Structured Analysis of Reddit Post on Consistent XAUUSD Trading Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The Reddit post author improved XAUUSD results by adopting an institutional-focused strategy, which aligns with industry best practices [2]. Key elements include:

- HTF Structure: Using daily/4H charts for trend bias before lower-timeframe entries [1,2].

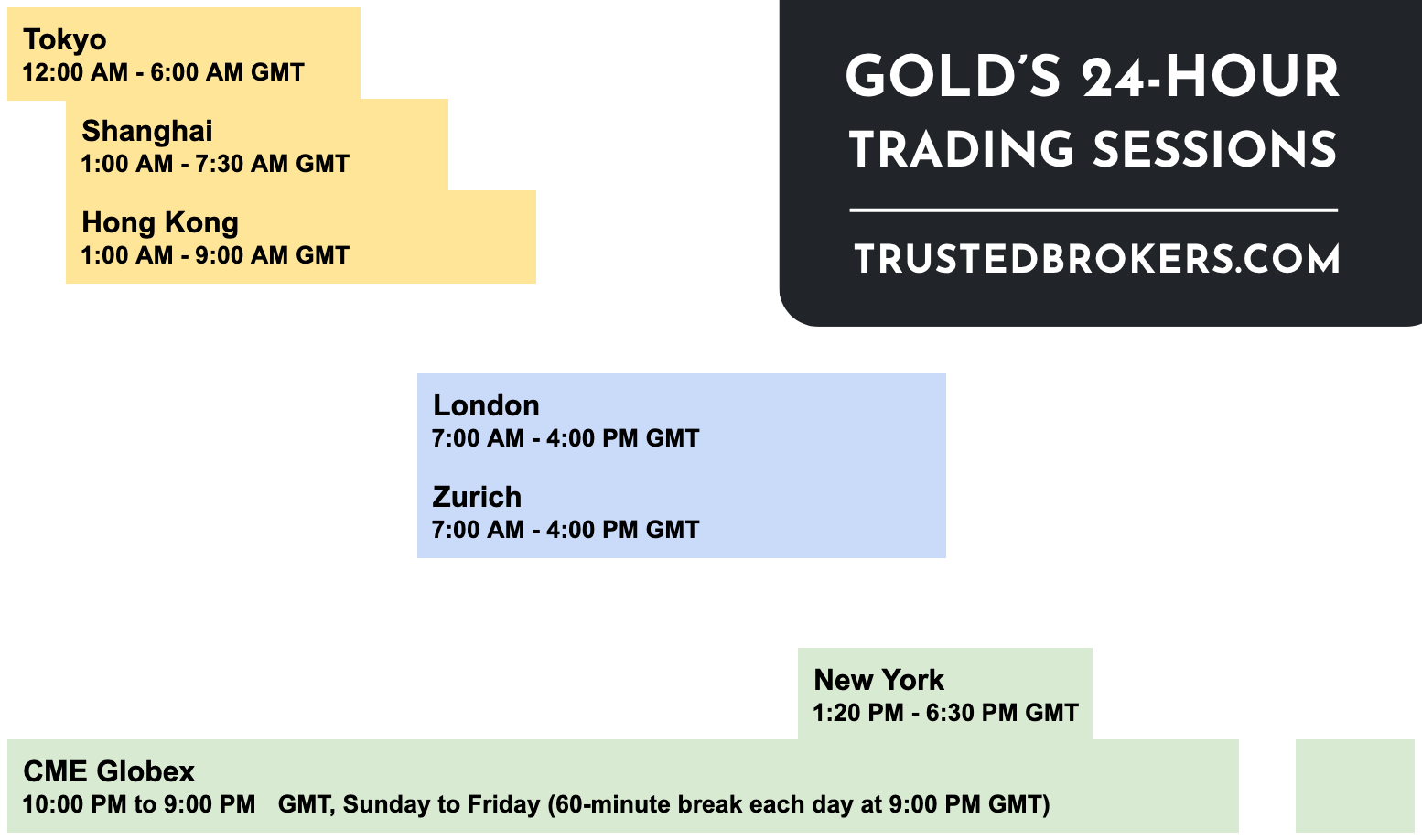

- Session Timing: Focusing on London-New York overlap (13-16 GMT) for peak liquidity [3,4].

- Liquidity-Based Stops: Placing stops beyond crowd levels to avoid institutional stop hunts [5,6].

- Structure-Invalidation Stops: Exiting trades when structural invalidation points are hit [7,8].

- Cross-Domain Alignment: The author’s focus on institutional behavior is consistent across multiple validating sources, emphasizing the importance of aligning with large player order flow.

- Session-Liquidity Synergy: Optimal session timing enhances liquidity-based strategies, as peak activity periods increase the likelihood of institutional reaction points.

- Non-Predictive Approach: The core lesson of positioning around reaction points instead of predictions is a recurring theme in professional trading literature.

- Risks: Misidentifying institutional order flow, liquidity zones, or invalidation levels can lead to losses. Traders need training to implement these strategies effectively.

- Opportunities: Reduced premature stops via liquidity-based placement, optimized entry windows via session timing, and clearer trade theses via HTF structure.

- HTF Structure: Use daily/4H charts for trend bias.

- Optimal Session: London-New York overlap (13-16 GMT) for peak liquidity.

- Liquidity Stops: Place stops beyond obvious support/resistance to avoid institutional hunting.

- Structure Invalidation: Exit trades at levels where your thesis is invalidated.

- Core Principle: Position around institutional reaction points, not predictions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.