Impact of September Jobs Report and Hyperscaler Capex Shift on NVDA and AI Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

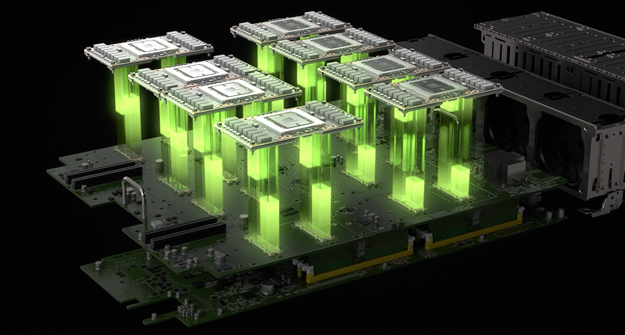

This analysis is based on a Reddit post [1] arguing that the recent market sell-off isn’t due to AI sector rotation but the delayed September 2025 jobs report [2] and hyperscalers shifting to debt-funded capex [5]. NVDA experienced a 5.35% drop on October 10, 2025 [3], alongside broader market declines (S&P500 down 2.79%, NASDAQ down 3.64% [4]). The jobs report, released on November 20, showed stronger-than-expected labor market data, reducing expectations of a December Fed rate cut [2]. Hyperscalers have increased debt issuance for AI capex to $121B (4x usual levels) [5], increasing their sensitivity to interest rates.

- The jobs report’s impact on Fed rate policy is a more significant driver of recent AI stock sell-off than AI sector rotation.

- Hyperscalers’ shift to debt-funded capex creates medium-term risks for NVDA’s revenue, as higher interest rates could reduce future AI investments.

- NVDA’s strong Q3 earnings (62% YoY revenue growth [5]) contrast with short-term headwinds from rate policy, indicating mixed outlook.

- Interest Rate Sensitivity: Hyperscalers’ debt-funded capex increases their vulnerability to Fed rate hikes, potentially reducing AI chip orders from NVDA [5].

- AI Spending Sustainability: The gap between AI capex ($400B+/year) and AI revenue (e.g., OpenAI’s $13B in 2025 [5]) raises concerns about long-term investment viability.

- Competitive Pressure: NVDA faces growing competition from other chipmakers [5].

- NVDA’s dominant market position in AI chips and strong Q3 earnings suggest long-term demand remains robust [5].

- If the labor market weakens in the coming months, Fed rate cut expectations could revive AI stock sentiment [2].

- NVDA’s October 10 drop aligns with broader market volatility, but recent jobs report adds new headwinds [2,3,4].

- Hyperscalers’ debt shift is a medium-term risk to monitor, alongside Fed policy announcements [5].

- NVDA’s strong Q3 performance provides a counterbalance to short-term market pressures [5].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.