MSTR Risk Profile: 2000 Crash vs Current Bitcoin-Leveraged Model

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit users on r/wallstreetbets discuss whether Michael Saylor’s aggressive financial engineering could lead to another MSTR crash, with some hoping for a drop before Friday options expiration [12]. Several commenters label MSTR a Ponzi-like scheme, while others view it as a leveraged Bitcoin proxy [12]. One user notes MSTR has fallen over 50% since July, suggesting a crash is underway [12].

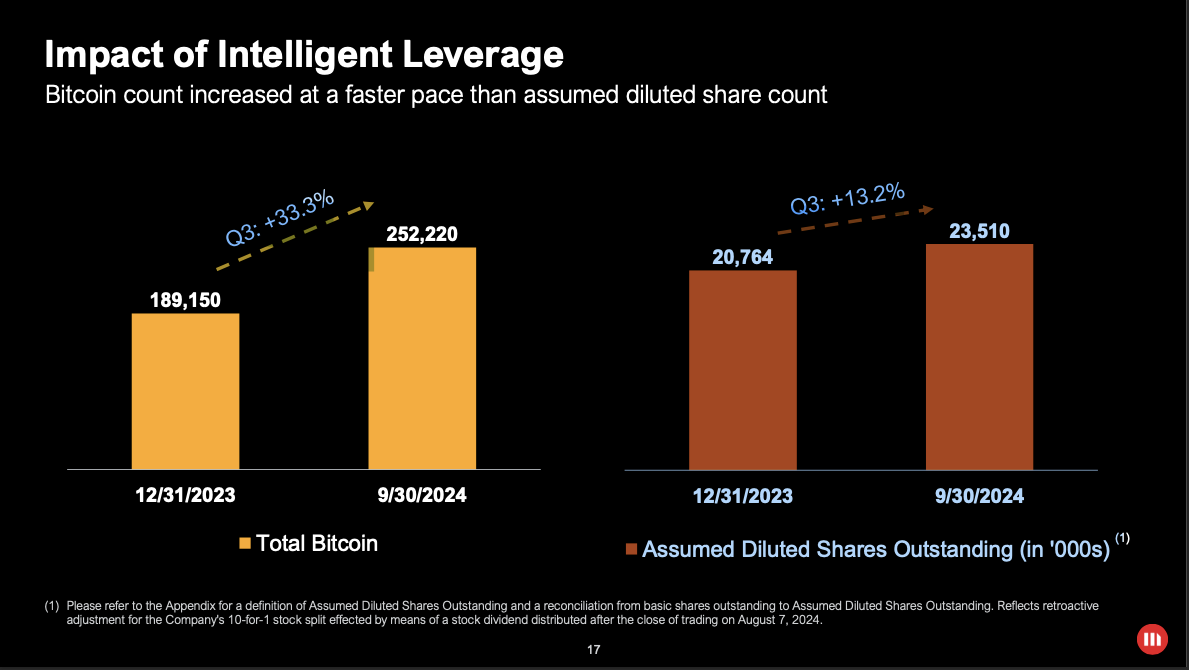

The 2000 MSTR crash stemmed from accounting restatements and SEC charges against Saylor for inaccurate reporting, leading to a 62% single-day drop [3][2]. Today, MSTR holds 649,870 Bitcoin ($61.7B) via leveraged financing (convertible notes, preferred shares) [6][8]. Its stock has a 0.89-0.93 correlation with Bitcoin, causing extreme volatility—e.g., a 57% plunge when BTC dropped 25% [5][7]. Traditional software revenue declined to $114.5M annually, making Bitcoin holdings dominant [10].

The 2000 crash was accounting fraud-driven, while current risks tie to Bitcoin volatility and leverage—distinct profiles [3][8]. Reddit’s Ponzi claims contrast with research showing a structured but risky model依赖 on mNAV premium; mNAV below 1 breaks the “BTC money printer” [8].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.