Analysis of Trump Administration's Potential Approval of Nvidia H200 Chip Sales to China

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

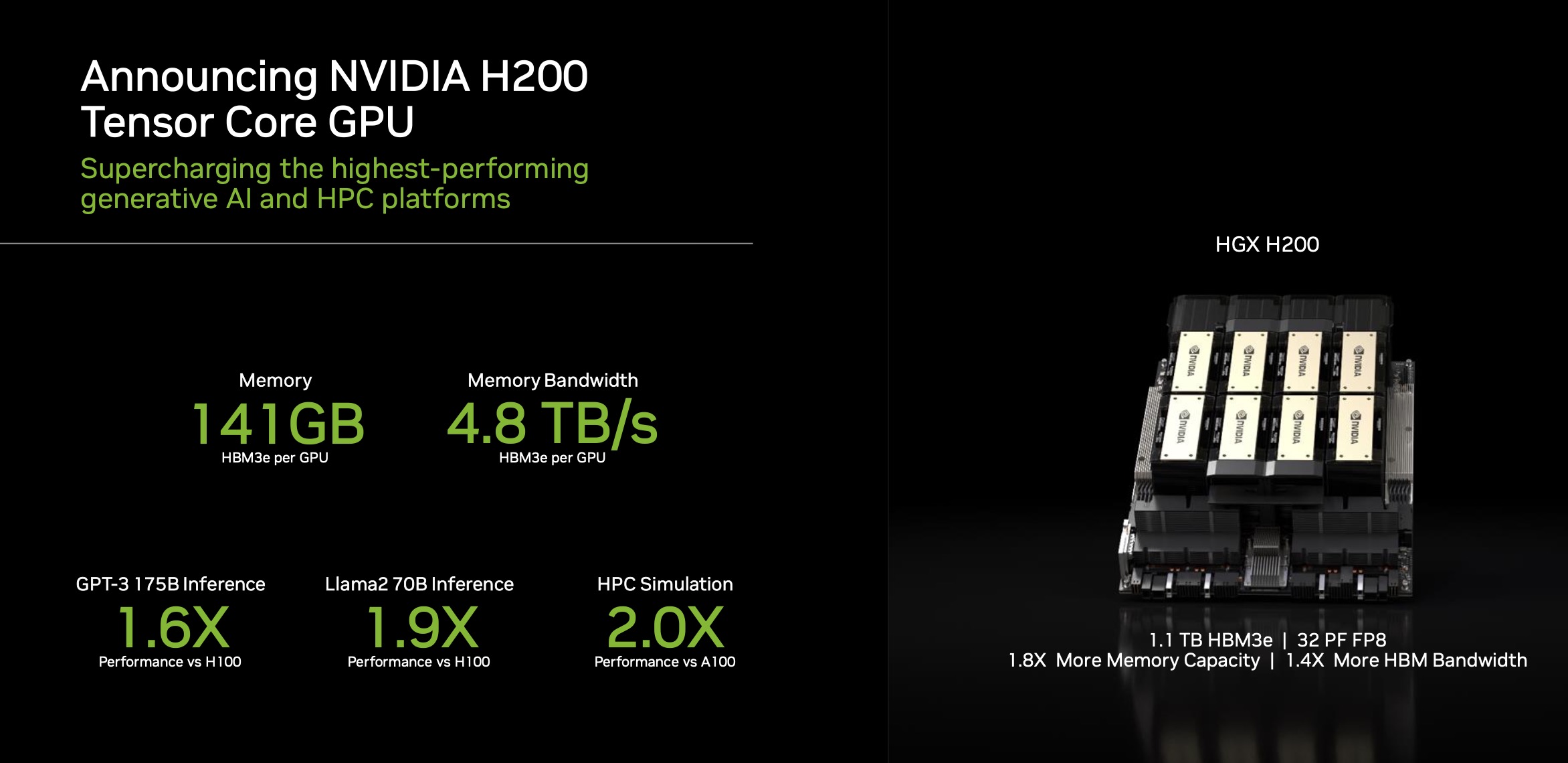

The Trump administration is internally considering allowing Nvidia (NVDA) to sell its H200 AI chips to China, according to a Bloomberg report [1]. This news triggered an intraday spike in NVDA stock around 1:49 PM EST on November 21, 2025, though the stock closed down 1.30% for the day (open: $181.24, close: $178.88) [0]. China represents 13.1% of NVDA’s FY2025 revenue ($17.11 billion), so approval of H200 sales could significantly boost this segment [0].

- Short-term market reactions to regulatory news are volatile: NVDA’s intraday spike followed by a lower close highlights investor uncertainty about the decision’s finalization.

- China’s revenue contribution is critical: The 13.1% share underscores the importance of the Chinese market for NVDA’s growth trajectory.

- Geopolitical trade-offs exist: The potential approval signals a possible easing of US-China tech tensions, but it may face opposition from China hawks in Congress.

- Regulatory Uncertainty: The decision is not final, and congressional opposition could reverse any approval.

- Competition: Chinese chipmakers like Huawei may already have alternative chips (e.g., Ascend 910B) that could limit NVDA’s market share in China.

- Geopolitical Tensions: Ongoing US-China conflicts could derail the approval process.

- Revenue Growth: H200 sales to China could add significant revenue to NVDA’s top line.

- Market Sentiment: Approval may improve investor sentiment toward NVDA and US-China tech relations.

This event centers on a potential regulatory shift for NVDA’s H200 chip sales to China. The market reaction showed short-term volatility, with an intraday spike followed by a lower close. China’s 13.1% revenue share makes this decision impactful for NVDA’s financial performance. Key factors to monitor include the final regulatory decision, congressional feedback, and competitive responses from Chinese chipmakers.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.