Behind Rongji Software (002474.SZ)'s Five Consecutive Daily Limit-Ups: Contradiction Between AI Concept Hype and Performance Loss

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Rongji Software (002474.SZ) recently had a five consecutive daily limit-up trend, becoming a focus stock in the market [1]. Despite the company’s net profit loss of 32.5519 million yuan in the first three quarters, it was still heavily speculated by hot money and institutions [1].

- AI Concept Promotion: The AI application segment has performed prominently in the current market environment, and Rongji Software, as a related concept stock, has benefited [2].

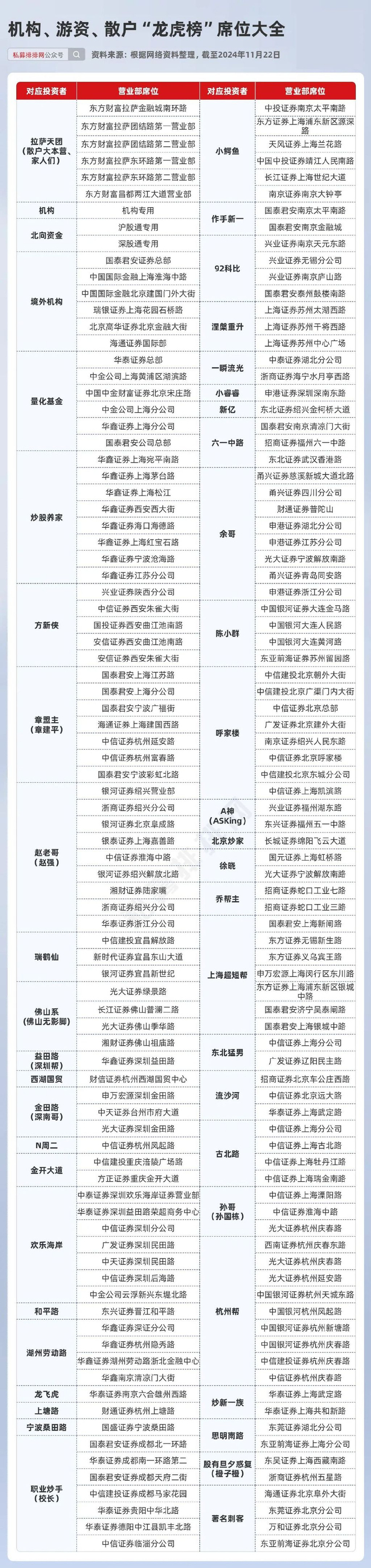

- Joint Capital Speculation: It has been on the Dragon and Tiger List multiple times, showing the active participation of hot money and institutions [3].

- Sector Rotation: Against the background of overall market adjustment, the AI sector has become one of the safe-haven choices for funds [2].

The company’s performance in the first three quarters did not improve, but its stock price rose against the trend, reflecting the divergence between concept speculation and fundamentals [1].

Investors need to pay attention to the short-term nature of concept speculation and the long-term risks brought by performance losses [1][3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.