Analysis of Reddit User's $113K Loss Amid November 21, 2025 Market Bull Trap & 0DTE Options Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

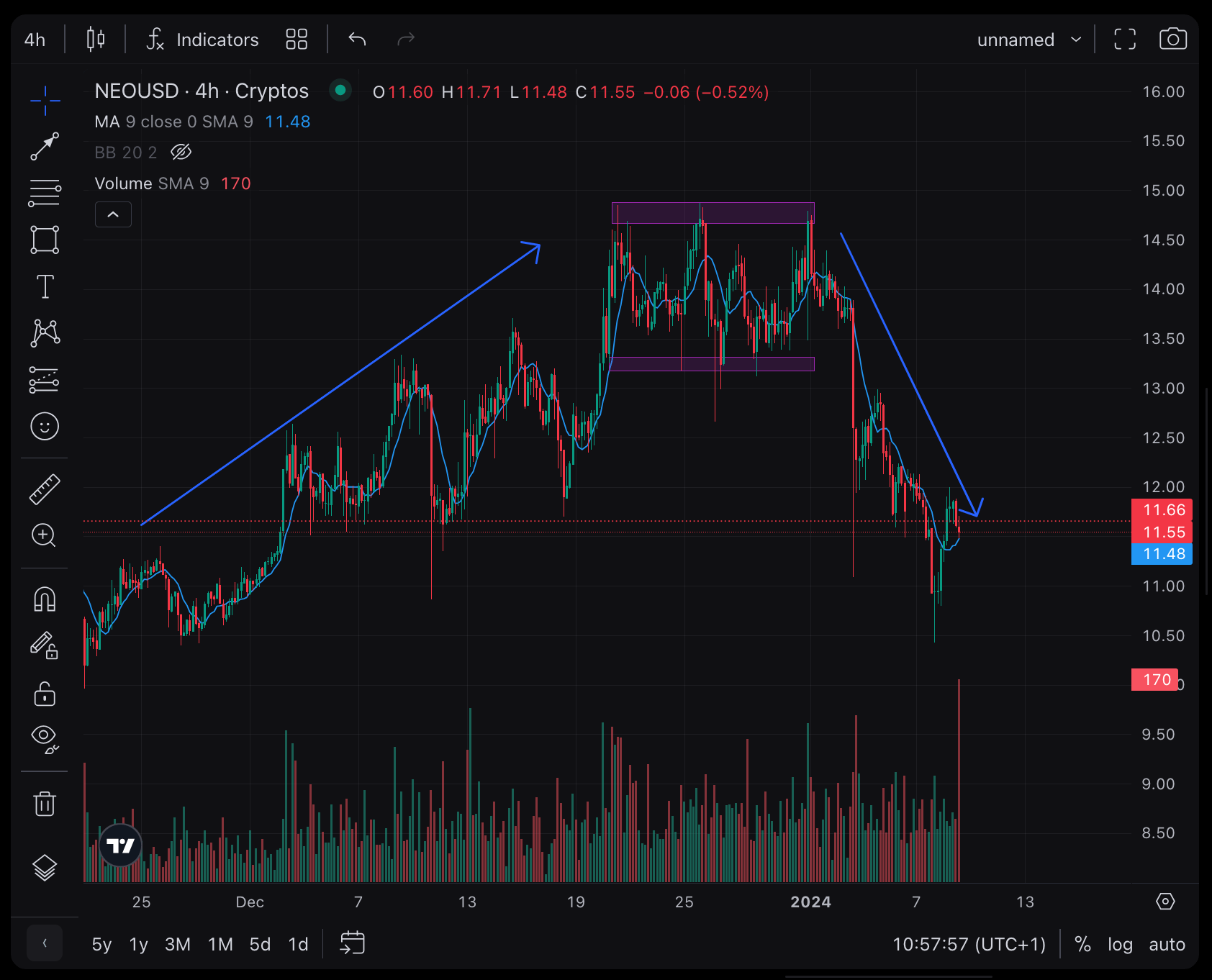

A Reddit user reported losing $113K in a single day (including 401K debt) amid the November 21, 2025 market bull trap ([6]). The S&P500 reversed a 1.9% intraday gain to close down 1.6%—a coordinated risk-off event driven by liquidity tightening and valuation concerns ([1], [2]). This reversal likely amplified losses from risky options trading, possibly including zero-day-to-expiration (0DTE) instruments. 0DTEs carry extreme risks: low success probability (entire premium lost if no meaningful price move within the day ([3])), high gamma risk (sharp delta swings with small price changes ([4])), and rapid time decay ([5]).

- Retail traders are particularly vulnerable to 0DTE options during market reversals like the November 21 bull trap, as short-term positions face amplified losses from gamma and theta risks ([3], [4], [5]).

- Conflicting advice in the Reddit discussion reflects broader tensions in retail trading: while some advocate for high-risk recovery strategies (0DTEs), others recommend low-risk index funds ([6]).

- The inclusion of 401K debt in the loss highlights long-term financial repercussions for retail traders who use retirement funds for risky trading ([6]).

- Risks: 0DTE options’ low success rate ([3]), market bull traps leading to sudden reversals ([1], [2]), and emotional distress from large financial losses ([6]).

- Opportunities: Shifting to low-risk S&P500 index funds to mitigate short-term volatility ([6]), prioritizing mental well-being over financial recovery ([6]).

- OP lost $113K in one day, including 401K debt ([6]).

- November 21 market reversal: S&P500 from +1.9% to -1.6% ([1], [2]).

- 0DTE risks: low success, gamma/theta decay ([3], [4], [5]).

- Discussion advice: conflicting strategies (high-risk recovery vs. low-risk long-term) and well-being prioritization ([6]).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.