emphasize extreme caution [Reddit]

Research data reveals stark contradictions to the engineer’s claimed success:

- Mathematical Impossibility: 100% win rate strategies are impossible in real markets - even professional traders typically achieve only 50-70% win rates [Research]

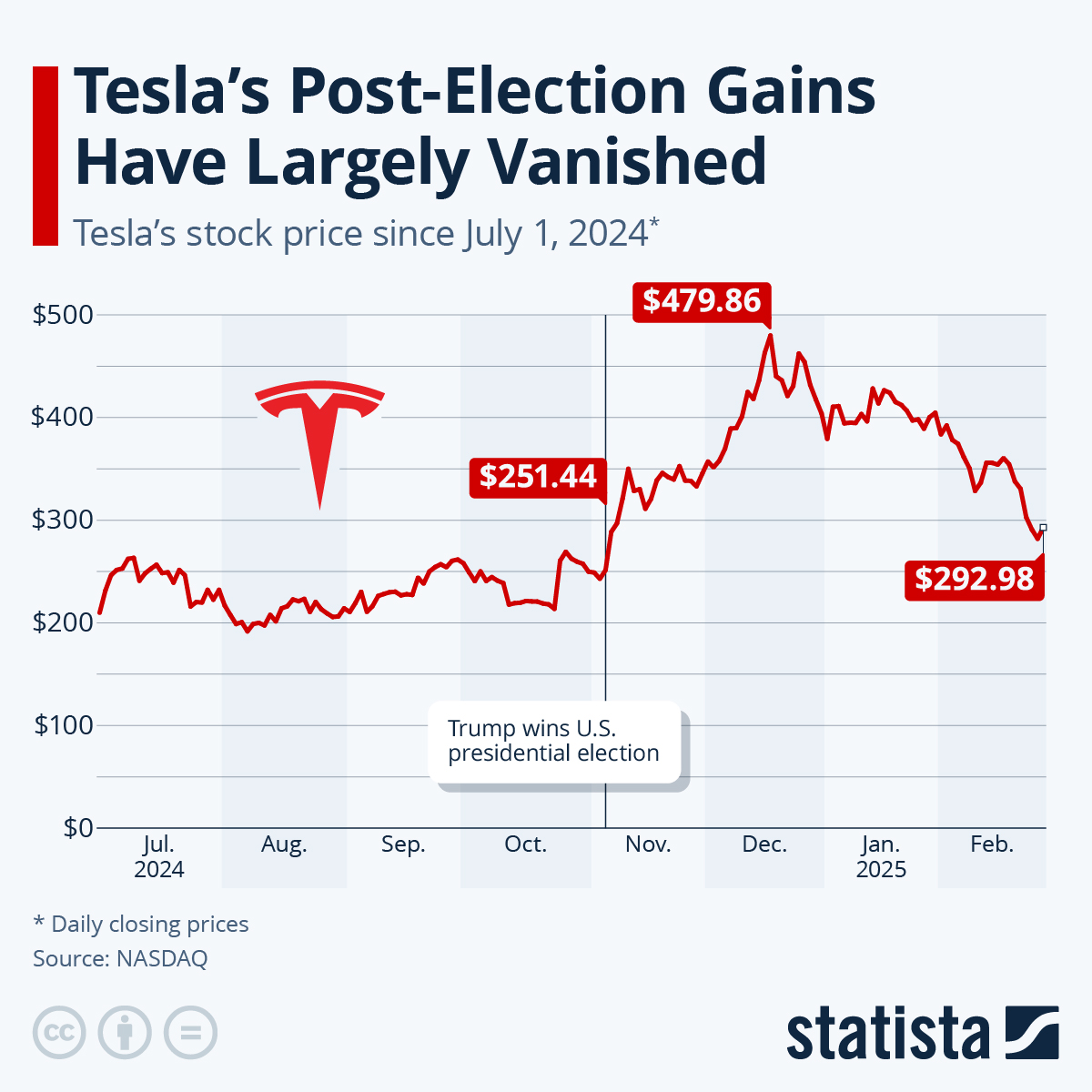

- Tesla Volatility: Tesla exhibits extreme intraday volatility with 4.15% average daily range and $18 average price movement, making it exceptionally risky for leveraged trading [Research]

- Leverage Dangers: High leverage (20x+) was capped by major exchanges in 2021 due to systemic risks and retail trader liquidations [Research]

- Failure Statistics: 97% of day traders with 300+ days of active trading lose money according to comprehensive research [Research]

- Long-term Survival: Only 7% of traders remain active after five years, with 80% quitting within the first two years [Research]

The Reddit community’s cautious advice aligns perfectly with research findings, creating a unified warning against the engineer’s proposed career change. Both sources emphasize that short-term success (even if real) doesn’t guarantee long-term viability. The claimed 28-day streak, while impressive, represents insufficient sample size given Tesla’s volatility and the statistical reality that 90% of retail traders fail due to emotional trading and poor risk management [Research][Reddit].

The absence of stop-losses mentioned in the Reddit post particularly concerns both communities, as this violates fundamental risk management principles. Research shows that holding losing positions through drawdowns (as claimed by the engineer) is a primary reason 90% of traders blow their accounts [Research].

- Account Liquidation: Tesla’s volatility combined with leverage could trigger margin calls during unexpected market movements

- Emotional Trading: Success may breed overconfidence, leading to increased position sizes and risk exposure

- Market Regime Changes: Tesla’s trading patterns can shift dramatically, rendering even successful strategies obsolete

- Fee Impact: High-frequency trading generates substantial costs that erode profits over time

- Skill Development: The engineer’s technical background may provide analytical advantages if properly channeled

- Part-time Trading: Maintaining employment while trading part-time could provide capital and risk mitigation

- Strategy Validation: Extended backtesting and smaller position sizing could reveal if any edge exists

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.