Uber Earnings Risk Analysis: Restaurant Weakness vs. Business Travel Resilience

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The original Reddit post raises significant concerns about Uber’s valuation near all-time highs, arguing the stock faces 10-15% downside risk if earnings disappoint. Key Reddit concerns include:

- Restaurant Peer Weakness: Uber is trading near ATH while restaurant stocks have sold off dramatically, with the 25-35 year demographic showing particular consumer weakness

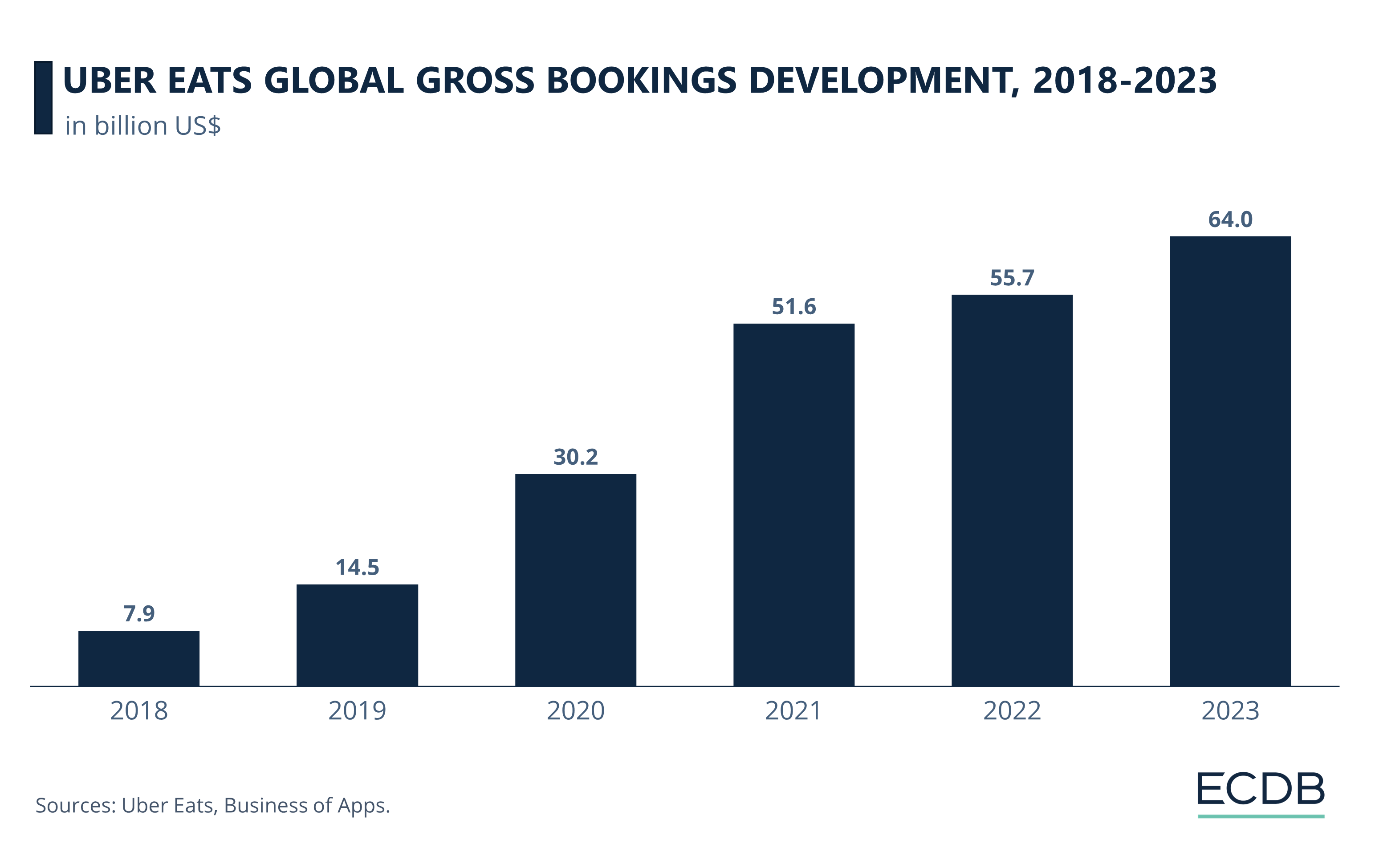

- Delivery Exposure: Uber Eats represents 32% of revenue, making it a leveraged bet on declining restaurant traffic

- High Expectations: Limited upside potential with elevated risk of a correction if delivery growth slows or guidance is cautious

Reddit comments provide counterarguments:

- Some users note many Uber trips are for work/business travel, not comparable to restaurant stocks

- Others argue Uber appears fairly/undervalued with low P/E ratio

- Business travel spending is confirmed as a significant component

- GLP-1 weight loss drugs may reduce restaurant demand but potentially shift to delivery

- Chipotle down 44%, Cava Group down 51%, Sweetgreen down 76% YTD

- Hospitality sector down 2.12%, restaurants specifically down 1.97%

- Consumer weakness driven by inflation, weak labor market, unemployment, increased student loan repayments, and slower real wage growth

The Reddit concerns about restaurant sector weakness are well-founded and validated by research data. However, several factors differentiate Uber from pure-play restaurant stocks:

-

Business Travel Component: Reddit comments correctly identify that Uber’s ride-sharing business has significant business travel exposure, providing insulation from pure consumer discretionary weakness

-

Delivery Market Dynamics: While restaurant traffic is declining, the food delivery market continues to grow, potentially benefiting Uber Eats even as in-person dining weakens

-

Valuation Perspective: Reddit’s bearish view on valuation contrasts with some commenters’ assessment of fair value based on low P/E ratios

The key earnings question is whether Uber’s delivery segment can maintain growth amid restaurant weakness, or if the broader consumer headwinds will impact both segments.

- Delivery growth slowdown if restaurant traffic decline accelerates

- Cautious forward guidance given macro uncertainty

- Potential miss on MAPC growth metrics

- Continued consumer weakness among core 25-35 demographic

- Business travel resilience providing segment stability

- Potential market share gains in delivery if weaker competitors struggle

- Low valuation relative to growth prospects if execution continues

- Shift from in-person dining to delivery could benefit Uber Eats

- Delivery segment growth rate and guidance

- MAPC trends, particularly among younger demographics

- Gross bookings growth across both segments

- Management commentary on consumer spending trends

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.