Market Overview Report: Fragmented Landscape Beyond Bull vs Bear

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

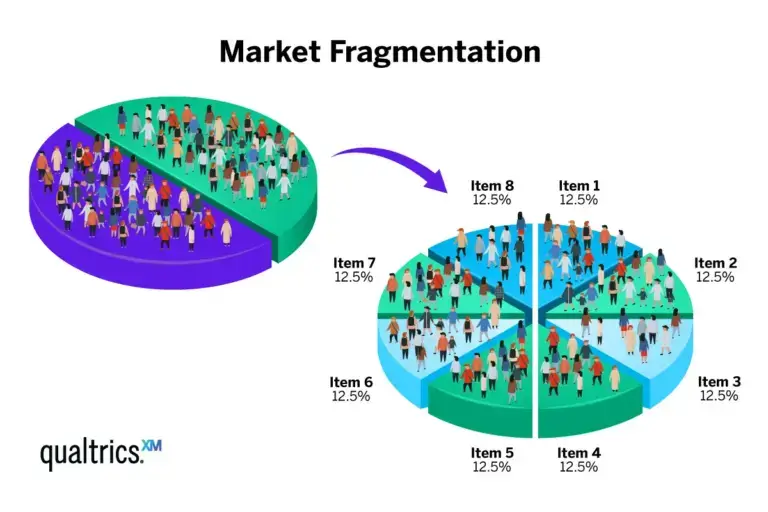

The U.S. market exhibits a fragmented landscape, with large-cap indices (Nasdaq +3.55%, S&P500 +2.2%) posting gains over the past 60 days while small caps (Russell2000 -0.17%) remain flat [0]. Healthcare leads sector performance (+2.4%) amid near-record-low consumer sentiment (51 in November) [0,1], highlighting a disconnect between investor optimism and household economic outlook. The key theme is that ‘bull vs bear’ is an oversimplification—market concentration (tech’s 36% weight in S&P500) and sector rotation mask broader economic fragility [3].

- Indices: Nasdaq Composite (+3.55%) outperformed S&P500 (+2.2%) and Dow Jones (+1.83%), while Russell2000 (small caps) declined slightly (-0.17%) over 60 days [0]. Short-term, healthcare (+2.4%) led daily gains, outpacing tech (+1.14%) [0].

- Sectors: Healthcare (+2.4%) was the top performer, followed by Industrials (+1.9%) and Consumer Cyclical (+1.78%). Utilities (-0.6%) were the only sector in decline [0].

- Sentiment: Consumer confidence stood at 51 in November, near record lows, as Americans prepared for the holiday season [1].

- Breadth: Russell2000’s flat performance indicates narrow leadership, with gains concentrated in large-cap stocks [0].

- Market Concentration Risk: Tech accounts for ~36% of S&P500 weight—higher than the dot-com bubble—making broader markets vulnerable to tech wobbles [3]. Recent AI stock slumps have exposed this reliance [3].

- Consumer Sentiment vs Market Gains: Consumer confidence is near record lows [1], contrasting with large-cap index gains, suggesting a disconnect between investor optimism and household finances.

- GDP Growth Forecast: USBank projects 2025 real GDP growth of 3.8% [2], but consumer spending growth is modest (2.5% in 2025) [2], signaling potential cyclical headwinds.

- Sector Rotation: Healthcare’s leadership (+2.4%) over tech (+1.14%) reflects a shift toward defensive growth amid uncertainty [0].

- Tech Wobble Impact: Recent tech slides (e.g., AI-related stocks) have led to broader market declines, underscoring the need for diversification [3,4].

- Top Gainers: Healthcare sector stocks (e.g., pharma, medical devices) led daily gains [0].

- Top Losers: Utilities sector (-0.6%) and Home Depot (-3% after weak Q3 sales and margin cuts) [0,4].

- Unusual Activity: Tech stocks showed volatility amid AI-related news, with large-cap tech names experiencing recent declines [3].

- Upcoming Catalysts: Monitor holiday consumer spending data (to validate GDP forecasts), Fed policy decisions (lower T-note yields suggest rate cut expectations), and tech sector earnings (AI-related companies) [2,3].

- Technical Levels: S&P500 (6631) and Nasdaq (22397) trade below their 20-day moving averages (6764 and23191, respectively), indicating short-term downward pressure [0].

- Risks: Tech overconcentration, low consumer sentiment impacting retail sales, and small-cap weakness as a leading indicator of broader slowdown [3,1,0].

- Recommendations: Diversify beyond tech—focus on healthcare and industrials (strong recent performance) and defensive growth areas [0,5].

Generated on 2025-11-21 UTC

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.