Nvidia CEO’s No-Win Situation Amid AI Bubble Chatter: Market Impact & Risk Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

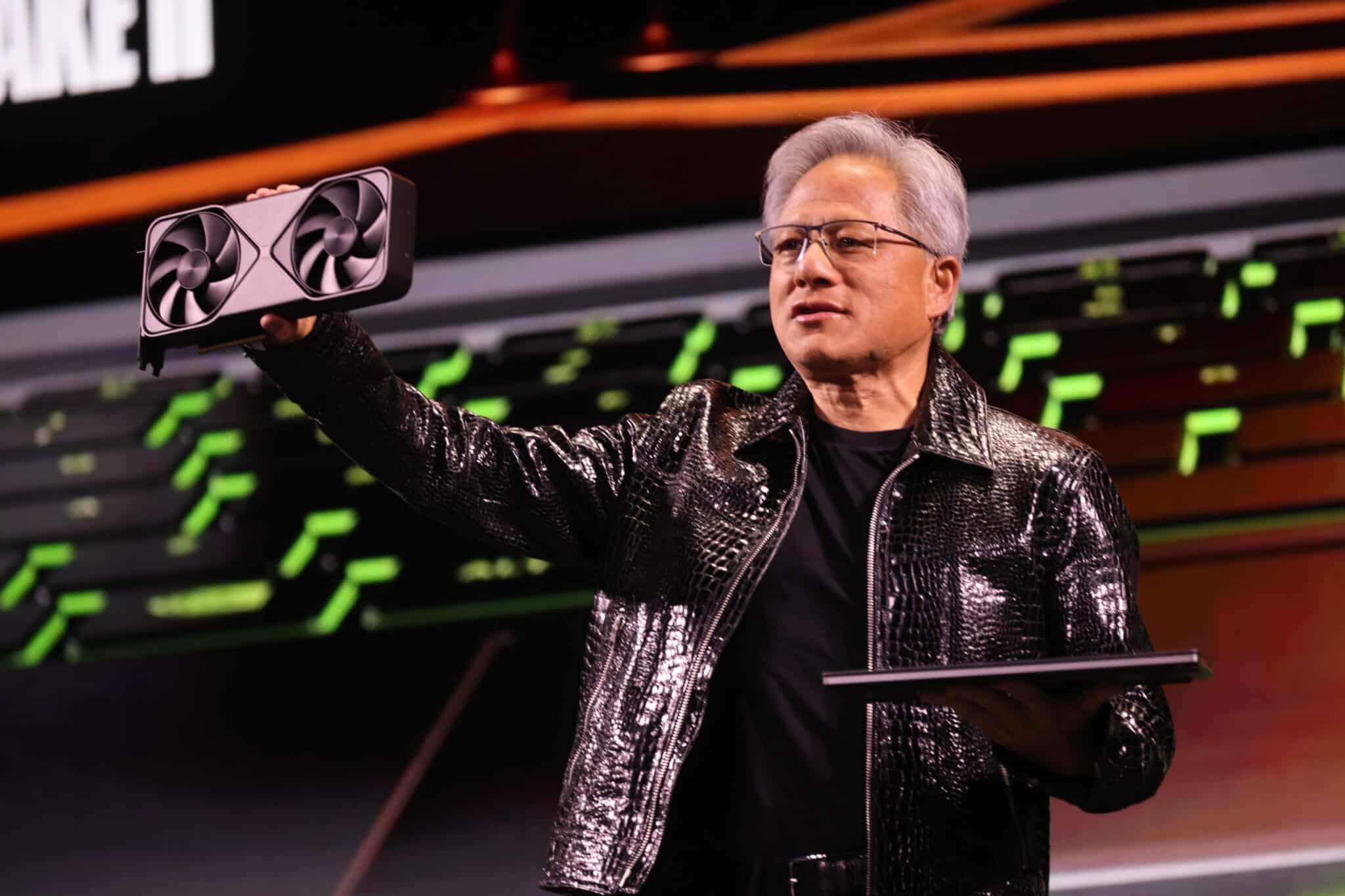

This analysis is based on a Fortune report [1] detailing Nvidia CEO Jensen Huang’s leaked internal meeting comments about the company’s no-win market position amid AI bubble chatter. The company faces a paradox: robust earnings amplify bubble fears, while any miss would validate them [1]. NVDA’s stock dropped ~9% over two days (Nov 20–21) to close at $178.88 [0], underperforming the Tech sector which rose 0.146% on Nov 21 [0]. This reflects heightened investor anxiety, though counterpoints exist—ARK Innovation Fund (Cathie Wood) purchased shares post-earnings [3], and Nvidia cites $500B in revenue visibility through 2026 [3].

Cross-domain correlations emerge: CEO comments amplified existing market sentiment, creating a disconnect between strong fundamentals (e.g., high trading volume of 346.93M on Nov 21 [0]) and short-term price action. The no-win dynamic highlights systemic risk for high-growth AI stocks—market expectations have reached unsustainable levels where even positive results may not drive gains [1].

- Short-term Volatility: The ~9% two-day drop signals potential for further swings [0].

- Bubble Concerns: Huang’s comments underscore persistent market fears about AI sector overvaluation [1].

- High Expectations: The no-win dynamic means Nvidia faces headwinds regardless of performance [1].

- Long-term Demand: $500B revenue visibility indicates strong underlying demand [3].

- Dip Buying: Institutional investors like ARK are capitalizing on short-term sell-offs [3].

| Metric | Value | Source |

|---|---|---|

| NVDA Close Price (2025-11-21) | $178.88 | [0] |

| Two-day Price Drop | ~9% | [0] |

| Nov 21 Trading Volume | 346.93M | [0] |

| Tech Sector Performance (Nov21) | +0.146% | [0] |

| Revenue Visibility (2025-2026) | $500B | [3] |

This summary provides objective data for decision-making without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.