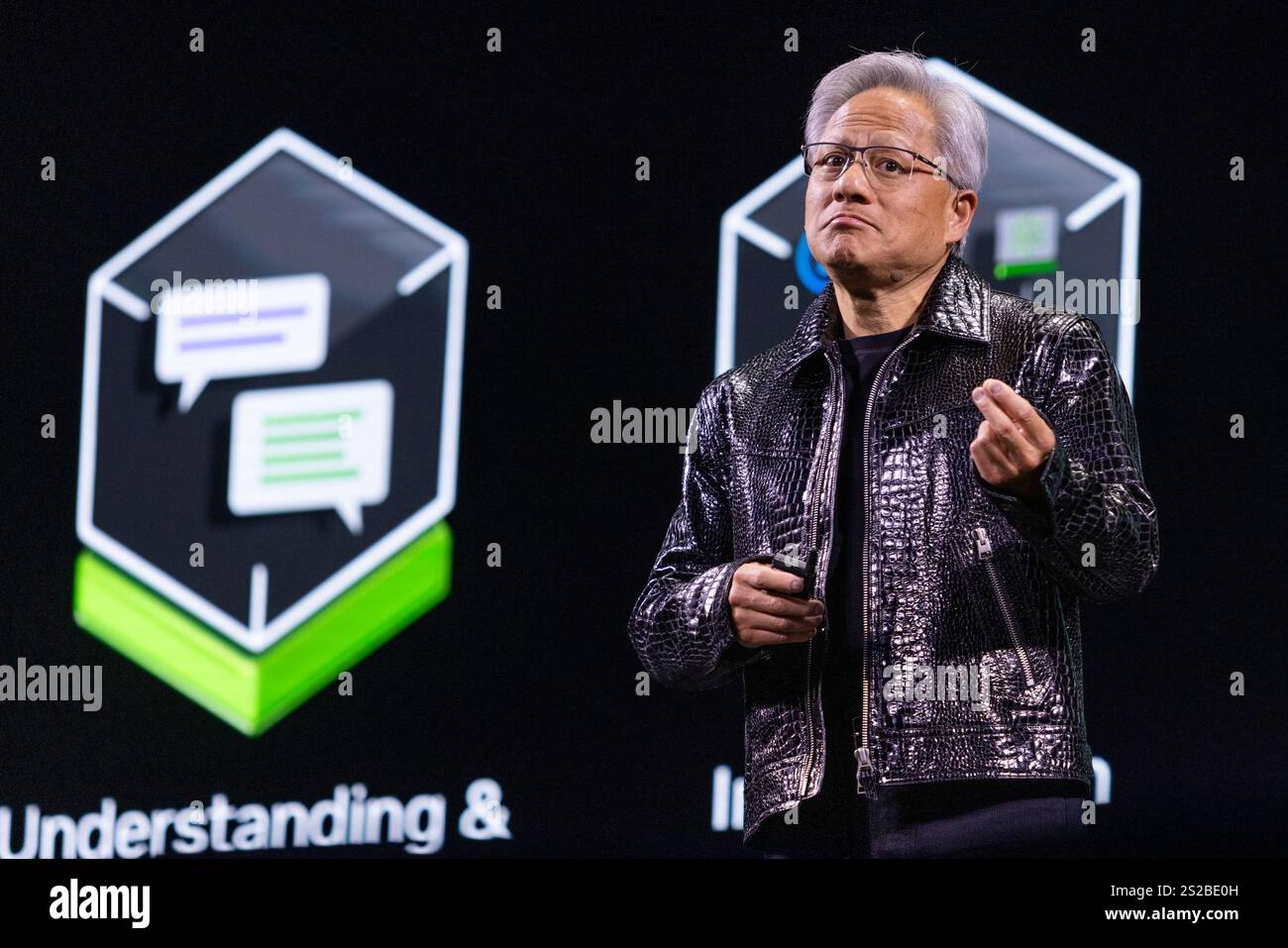

Analysis of Nvidia CEO's 'No-Win' Situation Amid AI Bubble Chatter

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Fortune article (user-provided) [6] and internal market data [0]. Nvidia CEO Jensen Huang’s leaked comments highlight a no-win dynamic: strong results fuel AI bubble fears, while misses confirm them [6]. NVDA’s stock closed down 1.3% on Nov21 with 1.8x average volume, indicating selling pressure [0]. The tech sector underperformed (0.15% gain) vs defensive sectors like healthcare (1.73%) [0], showing investor rotation away from high-growth AI stocks [3].

- Sentiment-Fundamental Disconnect: Despite Nvidia’s $500B AI chip order backlog [3], investor skepticism about AI bubble risks drives short-term volatility.

- Sector Rotation: Tech sector lagging suggests a shift to defensive assets amid macro uncertainty [0].

- Valuation Risk: NVDA’s 44x P/E ratio (vs S&P500’s ~20x) makes it vulnerable to correction if AI growth expectations weaken [0].

- Valuation: High P/E ratio increases downside risk if AI demand slows [0].

- Volatility: The no-win dynamic may lead to increased stock swings [6].

- Sector Rotation: Continued shift to defensives could pressure tech stocks [0].

- Long-Term AI Demand: Strong order backlog indicates sustained need for Nvidia’s chips [3].

- Market Leadership: Nvidia’s 80% AI chip market share positions it to benefit from long-term AI adoption [4].

Nvidia faces a challenging market environment due to AI bubble chatter, with its stock reacting negatively to CEO Huang’s comments. While fundamentals remain strong (record earnings, large order backlog), high valuation and investor skepticism pose short-term risks. The tech sector’s underperformance signals broader market rotation, which investors should monitor closely.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.