Analysis of Reddit Claim on Oracle (ORCL) and Vertiv (VRT) Data Center Cooling Efficiency

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

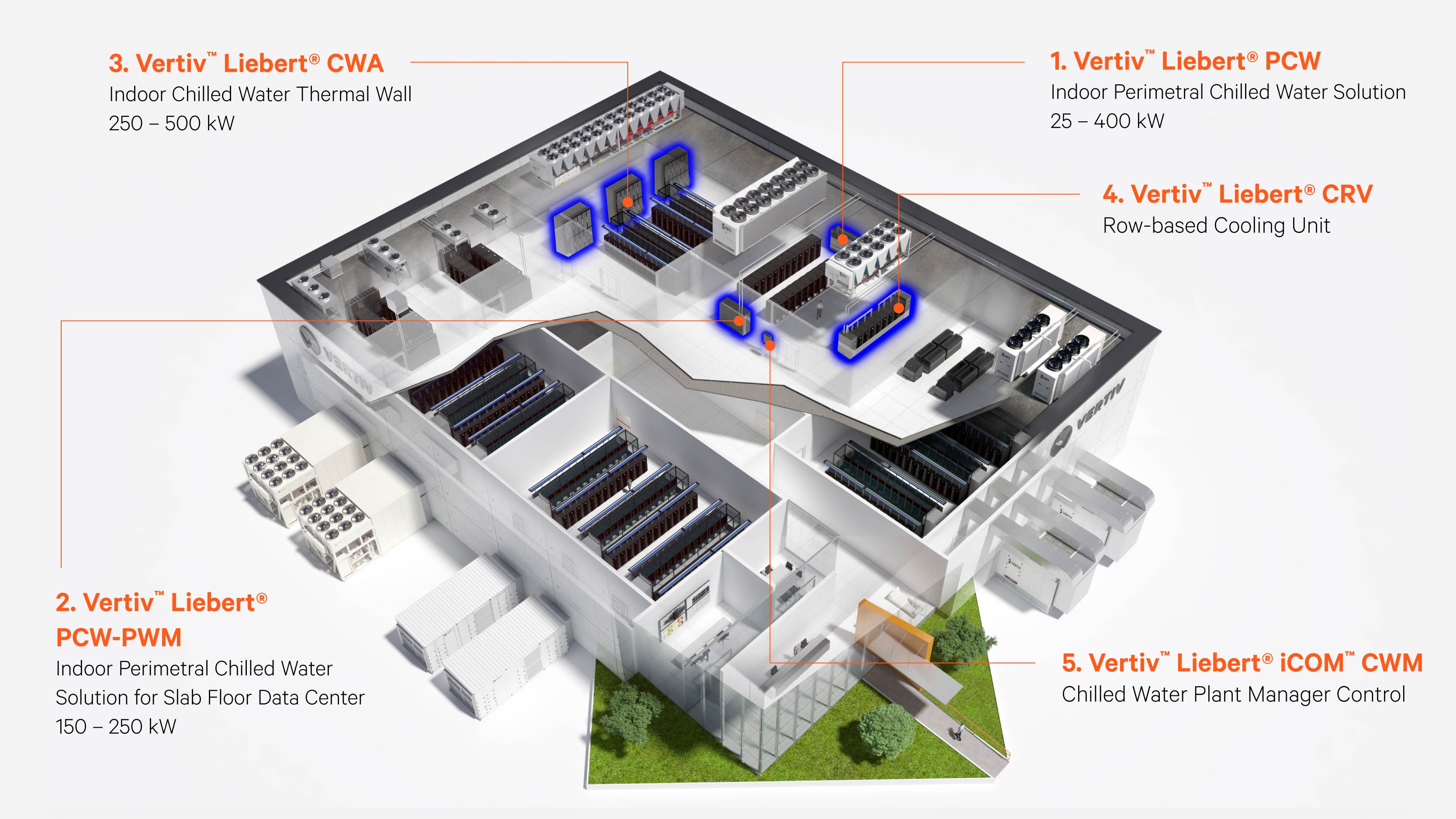

On 2025-11-18 (EST), a Reddit post argued Oracle (ORCL) data centers have inefficient cooling leading to obsolescence and recommended buying ORCL and VRT puts [Event Context]. This claim contradicts available data: Oracle’s Cloud Infrastructure (OCI) data centers have a Power Usage Effectiveness (PUE) as low as 1.15 (well below the 2025 industry average of 1.54) [0], with 86% renewable energy use globally (targeting 100% by 2025) [0]. Vertiv (VRT), a leader in data center cooling, has 2025 innovations including direct-to-chip liquid cooling for high-density AI racks [1], with case studies like Oxigen Barcelona demonstrating efficient deployment [3]. Industry trends show hybrid liquid-air cooling is becoming standard for AI workloads (addressing the70kW rack limit of air cooling) [7], with new facilities achieving average PUE of1.48 [2].

- The Reddit claim of inefficient cooling is unsupported: ORCL’s PUE is30% below industry average, and VRT is at the forefront of AI cooling solutions.

- Strong analyst consensus: ORCL has a 59.5% Buy rating (target $365, +65.5%) and VRT has a94.7% Buy rating (target $196, +18.9%) [5][6].

- Industry shift: Hybrid cooling is critical for AI scalability, benefiting innovators like VRT [2][7].

- ORCL’s 24% 1-month drop indicates short-term market concerns [5].

- VRT’s high P/E (60x) may pose downside risk if growth slows [6].

- Regulatory changes on data center energy use could impact both companies [2][7].

- ORCL’s progress toward 100% renewable energy and VRT’s AI cooling innovations present long-term growth potential [0][1].

ORCL closed at $220.49 (market cap $618.54B) and VRT at $164.86 (market cap $63.03B) on2025-11-18 [4][5][6]. ORCL’s P/E ratio is 50.08x, VRT’s is60.81x. Both companies have strong positions in the evolving data center infrastructure market, countering the Reddit post’s bearish thesis.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.