Long-Term Investment Opportunities Amidst November 2025 Market Pullback: Reddit Insights vs. Fundamental Research

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit users prioritize long-term buys including megacap tech (GOOGL, META, AMZN), tech ETFs (QQQ, SMH) and broad market ETFs (VOO, SCHD), specific stocks (ASTS for satellite broadband, RIVN ahead of AI day, UNH, PYPL at 10-11x forward earnings), energy/defensive picks (CNQ natural gas, WMT, WM), and contrarian plays (short TSLA, GLD as hedge). Some users advise waiting 1-2 weeks to avoid catching a falling knife [17].

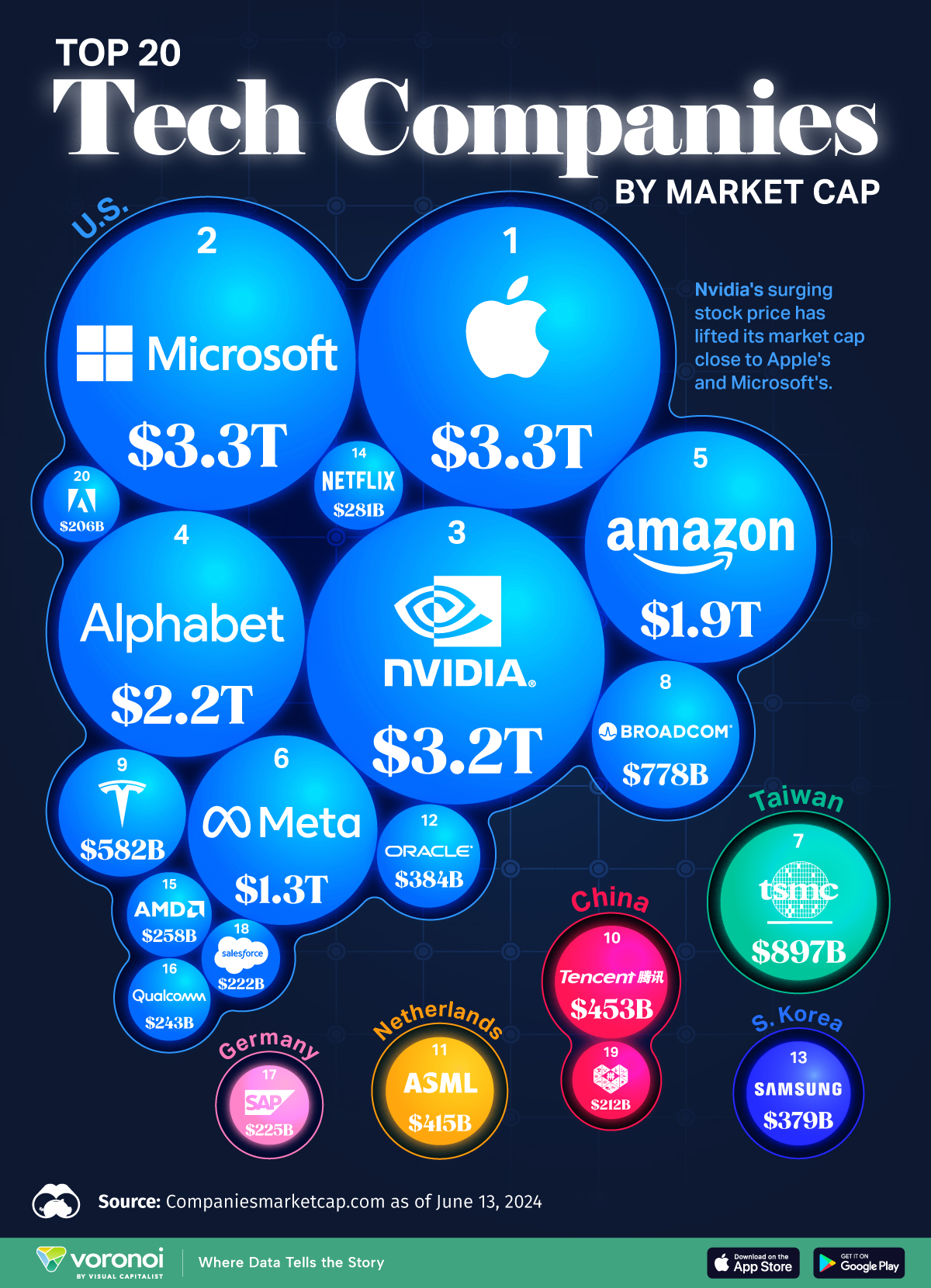

The November 2025 pullback has hit tech hardest (NASDAQ down 2.5% weekly [1], sector down 8% [2]) while healthcare outperforms (up 5% [2]). The VIX spiked to 52.87, indicating deep anxiety [3]. Top tech fundamentals: GOOGL offers best value (P/E 26.27, 32.23% margin [7]), META has strong growth (18-22% revenue growth [9]), AMZN is undervalued but needs AWS reacceleration [12], MSFT trades at premium 30x forward P/E [14], and NVDA faces volatility due to AI bubble fears [16].

Alignments: Both Reddit and research highlight GOOGL/META as top picks and ETFs for diversification. Contradictions: Reddit’s immediate buys vs research’s AI bubble concerns for NVDA; Reddit’s RIVN call lacks research validation. Implications: Focus on profitable tech with solid fundamentals and defensive sectors as hedges.

Risks: Catching falling knife, AI bubble burst [15], AWS headwinds for AMZN [12]. Opportunities: Undervalued tech (GOOGL, META [7][9]), healthcare outperformance [2], defensive stocks (WMT, WM [1]).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.