S&P 500 Valuation & Volatility: Analysis of Nov 2025 Correction and Market Sentiment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The S&P 500 experienced a ~5% correction from its Nov12 high ($6869.91) to Nov20 low ($6534.05) [0]. On Nov21, it rebounded +0.72% to close at $6602.98 with lower volume (4.00B vs Nov20’s5.60B), indicating reduced selling pressure but limited buying interest [0]. Sector performance showed defensive sectors leading: Healthcare (+1.73%), Industrials (+1.52%), while interest-sensitive sectors lagged: Utilities (-0.89%), Real Estate (+0.07%) [0]. This aligns with the Seeking Alpha article’s recommendation to maintain exposure but avoid aggressive buying due to high valuations [1].

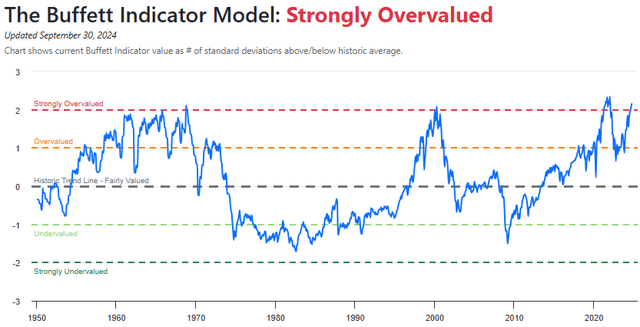

- Valuation Concerns: The article’s claim of “historically expensive” valuations is supported by the market’s cautious rotation to defensive sectors [1].

- Sector Rotation: Defensive outperformance signals investor wariness of further volatility [0].

- Macro Dependence: The need for clearer employment/Fed signals highlights the market’s sensitivity to macroeconomic policy [1].

- Valuation risk: High valuations increase downside potential [1].

- Volatility risk: Recent sharp moves (Nov20 drop ~3%) indicate rising instability [0].

- Macro risk: Weakening employment or tighter Fed policy could deepen the correction [1].

- Defensive sectors (Healthcare, Industrials) offer relative safety during volatility [0].

- A confirmation of stable employment/Fed policy could present buying opportunities [1].

- Correction: ~5% (Nov12-Nov20) [0].

- Nov21 Metrics: Close $6602.98, +0.72%, volume 4.00B [0].

- Leading Sectors: Healthcare (+1.73%), Industrials (+1.52%) [0].

- Recommendation: Hold exposure; avoid aggressive buying until macro signals (employment/Fed) clarify [1].

- Gaps: Recent employment data, inflation metrics, exact valuation multiples [1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.