BYD (002594.SZ) Hot Analysis: Long-Term Potential Amid 2024 Sales Leadership and 2025 Q3 Performance Adjustment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

#1. Executive Summary

This analysis is based on BYD (002594.SZ) being listed on the hot list released by tushare_hot_stocks [0], combined with its 2024 global new energy vehicle sales of 4.27 million units (a year-on-year increase of 41.26%) leading the industry [2], and technological innovations (second-generation blade battery, megawatt fast charging) which have attracted market attention. Despite short-term adjustments in Q3 2025 revenue (194.98 billion yuan, down 3.05% year-on-year) and net profit (7.82 billion yuan, down 32.6% year-on-year) [3], analysts generally remain optimistic about its long-term potential, with an average target price of 129.78 yuan [1].

#2. Comprehensive Analysis

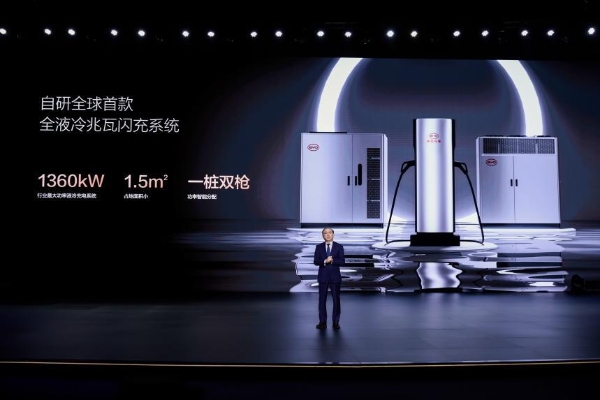

As China’s largest new energy vehicle manufacturer, BYD sold 4.27 million units globally in 2024, surpassing Tesla to become the world’s top-selling new energy vehicle brand [2], with a global market share of 22% [2]. In terms of technology, the second-generation blade battery has a range of over 1000 kilometers, the megawatt fast charging technology enables 400 kilometers of driving with 5 minutes of charging, and solid-state battery technology continues to make breakthroughs [5]. However, Q3 2025 performance declined: revenue fell by 3.05% year-on-year and net profit dropped by 32.6% year-on-year [3], possibly affected by intensified market competition and cost pressures. The current stock price is 96.49 yuan, located in the lower-middle part of the 52-week range (87.40-138.99 yuan), with a market value of 849.08 billion yuan [1].

#3. Key Insights

- Coexistence of Sales Leadership and Short-Term Performance Decline: BYD’s leading position in the global market (22% share) contrasts with its Q3 2025 performance adjustment, reflecting a balance between short-term challenges and long-term advantages amid slowing industry growth.

- Technology-Driven Long-Term Value: The average analyst target price of 129.78 yuan (34% upside from the current price) [1] is mainly based on its continuous innovation in battery technology (blade battery, solid-state battery) and scale advantages.

- Overseas Market Potential: Rapid sales growth in markets such as Europe and the UK provides new momentum for future growth [2].

#4. Risks and Opportunities

#5. Key Information Summary

BYD (002594.SZ) is a leader in the global new energy vehicle industry, with 2024 sales of 4.27 million units [2] and obvious technological advantages [5]. Despite short-term performance pressure [3], its long-term growth potential is recognized by analysts [1]. Investors should pay attention to its technological progress and overseas market expansion, while keeping an eye on industry competition and the impact of short-term financial fluctuations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.