Options vs. Stocks for Undervalued Companies: Decision Framework and Risk Considerations for Investors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Per Reddit comments, users highlight critical considerations:

- Contract Selection: Advice includes 6+ month DTE (days to expiration) ITM (in-the-money) contracts and buying during low volatility periods.

- Leverage: ~7x leverage on slightly ITM/OTM monthlies vs. 2x margin (no margin calls) is noted.

- Risk Warnings: Cautionary tales include $10k loss from holding a winning option too long (timing risk) and views of options as gambling.

- Complexity: Options add layers like premium decay; simple directional moves may be better with stocks.

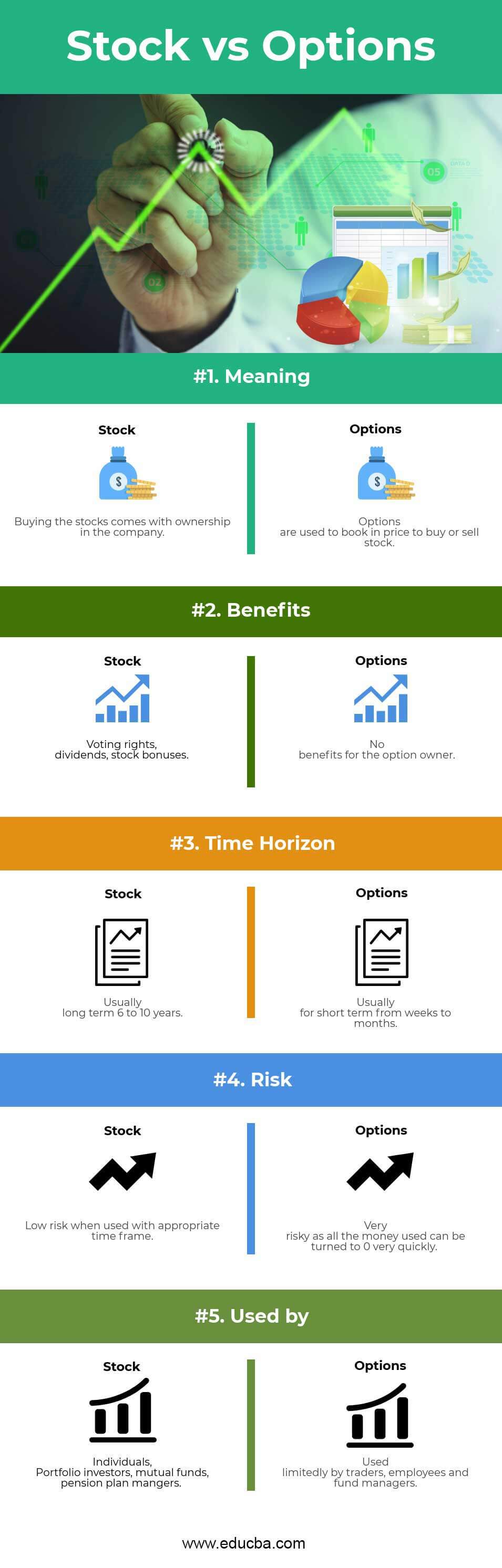

Structured decision framework from research:

- Capital Efficiency: Options require only premium payment vs. full stock cost [2,3].

- Leverage: Embedded leverage (100 shares per contract) allows control of larger positions [5].

- Risk Tradeoffs: Options have limited downside (premium loss) but carry time decay/expiration risks; stocks offer unlimited holding periods [4,6].

- Beginner Risks: Options’ complexity (Greeks, liquidity) conflicts with undervalued stocks’ long recovery timelines [4,7].

Both Reddit and research align:

- Long DTE ITM contracts (Reddit) address expiration conflicts with undervalued stocks [3].

- Capital efficiency (research) resonates with Reddit users’ preference for options when capital is limited [2].

- Options: Opportunities (leverage, capital efficiency); Risks (time decay, expiration, complexity for beginners) [3,4].

- Stocks: Opportunities (ownership, dividends, no expiration); Risks (higher capital, unlimited downside) [6,8].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.